NFT sales rise 12% to $67.7M, Ethereum sales spike 45%

According to CryptoSlam data, NFT sales volume has climbed by 12.03% to $67.76 million, up from last week’s $64.95 million.

- NFT sales rose 12% to $67.76M as buyers and sellers returned to the market.

- Ethereum led NFT blockchains with $28.06M in sales, up over 45% week-on-week.

- Bitcoin fell to $88K and ETH dropped below $3K, but NFTs bucked the market trend.

Market participation has rebounded, with NFT buyers surging by 49.30% to 231,210 and sellers jumping by 43.43% to 164,944. NFT transactions remained essentially flat, down just 0.16% to 910,892.

The market has also taken a hit as Bitcoin’s (BTC) price has dropped to the $88,000 level as selling pressure returns.

Ethereum (ETH) has lost the $3,000 level and is hovering at $2,900, extending its recent decline.

The global crypto market cap now stands at $2.99 trillion, down from last week’s $3.07 trillion. However, the NFT sector has bucked this trend with a solid recovery in both sales and participation.

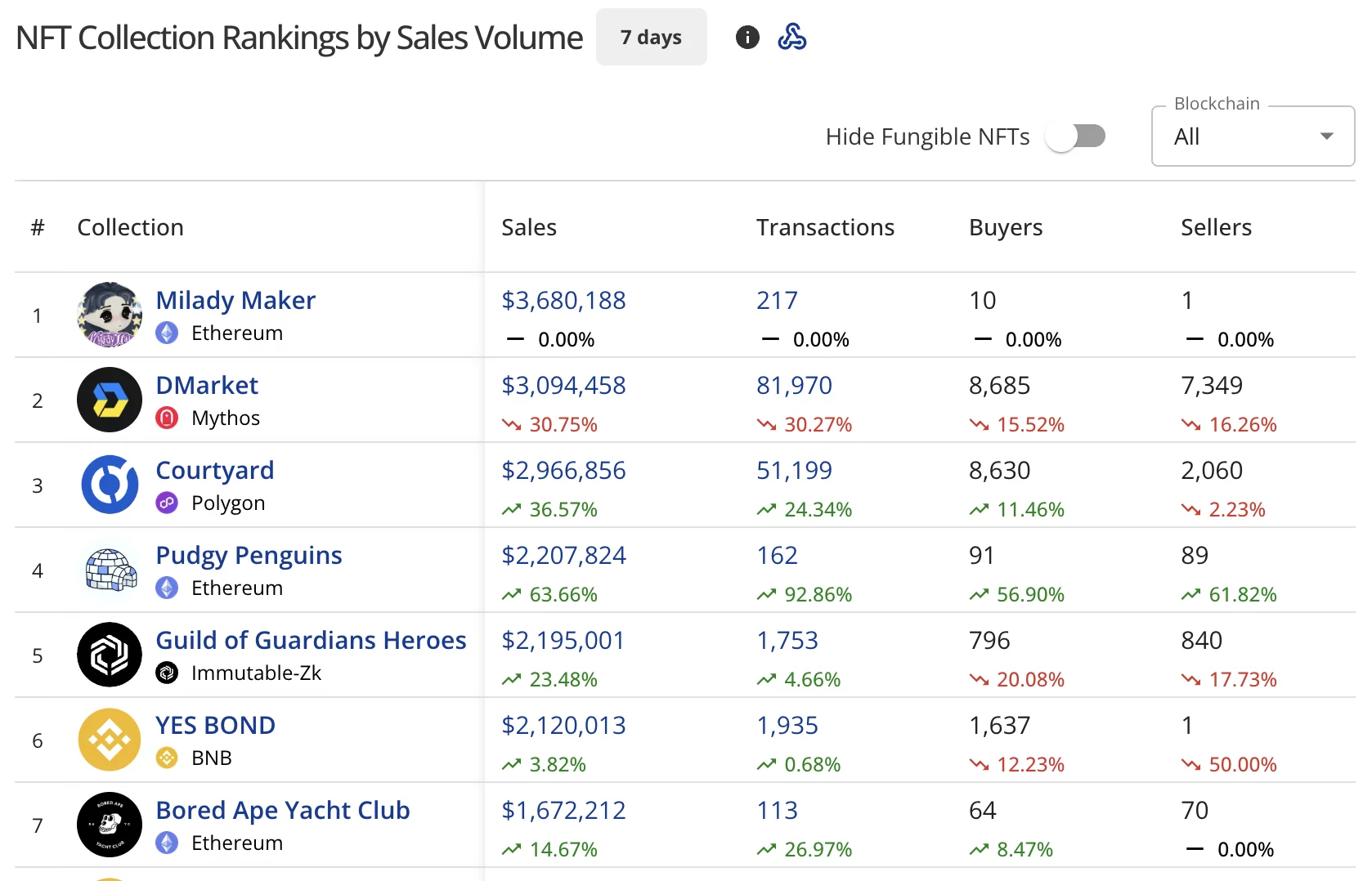

Milady Maker debuts at top as DMarket falls

Milady Maker on Ethereum has claimed first place with $3.68 million in sales. The collection processed 217 transactions with just 10 buyers and 1 seller.

DMarket on the Mythos blockchain dropped to second with $3.09 million, down 30.75% from last week’s $4.50 million. The collection recorded 81,970 transactions with 8,685 buyers and 7,349 sellers.

Courtyard on Polygon (POL) surged to third place with $2.97 million, up 36.57% from last week’s $2.18 million. The collection processed 51,199 transactions with 8,630 buyers and 2,060 sellers.

Pudgy Penguins jumped to fourth at $2.21 million, soaring 63.66%. The Ethereum collection saw 162 transactions with 91 buyers and 89 sellers, marking a strong recovery.

Guild of Guardians Heroes on Immutable-Zk secured fifth position with $2.20 million, up 23.48% from last week’s $1.78 million. The collection had 1,753 transactions.

YES BOND on BNB held sixth place at $2.12 million, up 3.82% from last week’s $2.04 million. The collection recorded 1,935 transactions.

Bored Ape Yacht Club rounded out the top seven with $1.67 million, up 14.67%. The collection processed 113 transactions with 64 buyers and 70 sellers.

