AIOZ Network presents as a blockchain-powered decentralised content delivery solution that seeks to replace or augment traditional CDN infrastructure by routing video and media distribution through a peer-to-peer network, with a reported market valuation near $137 million and a spot price around $0.1119 per token.

Platform Overview and Technical Architecture

AIOZ's market introduction frames it as a decentralised content delivery network (dCDN) that couples distributed ledger primitives with edge computing and peer bandwidth sharing to deliver streaming media more cost-effectively and resiliently than centralised CDNs, according to the project's technical materials and public documentation. The white paper and official project materials emphasise incentivising node operators with native AIOZ tokens to contribute storage, bandwidth, and compute for media distribution whilst using on‑chain settlement and reputation layers to coordinate delivery. This architecture targets video streamers, live events, on‑demand content, and other large media workloads where latency, throughput, and cost matter.

Historical Price Performance and Market Cycles

AIOZ's historical price performance shows a dramatic lifecycle typical of many crypto infrastructure tokens. The token reached an all‑time high near $2.65 in April 2021 and later fell to lows near $0.01099588 in September 2023, reflecting a peak-to-trough correction on the order of 95.66% from historical highs and heavy negative annualised returns in certain intervals (reported -89.82% year-over-year in the supplied brief). Those moves underline both sector-wide cyclicality and token‑specific dynamics such as sentiment, macro liquidity, and token supply mechanics.

Current Market Metrics and Trading Data

Current market metrics and trading data point to modest daily liquidity relative to larger layer‑1 and infrastructure tokens. Recent price prints sit near $0.11 with reported 24‑hour volumes that vary by source—examples include roughly $98k in a local brief and higher multi‑million dollar figures on market aggregators—illustrating data discrepancies across feeds and the importance of sourcing from reliable on‑chain and market data providers for exact figures. Circulating supply figures commonly cited are about 1.2 billion AIOZ in circulation, with the project described as having an uncapped maximum supply model in the materials provided, and a market ranking around #291 by market cap on some aggregators. Those supply and ranking figures materially affect dilution, market depth, and the token's attractiveness for large allocations.

Technical Infrastructure and dCDN Framework

At the technical level, AIOZ's platform is built around a peer‑to‑peer distributed network design and dCDN framework that routes media pieces across edge nodes (viewers and dedicated relays) and leverages the blockchain for settlement and accounting of contributions. The white paper highlights mechanisms for content chunking, segment replication, and incentive alignment so that nodes are paid in AIOZ tokens for serving content, whilst reputational scores and smart contracts enforce correct behaviour. This design promises lower delivery costs and improved resilience, but it also introduces challenges—peer availability, varying node quality, and on‑chain settlement latency—that the team addresses through hybrid architectures and off‑chain coordination layers in their documentation.

Token Economics and Utility Design

Token economics (tokenomics) for AIOZ assign core functional roles to the native token: rewarding node operators and content contributors, serving as a payment medium for subscriptions or premium delivery, incentivising user engagement, and enabling participation in governance processes where token holders can vote on protocol parameters. These multi‑role tokens can create utility demand if adoption and on‑chain settlement volumes scale; however, real utility capture depends on active network usage and retention of paying customers for content distribution services.

Ecosystem Adoption and Cross-Chain Presence

Ecosystem reach shows measurable but limited adoption: public metrics indicate tens of thousands of token holders (for example, a cited count of ~29,328 holders), multi‑exchange listings across roughly 21 trading venues according to summary data, plus cross‑chain deployments—AIOZ has tokens and bridges appearing on Ethereum and Binance Smart Chain ecosystems per public smart contract records and aggregator listings. Smart contract addresses and audit status should always be verified on the project's official site and white paper before interacting; availability across multiple chains expands accessibility but also magnifies security and bridge risk.

Price Volatility and Market Sentiment

Price movement and volatility metrics reveal persistent downward pressure over multi‑year horizons with intermittent short-term rebounds. The token has shown sharp drawdowns and wide intraday ranges; sentiment indicators in on‑chain and social datasets aligned with price behaviour suggest extended bearish cycles since 2021, whilst recent stabilisation in the $0.11–$0.12 corridor has been observed in some markets, indicating consolidation after steep declines. Technical indicator mixes are conflicting: long-term moving averages and momentum point to sustained depreciation, whereas short-term oscillators and volume spikes occasionally signal local recoveries.

Investment Risks and Critical Considerations

Primary investment risks are concentrated and should be highlighted clearly. An uncapped token supply model introduces ongoing issuance risk and potential inflationary pressure on per‑token value unless counterbalanced by robust and sustained utility demand that absorbs new supply. The historically large drawdown (~95.8% from peak) also indicates high downside risk for new entrants and reflects either weaker fundamental adoption than initially priced in, broader sector declines, or a combination of both. Additional risks include limited liquidity concentration amongst large holders, smart contract vulnerabilities, and competition from established CDN providers that benefit from decades of engineering and customer relationships.

Supply Dynamics and Dilution Concerns

Supply dynamics deserve careful scrutiny: public summaries note an effectively unlimited maximum issuance mechanism in protocol documents and circulating ratios that at times exceed conservative benchmarks, creating long‑term dilution concerns for holders if issuance continues without commensurate demand growth. For long‑term investors, this means potential erosion of ownership percentage and required higher network adoption to maintain or grow token value. Exact issuance schedules and any token burn or buyback programmes should be checked directly in the official tokenomics page and white paper for up‑to‑date on‑chain policies.

Liquidity Analysis and Trading Conditions

Liquidity conditions are mixed—daily volumes vary across data sources, distribution across the aforementioned 21 trading platforms suggests reasonable access for retail traders, and the 29,328 holder base implies moderate decentralisation of ownership, but major concentration risks can still produce thin liquidity during stress periods. For sizeable positions, slippage and execution risk must be managed carefully.

