APY up to 9%, 20 types of stablecoins with yield

Author: Mars_DeFi , Crypto KOL

Compiled by: Felix, PANews

If users want to maximize profits, they can maximize the value of stablecoins through yield-based stablecoins.

Yield stablecoins are assets that generate income through DeFi activities, derivative strategies, or RWA investments. Currently, these stablecoins account for 6% of the $240 billion market value of stablecoins. As demand grows, JPMorgan believes that a 50% share is not out of reach.

Yield stablecoins are minted by depositing collateral into the protocol. The deposited funds are invested in yield strategies, and the yield is shared by the holders. This is like a traditional bank lending out deposited funds and sharing the interest with depositors, except that the interest on yield stablecoins is higher.

This article aims to review 20 stablecoins that can generate income.

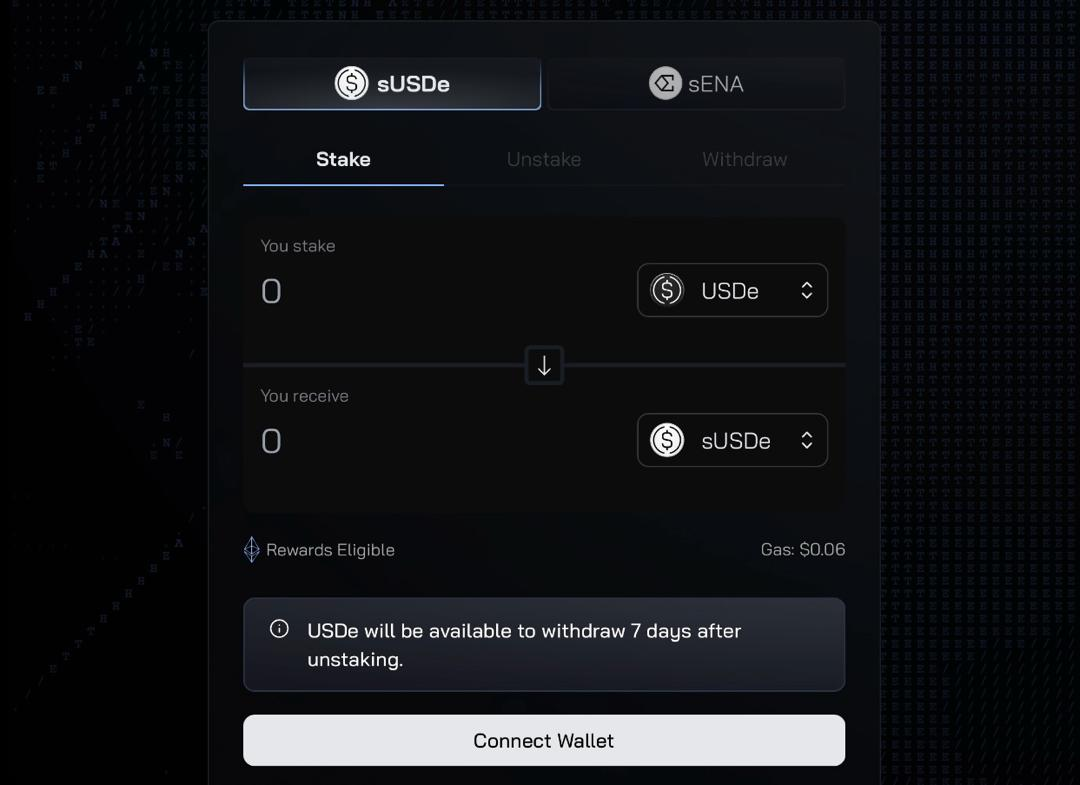

1.Ethena Labs (USDe/sUSDe)

Ethena maintains the value of its stablecoin and generates yield through delta-neutral hedging.

USDe is minted by depositing the pledged ETH (stETH) into the Ethena protocol. Afterwards, the ETH position is hedged by shorting.

In addition to the income from stETH (currently 2.76% annual interest rate), the positive funding rate for short selling will also generate income, and Ethena will distribute these income to users who pledge USDe in exchange for sUSDe (annual interest rate of 5%).

