Bitcoin’s Illiquid Supply Drops By 62,000 BTC – What’s Behind The Shift?

Blockchain analysis platform Glassnode has shared some important insights on Bitcoin’s liquidity levels amid a rather volatile market period. Notably, the leading cryptocurrency has struggled to maintain its “Uptober” form after a price surge to $126,000 was followed by a heavy correction to below $105,000. While Bitcoin has shown some recovery activity since then, it is yet to break above the $115,000 resistance, while its total monthly gain stands at 0.47%.

Bitcoin Liquidity Rises, Testing Demand Strength

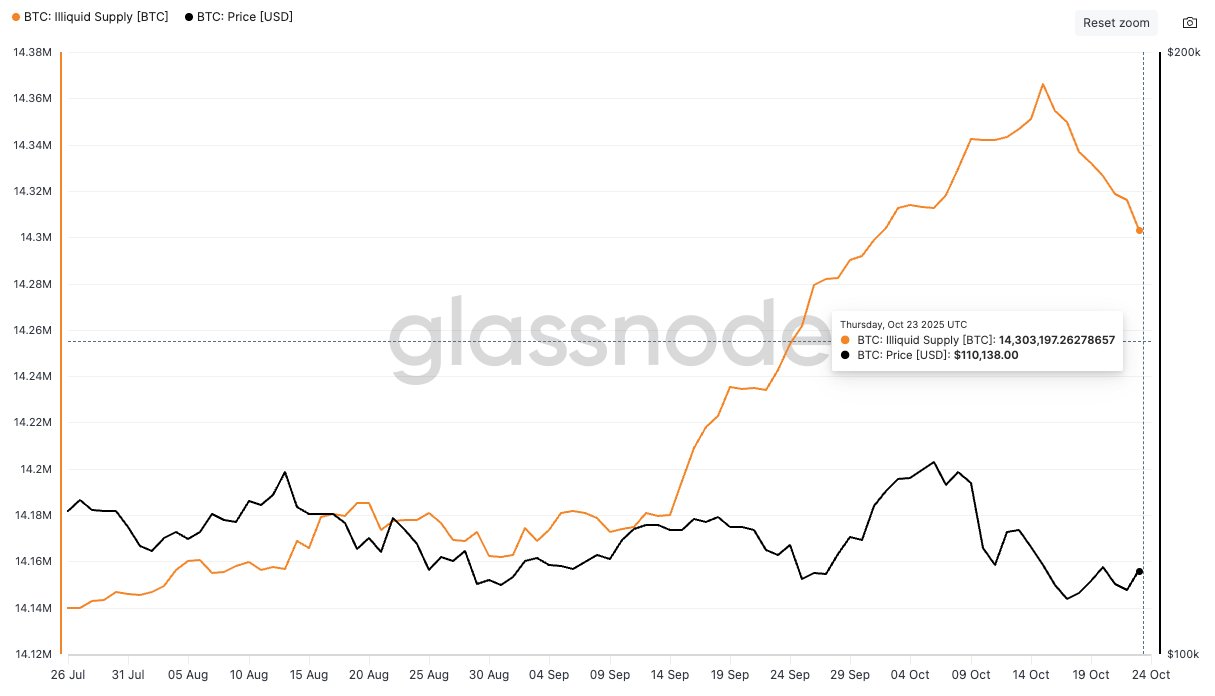

In an X post on October 25, Glassnode reports that Bitcoin’s illiquid supply has fallen by 62,000 BTC since mid-October. For context, Illiquid Bitcoin refers to BTC that is held in wallets with little to no history of selling. They are essentially coins that are unlikely to move because their holders rarely spend and are considered off the market.

Therefore, a decline in illiquid BTC suggests that more coins are returning to active circulation, increasing available supply. This dynamic can make sustained price growth more challenging unless offset by a strong surge in demand.

Glassnode explains that illiquid supply growth has been a positive catalyst in this market cycle before this recent decline occurred. Historically, similar pullbacks, such as the 400,000 BTC decline in January 2024, have tended to slow market momentum by increasing the amount of Bitcoin in active circulation.

Who’s Behind The Sale?

In analyzing this fall in illiquid BTC, Glassnode further discovered that Bitcoin whales’ accumulation activity has accelerated. In particular, BTC wallets have increased their holdings over the past 30 days and have yet to liquidate any large positions since October 15.

Therefore, the rise in BTC liquidity has been driven by retail investors. More data from Glassnode reveals that wallets holding between 0.1-10 BTC, i.e. $10,000 to $1,000,000, have been producing consistent heavy outflows. In particular, this set of traders has been steadily reducing their BTC exposure since November 2024.

In relation to recent price action, Glassnode analysts note that momentum buyers, primarily retail investors, are increasingly exiting the market. Although dip buyers i.e., whales, have stepped up their activity, their demand has not been sufficient to absorb the excess supply, leading to the price imbalance currently observed.

At the time of writing, Bitcoin is trading at $111,570, reflecting a modest 0.89% gain over the past 24 hours. On higher timeframes, the leading cryptocurrency has recorded a 4.11% increase over the past week and a marginal 0.05% rise over the past month.

You May Also Like

qLabs Fires First Shot in Quantum Crypto Race — Can Coinbase Catch Up?

Slate Milk Raises $23 Million Series B Round To Bolster Protein Drink’s Rapid Growth