Price Projections and Scenario Analysis

Projected price scenarios from conservative to bullish range widely and should be treated as hypothetical: near‑term conservative estimates cluster around $0.0814–$0.1134, whilst more optimistic decade‑end projections place AIOZ in a $0.2269–$0.2746 range—these are scenario exercises contingent on adoption, network throughput growth, successful product integrations, and macro market conditions that materially impact valuations. They are not guarantees and rely on several positive outcomes including demand growth that outstrips inflationary token issuance.

Portfolio Strategy and Allocation Guidelines

For portfolio strategy, a risk‑aware allocation is paramount. Suggested weightings in the brief range from 0–1% for cautious capital preservation investors to 1–3% for growth‑oriented allocations, with emphasis on only committing capital one can afford to lose given the token's speculative profile and historical volatility. Active position management (stop limits, staged buys/sells, and regular rebalance) is recommended for traders, whilst long‑term holders should track adoption metrics and protocol developments.

Risk Mitigation and Custody Best Practices

Risk mitigation and custody best practices include diversification across non‑correlated assets, strict position-sizing rules, and secure storage—use of reputable software wallets, hardware devices, and offline custody solutions for larger holdings. Investors can access AIOZ trading through MEXC's platform infrastructure with the usual security hygiene: enable two‑factor authentication, use withdrawal whitelists, and review counterparty controls where applicable (MEXC being the referenced venue for trades in this article).

Technical and Regulatory Challenges

Technical and regulatory obstacles remain. Scalability under real-world video load, the resilience of a volunteer node economy, smart contract security, and potential compliance hurdles in jurisdictions concerned with data routing and content custody are non‑trivial and could slow enterprise adoption versus incumbents. Competition from traditional CDN providers and other decentralised alternatives also constrains market share capture unless AIOZ demonstrates reliable cost or performance superiority.

Final Assessment and Investor Guidance

In final assessment, AIOZ is best characterised as a high‑risk, speculative infrastructure play: it offers genuine technical innovation for decentralised media delivery but faces notable supply, liquidity, adoption, and competitive challenges that must be weighed carefully. Novice investors should approach with extreme caution and minimal allocation; experienced crypto investors may consider small, monitored positions as part of a diversified portfolio; institutions should demand comprehensive audits, on‑chain transparency, and clear token‑supply governance before sizeable exposure.

Common questions investors ask—what is AIOZ's mission, how does tokenomics work, and is it a buy?—are answered by pointing to the white paper for mission and mechanics, acknowledging the token's multi‑use utility but uncapped issuance, and advising that any purchase decision should follow rigorous due diligence including verification of smart contract addresses, audit reports, and independent on‑chain metrics referenced in official documentation.

Sources used in this analysis include public market aggregators and the project's white‑paper/official documentation and on‑chain summaries; readers should validate live market data and smart contract details on the AIOZ official site and white paper before transacting.

Description:Crypto Pulse is powered by AI and public sources to bring you the hottest token trends instantly. For expert insights and in-depth analysis, visit MEXC Learn.

The articles shared on this page are sourced from public platforms and are provided for informational purposes only. They do not necessarily represent the views of MEXC. All rights remain with the original authors. If you believe any content infringes upon third-party rights, please contact service@support.mexc.com for prompt removal.

MEXC does not guarantee the accuracy, completeness, or timeliness of any content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be interpreted as a recommendation or endorsement by MEXC.

Latest Updates on TokenFi

View More

Loopring (LRC) Under Pressure After Failed Breakout Attempt

HYPE Token Slides as Unlock Schedule Overpowers Hyperliquid’s Record Revenue

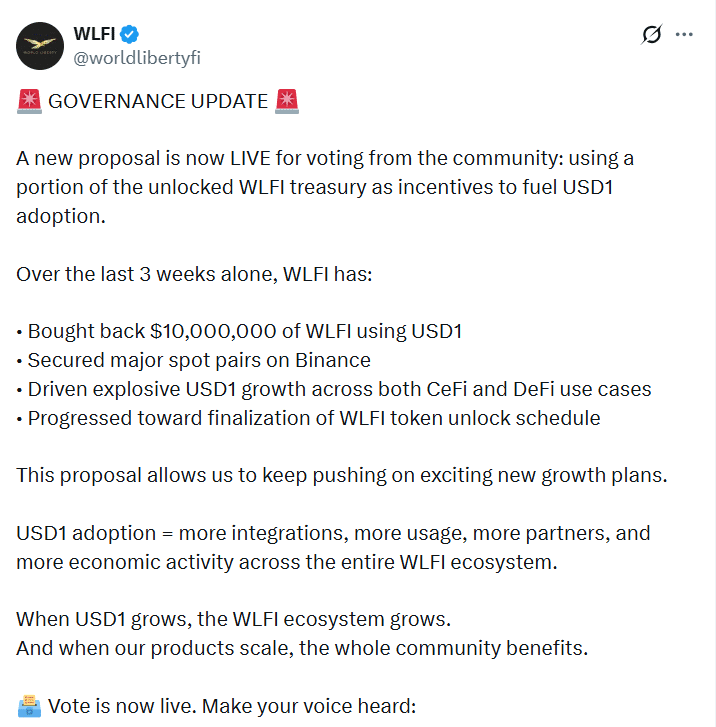

World Liberty Financial Proposes $120M Plan to Expand USD1 Usage

HOT

Currently trending cryptocurrencies that are gaining significant market attention

Crypto Prices

The cryptocurrencies with the highest trading volume

Newly Added

Recently listed cryptocurrencies that are available for trading