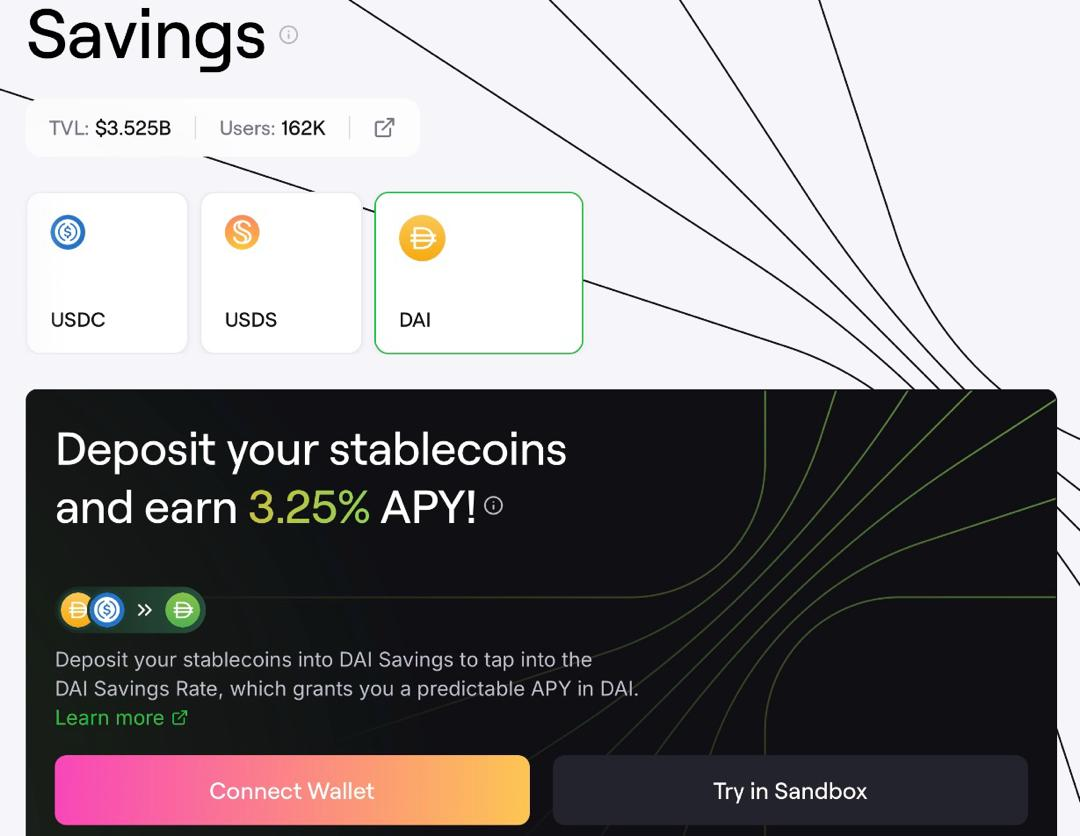

2. Spark (sDAI)

sDAI is generated by depositing DAI into Maker’s DAI Savings Rate (DSR) contract. The current annualized yield is 3.25%.

The yield is accumulated through interest on the DSR (the interest rate is determined by MakerDAO). sDAI can also be traded or used in DeFi like other stablecoins.