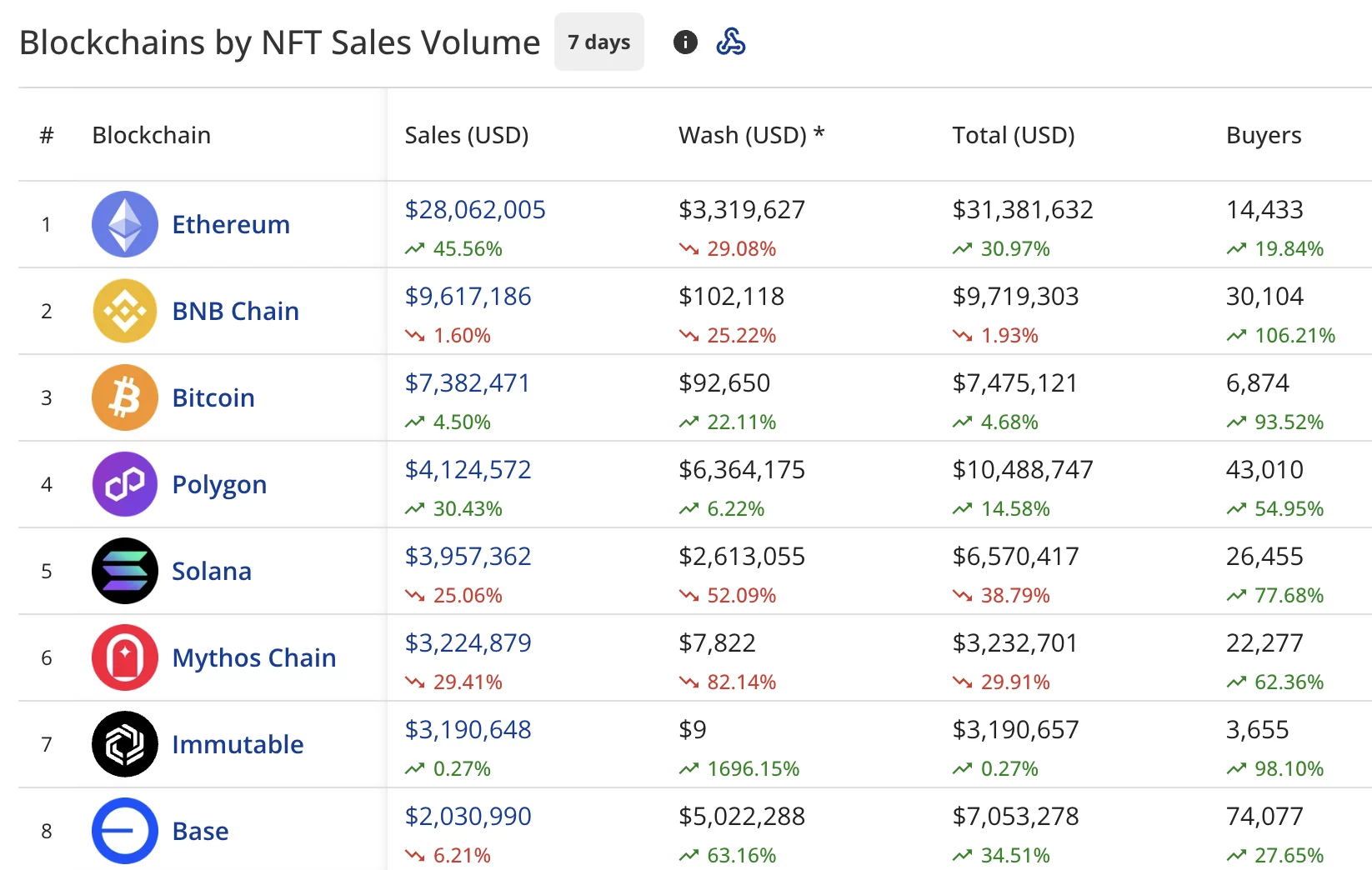

Ethereum posts notable growth as Solana retreats

Ethereum dominated with $28.06 million in sales, exploding 45.56% from last week’s $23.93 million.

The network recorded $3.32 million in wash trading, bringing its total to $31.38 million. Buyers climbed 19.84% to 14,433.

BNB Chain (BNB) held second position at $9.62 million, down 1.60% from last week’s $9.44 million. The blockchain recorded $102,118 in wash trading, with buyers surging 106.21% to 30,104.

Bitcoin secured third place at $7.38 million, up 4.50% from last week’s $6.10 million. The network saw 6,874 buyers, up 93.52%.

Polygon climbed to fourth with $4.12 million, up 30.43% from last week’s $3.12 million. The blockchain recorded $6.36 million in wash trading, bringing its total to $10.49 million. Buyers rose 54.95% to 43,010.

Solana (SOL) dropped to fifth at $3.96 million, down 25.06% from last week’s $5.54 million. The network had 26,455 buyers, up 77.68% despite the sales decline.

Mythos Chain placed sixth with $3.22 million, down 29.41% from last week’s $4.64 million. The blockchain attracted 22,277 buyers, up 62.36%.

Immutable (IMX) secured seventh position at $3.19 million, up 0.27% from last week’s $3.15 million. Buyers jumped 98.10% to 3,655.

Base landed in eighth at $2.03 million, down 6.21%. The blockchain had 74,077 buyers, up 27.65%.

Wrapped Ether Rock leads NFT sales

- Wrapped Ether Rock #38 topped individual sales at $265,594.19 (90 ETH), sold three days ago.

- Beeple Spring Collection #100100001 placed second at $186,493.03 (60 ETH), sold six days ago.

- A $X@AI BRC-20 NFT sold for $160,299.03 (1.7951 BTC) six days ago.

- Autoglyphs #192 fetched $156,342.55 (55 WETH) a day ago.

- CryptoPunks #5133 completed the top five at $131,200.81 (44.99 ETH), sold four days ago.

You May Also Like

Wormhole launches reserve tying protocol revenue to token

Top Altcoins To Hold Before 2026 For Maximum ROI – One Is Under $1!