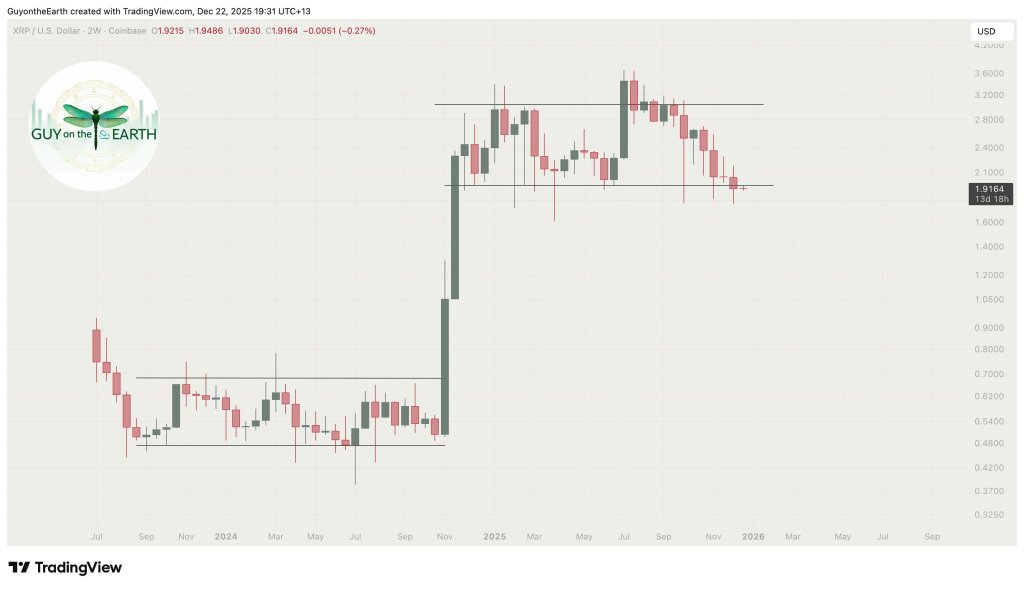

XRP Breaks $1.95 Support After 13 Months, Analyst Sees $0.90 Target

XRP has slipped below a level that, for much of the past year, acted like a structural anchor for the chart: the $1.95 area. Crypto analyst Guy on the Earth (@guyontheearth) argued that XRP has now closed under that zone on a higher timeframe, calling out the two-week chart specifically. “For the first time in 13 months XRP has closed under this monthly support at $1.95 on the 2 week chart,” he wrote. “It’s the second time on the weekly this has happened with April tariffs being the first.”

The 2-Weekly Close Is Crucial For XRP

From there, his analysis went straight to the downside implication. “The technical target of this break down is 90c,” he added. “Do with this information what you have to. Everyone must make their own decisions at this time. The goal is getting back above $1.95.”

The way he laid it out, $1.95 was not simply a mid-range price level but the lower boundary of a broader consolidation “rectangle.” Losing it, in that framework, opens the door to a measured move lower — with the reclaim of $1.95 as the key invalidation.

He also offered a risk-management approach for holders who are uncomfortable sitting through a potential continuation move. “If you are uncomfortable holding your bags with this breakdown – sell to reduce risk to where you feel comfortable,” he wrote. “Buy back on a close above $1.95 on the daily ( or a timeframe that you believe in) and your % loss of XRP is next to nothing. But should we go to 90c you are looking at a further 50% loss in capital.”

For those treating the move as an opportunity rather than a warning sign, he mapped out incremental levels he views as potential buy zones on the way down. “Alternatively if you believe in XRP longer term and don’t like trading at all – keep buying on the way down,” he wrote. “Key levels are at $1.61, $1.42 and finally the 90c target and the 75c initial breakout.”

Even in a bearish framing, he cautioned against assuming a straight-line cascade into every marked level. “We have went in a straight line down for weeks so it is unlikely that these targets would all be hit imminently,” he said. “$1.42 lowest this week if things get really ugly – not massively likely but possible with this breakdown and a big sell off in BTC to lower lows.”

Not everyone agreed with the choice of timeframe used to call the breakdown. One account, XRP whale (@cryptoXRPwhale), pushed back on the premise: “2 week chart is not significant. You can’t choose a specific timeframe and say it’s a structure breakdown that fits your narrative… lol” Guy responded by reiterating that the level being referenced is higher-timeframe support, not a short-term marker. “Look at the chart. It held 13 months and now broke structure,” he wrote. “The lower boundary is monthly support. I’ve said all this.”

There was also an attempt in the replies to flip the bearish target into a bullish setup. “Any price under $1 will be short-lived & sets $XRP up for a stronger push to the upside past ATH,” wrote Lawrence Bensen (@Lawrence_Bensen), referencing prior cycle lows and a reported wick below $1 on Binance earlier in the cycle. Guy acknowledged the point while keeping the technical math intact. “Yeah for sure – it has already been to 90c on Binance [on October 10],” he wrote. “I think we will recover before going as low as 90c – but that is the technical target of losing this consolidation.”

His near-term bias, meanwhile, leaned toward caution largely on liquidity conditions rather than an absolute conviction that $0.90 must print. “My bias is that I find it hard to believe at Christmas people are going to throw heaps of money in this market,” he wrote. “Low liquidity has been an issue anyways and this week wont help. So the slow bleed continues.”

At press time, XRP stood at $1.89.

You May Also Like

Ethereum Options Expiry Shows Risks Below $2,900

Fed forecasts only one rate cut in 2026, a more conservative outlook than expected