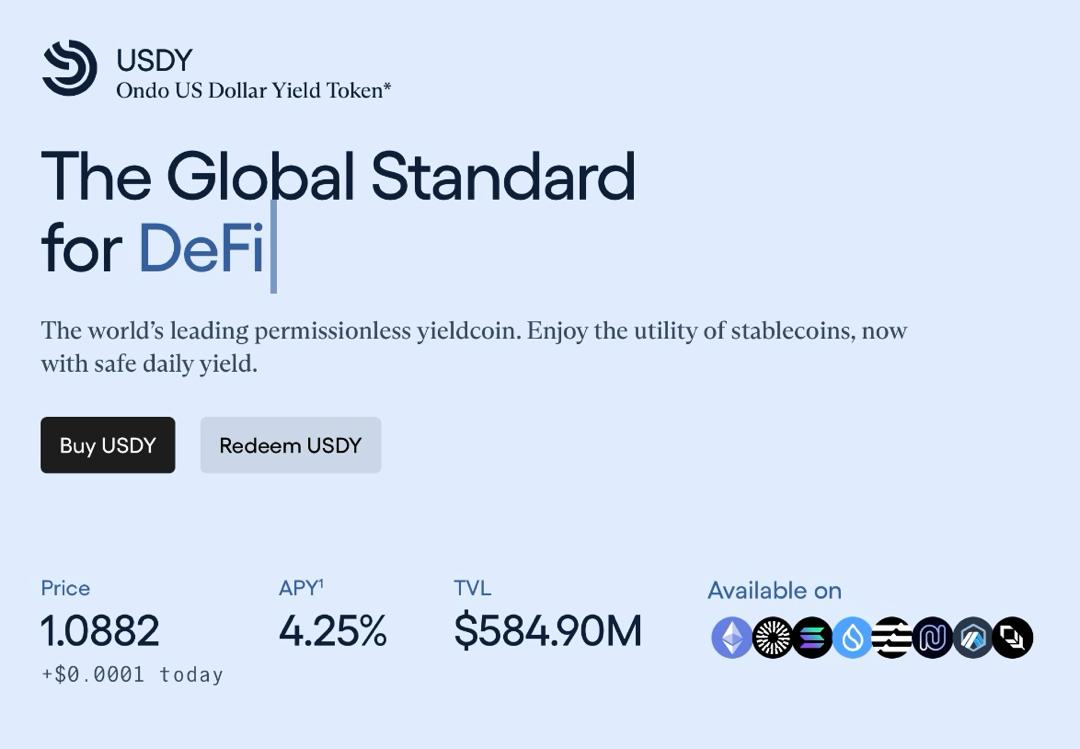

3. Ondo Finance (USDY)

Ondo issues USDY with USDC deposits. The deposited assets are used to purchase low-risk assets such as treasury bills (about 4-5% annual interest), and most of the interest is shared by USDY holders.

USDY's yield is set once a month and remains stable throughout the month. This month's annualized yield is 4.25%.

Note: USDY's yield is reflected in the token price, not the quantity. This is why USDY is always above $1.

4. BlackRock (BUIDL)

The BUIDL stablecoin represents ownership in a tokenized money market fund (MMF) managed by BlackRock.

The fund invests in cash and other instruments, such as short-term Treasury bills and repurchase agreements, and distributes interest to BUIDL holders.

The fund's yield is calculated on a daily basis but is distributed to BUIDL holders on a monthly basis.

5. Figure Markets (YLDS)

YLDS is the first yield-generating stablecoin registered as a public security with the U.S. SEC.

Figure Markets generates returns by investing in the same securities held by prime MMFs, which are riskier than tokenized government-backed MMFs.

YLDS offers an annual interest rate of 3.79%. Interest accrues daily and is paid monthly in USD or YLDS tokens.

