Yuan Soars, Bitcoin Stalls: Why the Dollar Dip Isn’t Lifting Crypto

China’s currency hits a 2.5-year high as the dollar weakens — a classic bullish setup for Bitcoin that isn’t working.

China’s onshore yuan closed at its strongest level since May 2023 on Thursday, trading at 7.0066 per dollar and nearly breaching the psychologically key 7-per-dollar mark. The move caps a 5% appreciation against the greenback since early April.

Yuan’s Rally, Dollar’s Exit

The rally is being driven by Chinese exporters rushing to convert their dollar revenues into yuan before year-end. This is more than seasonal housekeeping — analysts estimate that over $1 trillion in corporate dollars held offshore could eventually flow back to China.

Why now? The calculus has shifted. China’s economy is showing signs of recovery, the US Federal Reserve has been cutting rates, and the yuan itself is strengthening — creating a self-reinforcing cycle. Holding dollars looks less attractive when the currency you’re converting into keeps rising.

Some brokerages believe this is only the beginning. The headwinds that pressured the yuan for years — trade tensions, capital flight, a surging dollar — are now reversing into tailwinds. If the Fed eases more aggressively in 2026, as some expect, the yuan’s climb could accelerate further.

The Setup That Should Work

A weakening dollar typically lifts Bitcoin. The logic is straightforward: as the world’s reserve currency loses ground, dollar-denominated assets like BTC become relatively cheaper, and the “digital gold” narrative gains traction.

Gold is playing its part — the metal has hit record highs this month. Yet Bitcoin remains stuck in a $85,000-$90,000 range, unable to sustain breaks above $90,000 despite three attempts this week alone.

Why the Disconnect?

Several factors are muting Bitcoin’s response to what should be favorable macro conditions.

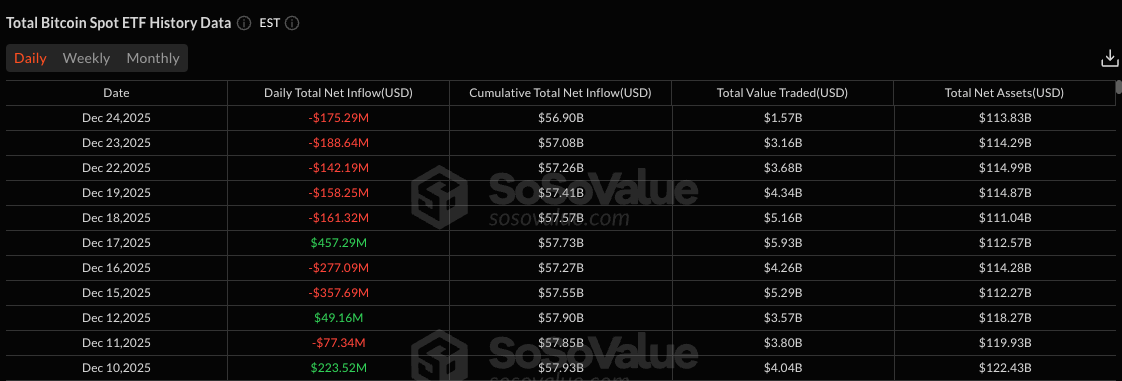

First, year-end liquidity is thin. Holiday trading volumes have amplified volatility while limiting conviction-driven moves. Second, institutional flows have turned negative — US spot Bitcoin ETFs have seen five consecutive days of net outflows totaling over $825 million, according to SoSoValue data.

Source: SoSoValue

Source: SoSoValue

Third, the Bank of Japan’s rate hike last week to a three-decade high has kept markets on edge. Although the yen weakened rather than strengthened after the decision — limiting carry trade unwind pressure — uncertainty over the BOJ’s future path continues to weigh on risk appetite.

2026: Delayed Rally?

The bullish case isn’t dead, just deferred. Some analysts expect the dollar to weaken further in 2026, particularly if US monetary easing exceeds current market expectations.

If that thesis plays out, Bitcoin’s muted response to current dollar weakness may reflect timing rather than a structural breakdown in the correlation. Once liquidity normalizes in January and Fed policy clarity improves, the yuan’s signal may finally reach crypto markets.

For now, Bitcoin watches from the sidelines as China flashes one of the clearest dollar-bearish signals in years.

You May Also Like

Fed Q1 2026 Outlook and Its Potential Impact on Crypto Markets

Taiko Makes Chainlink Data Streams Its Official Oracle