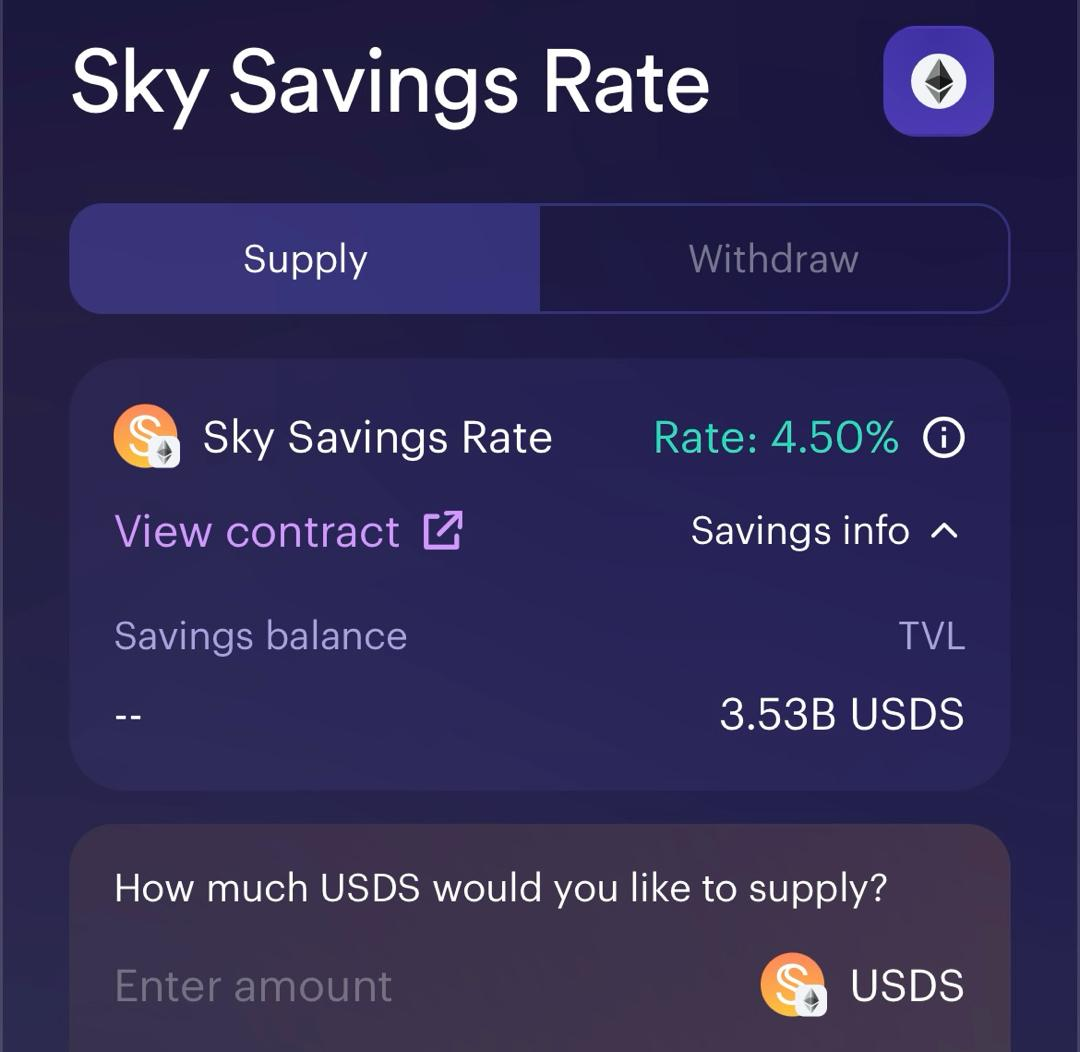

6. Sky (USDS/sUSDS)

USDS is a renamed version of DAI and can be minted by depositing eligible assets through Sky Protocol.

It can be used in DeFi and can also earn income from Sky Protocol through the Sky Savings Rate (SSR) contract. sUSDS is issued based on USDS deposits with an annual interest rate of 4.5%.

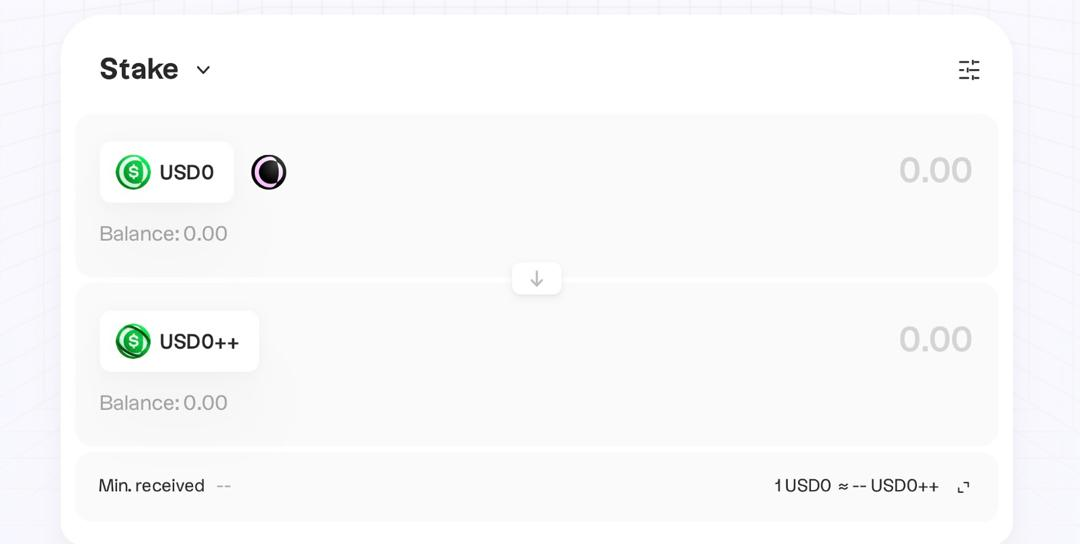

7.Usual(USD0)

USD0 is fully backed by real-world assets (RWAs) such as Treasuries, and is minted by depositing USDC or eligible RWAs as collateral on the Usual platform.

Users can also stake USD0 on Curve to get USD0++ (annual interest rate of 0.08%). USD0++ can be used in DeFi, and the income is distributed in the form of USUAL tokens (annual interest rate of 13%).

Note: To obtain USD0++ income, a 4-year pledge is required.

8. Mountain Protocol (USDM)

Mountain Protocol generates yield by investing in short-term U.S. Treasury bonds, but USDM is specifically for non-U.S. users.

The proceeds from these U.S. Treasury bonds are distributed to USDM holders through a daily reconciliation system, so balances automatically reflect the proceeds earned.

USDM currently offers an annualized yield of 3.8%.

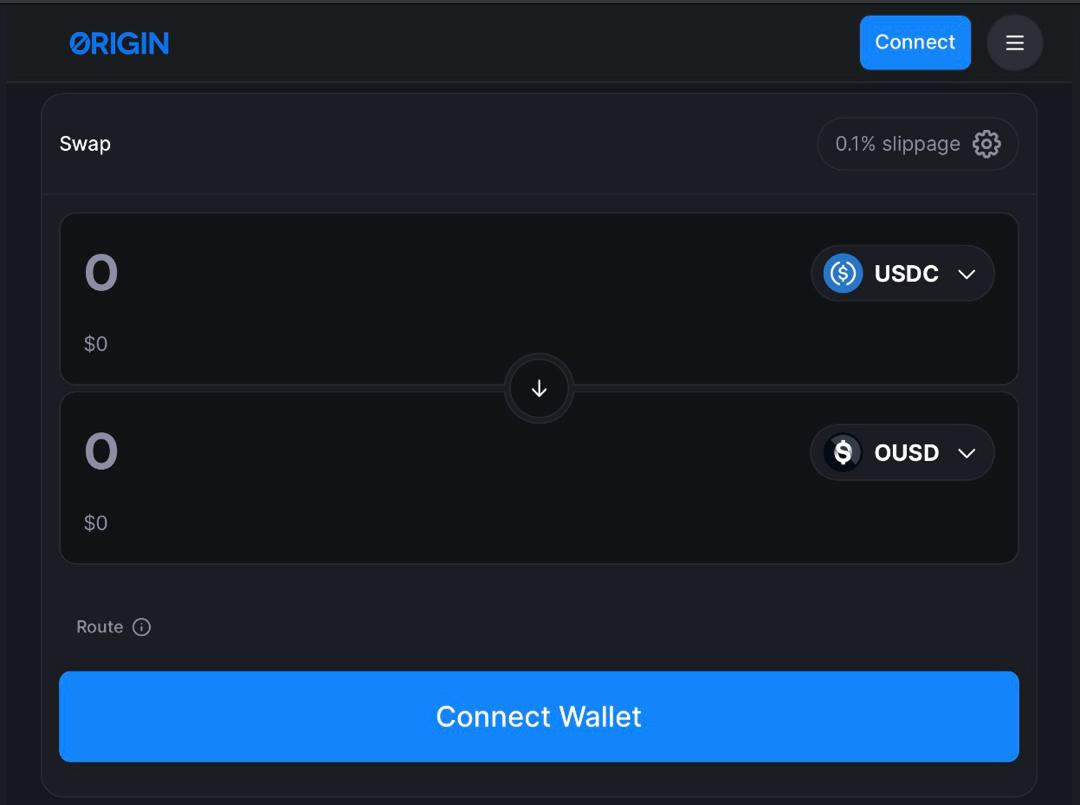

9. Origin Protocol (OUSD)

OUSD is minted by depositing stablecoins such as USDC, USDT, and DAI on the Origin Protocol.

Origin deploys collateral into low-risk DeFi strategies, generating returns through lending, liquidity provision, and transaction fees. These returns are distributed to OUSD holders through an automatically adjusted basis.

OUSD is backed by stablecoins and has an annual interest rate of 3.67%.

10. Prisma Finance (mkUSD)

mkUSD is backed by liquid staking derivatives. Yields are generated through rewards (2.5% - 7% variable annual interest rate) on the underlying staking assets and distributed among mkUSD holders.

mkUSD can be used for liquidity mining through platforms such as Curve, or it can be staked in Prisma's stable pool to receive PRISMA and ETH rewards from liquidations.

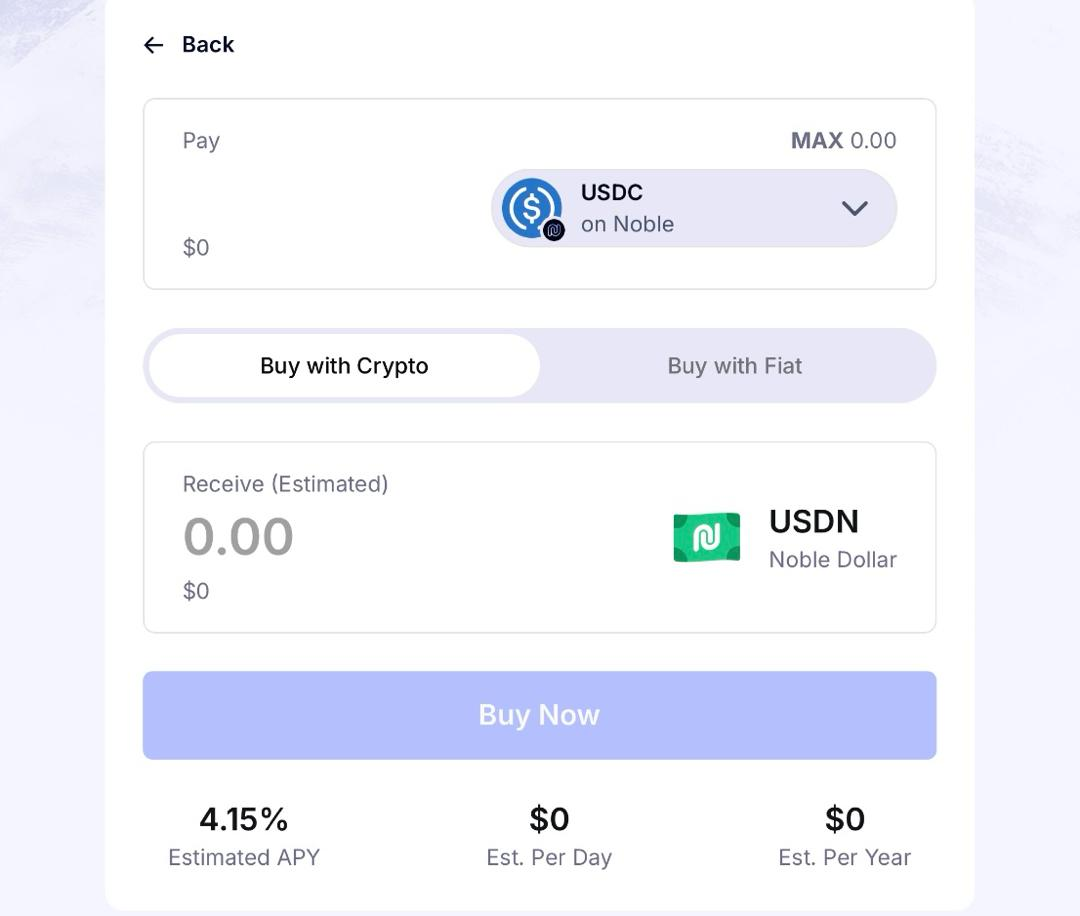

11. Noble (USDN)

USDN is backed by short-term government bonds. The income is derived from the interest on short-term government securities and distributed to USDN holders (4.2% annual interest rate).

Users can earn base yield by depositing USDN in a flexible vault, or earn Noble points by depositing it in a USDN locked vault (up to 4 months).

12. Frax Finance (sfrxUSD)

frxUSD is backed by the assets of BlackRock’s BUIDL and generates yield by leveraging its underlying assets such as treasuries and participating in DeFi.

The yield strategy is managed by the Benchmark Yield Strategy (BYS), which dynamically allocates staked frxUSD to the highest yield sources, enabling sfrxUSD holders to earn the highest yield.

13.Level(lvlUSD)

lvlUSD is minted by depositing and staking USDC or USDT. These collaterals are deployed in blue chip lending protocols such as Aave and Morpho.

Users can pledge IvIUSD in exchange for sIvIUSD, thereby enjoying the benefits brought by DeFi strategies.

The annual interest rate is 9.28%.

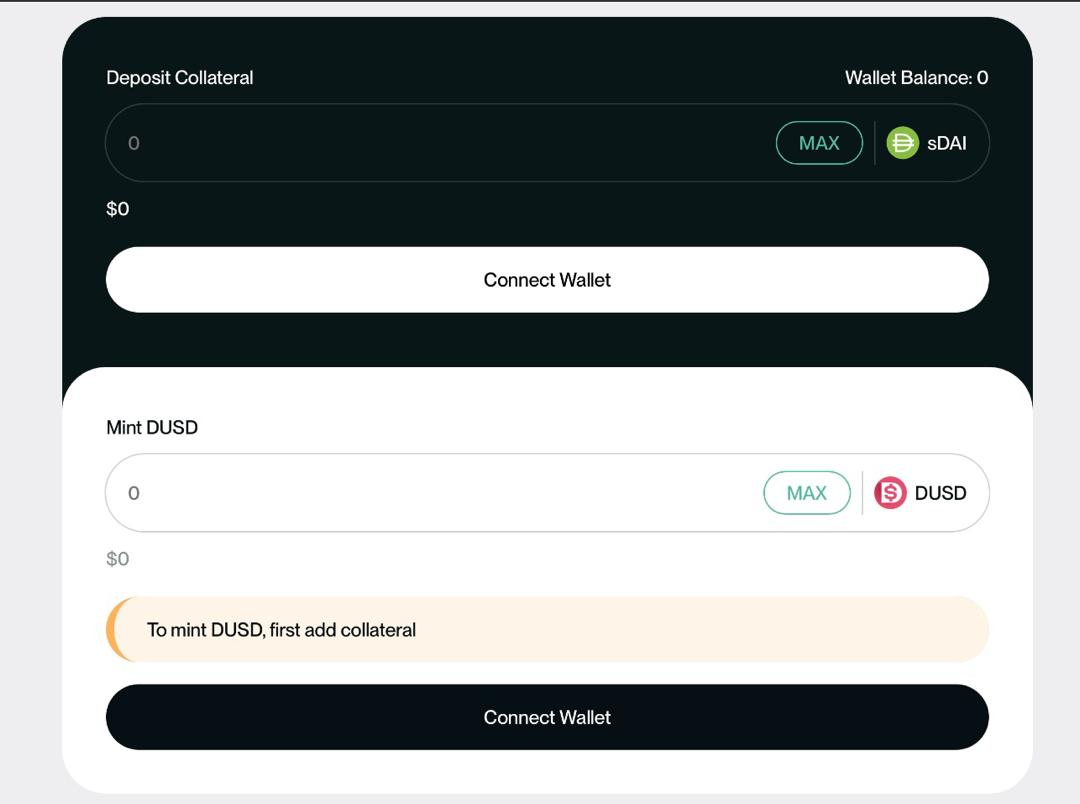

14. Davos (DUSD)

DUSD is a cross-chain stablecoin that can be minted with sDAI and other liquid collateral. It generates income through re-collateralized derivatives and distributes the income of the underlying assets to DUSD holders.

DUSD can be deposited in a liquidity pool or a value-added vault, or it can be pledged on Davos to earn an annual interest rate of 7-9% and lending interest income.

15. Reserve (USD3)

USD3 can be minted by depositing PYUSD on Aave v3, DAI on Spark Finance, or USDC on Compound v3.

The proceeds from allocating collateral to the top DeFi lending platforms will be distributed to USD3 holders (with an annual interest rate of approximately 5%).

Reserve Protocol provides over-collateralization for USD3 to prevent decoupling.

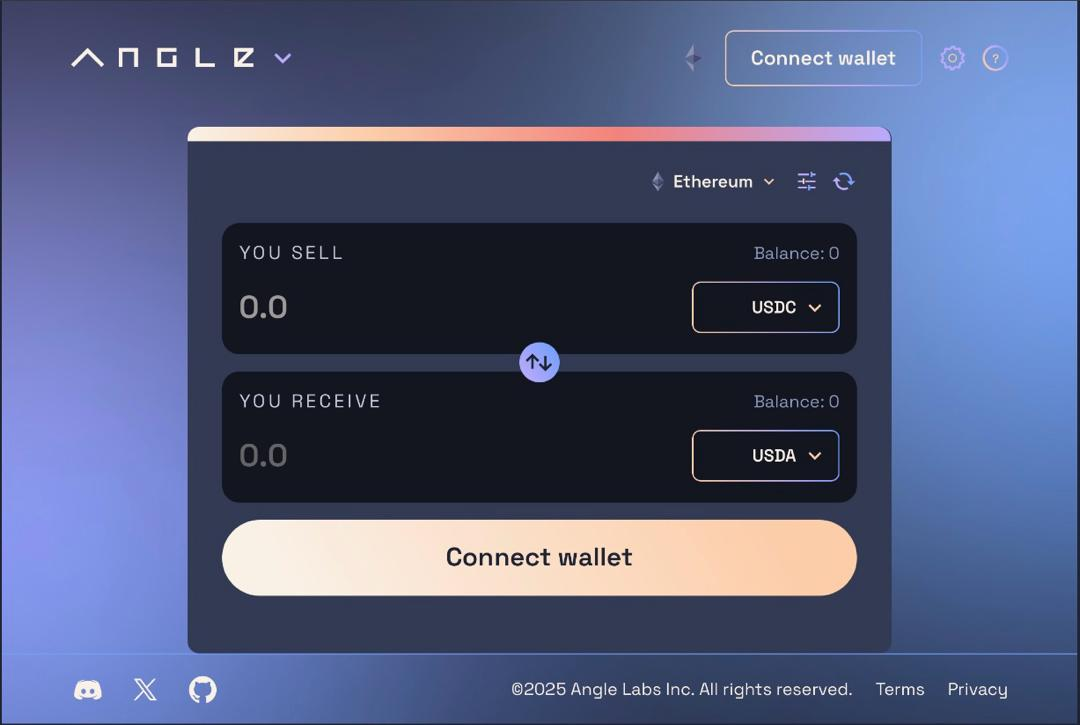

16. Angle (USDA/stUSD)

USDA is minted by depositing USDC. USDA income is generated through DeFi lending, treasury bills, and tokenized securities trading.

USDA can be deposited into Angle’s savings solution to obtain stUSD. stUSD holders can receive the income generated by USDA (6.38% annual interest rate).

17. Paxos (USDL)

USDL is the first stablecoin to provide daily returns under a regulatory framework. Its income comes from short-term US securities held in Paxos reserves, with a yield of approximately 5%. USDL holders can automatically receive USDL income.

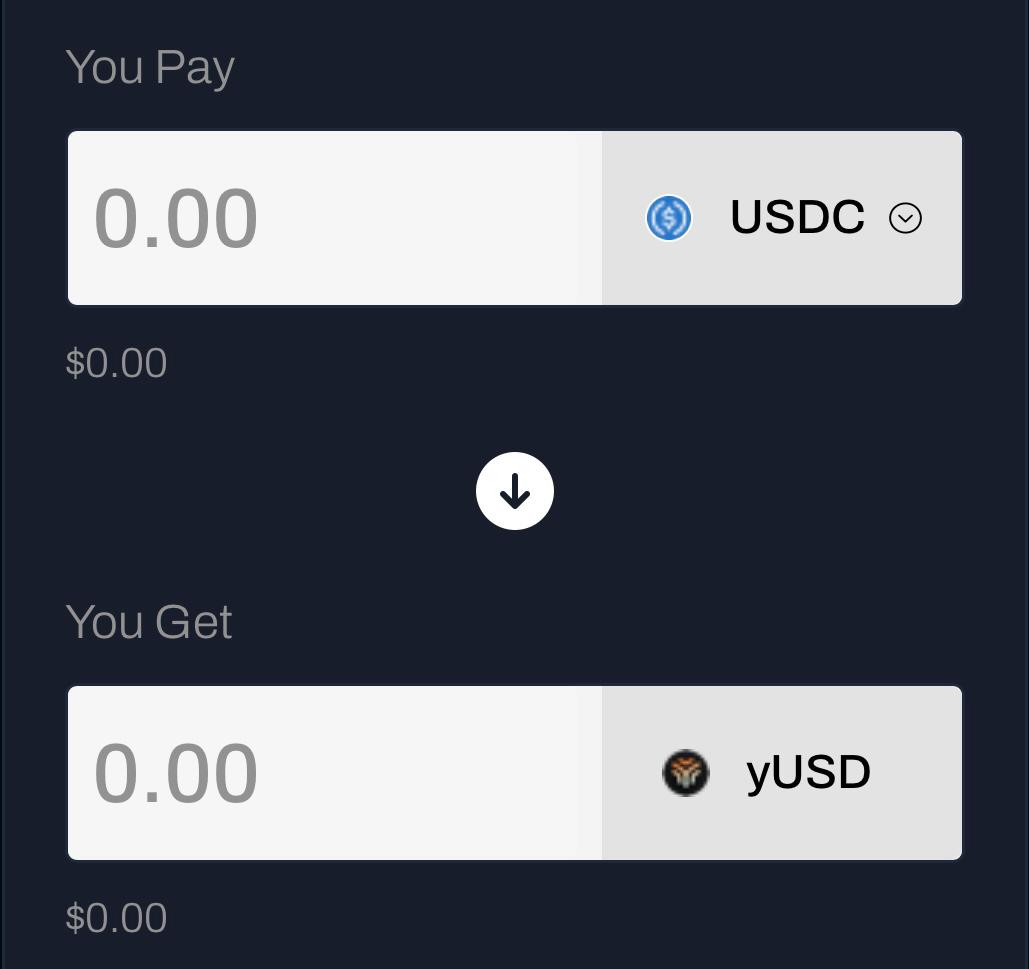

18. YieldFi (yUSD)

yUSD is backed by stablecoins and can be minted by depositing USDC or USDT on YieldFi (11.34% annual interest rate).

YieldFi generates yield by deploying collateral through delta-neutral strategies, while yUSD can be used for DeFi strategies such as lending and providing liquidity on protocols such as Origin Protocol.

19. OpenEden (USDO)

USDO is backed by tokenized U.S. Treasuries and money market funds such as OpenEden’s TBILL.

Its underlying assets are invested through on-chain and off-chain strategies to generate returns. The returns are distributed to USDO holders through a daily rebase mechanism.

The underlying assets are invested through on-chain and off-chain strategies to generate returns. This return is distributed daily to USDO holders.

20. Elixir (deUSD/sdeUSD)

Similar to Ethena's USDe, deUSD's income comes from its investment in traditional assets such as U.S. Treasuries, as well as the funding rates generated by lending within the Elixir protocol.

Users who pledge deUSD as sdeUSD can obtain an annualized return of 4.39% and 2x potion rewards.

Related reading: Stablecoin Earning Guide: Which of the 8 Types is Best?

You May Also Like

Pluvo Raises $5M Seed Round to Build the AI Decision Intelligence Platform for Modern Finance Teams

TMTG in talks with TAE and Texas Ventures III about spinning Truth Social and related businesses into SpinCo