I Unlocked Cash Without Selling Bitcoin: My OnLock Story

At some point, I needed extra funds, but selling bitcoin was not an option — that would mean locking in a loss.

I was looking for a way to keep my position while still getting access to liquidity. The solution was right there in my EMCD account.

There is a service called OnLock: you use BTC as collateral and receive USDT for temporary use. The whole process took about 15 minutes. Here’s how it worked for me.

Why Liquidity Services Are Trending

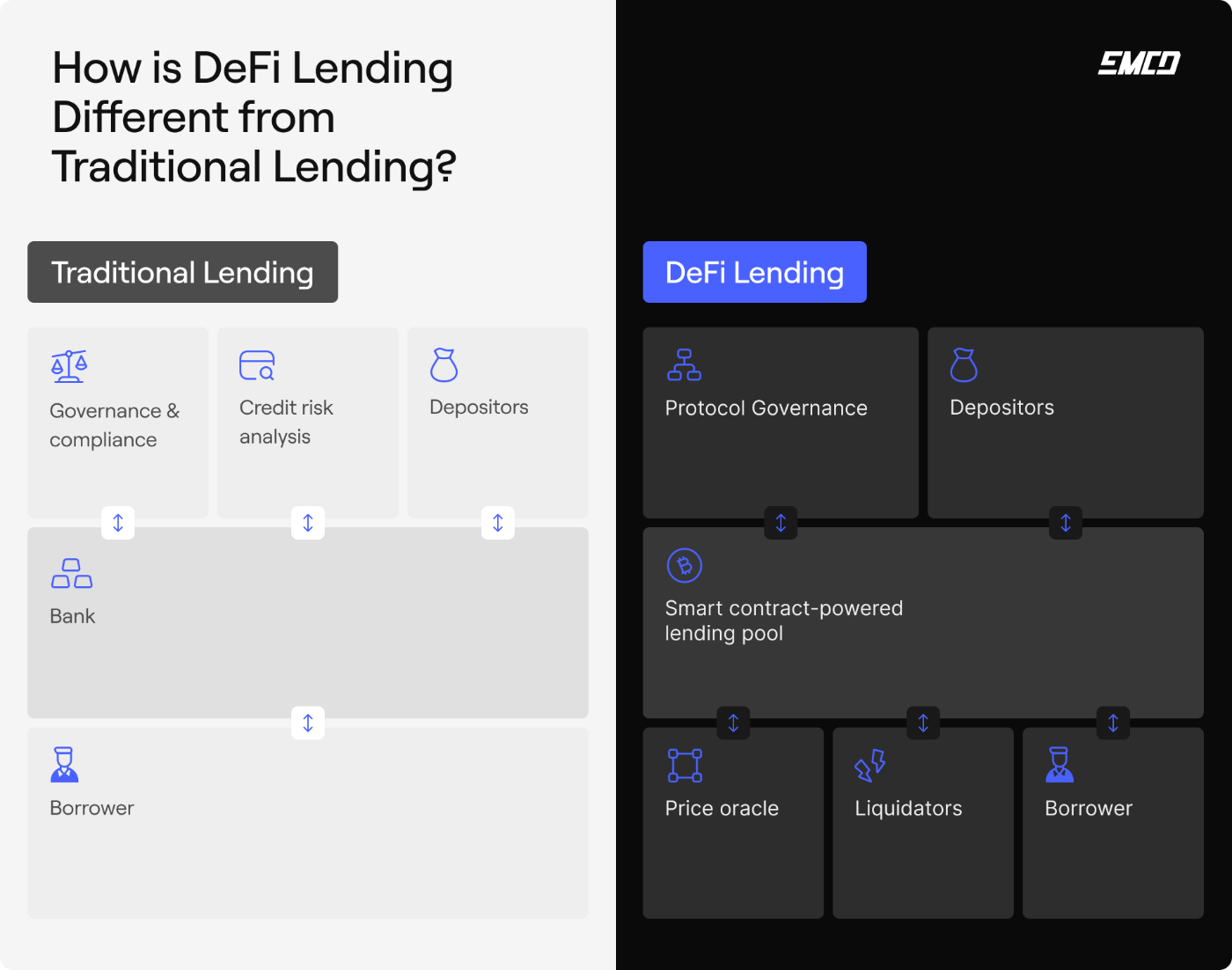

At the 0xConnect festival, there was a lot of discussion about platforms where crypto can be used as collateral. The idea is simple: you don’t sell bitcoin or ether; you leave them as collateral and receive USDT.

==Your assets remain with you, while the stablecoins can be used right away — withdrawn, used in services, or circulated.== Unlike traditional financial solutions, there’s no paperwork, credit history checks, or long waiting periods.

That’s exactly why I wanted to test OnLock in practice with EMCD.

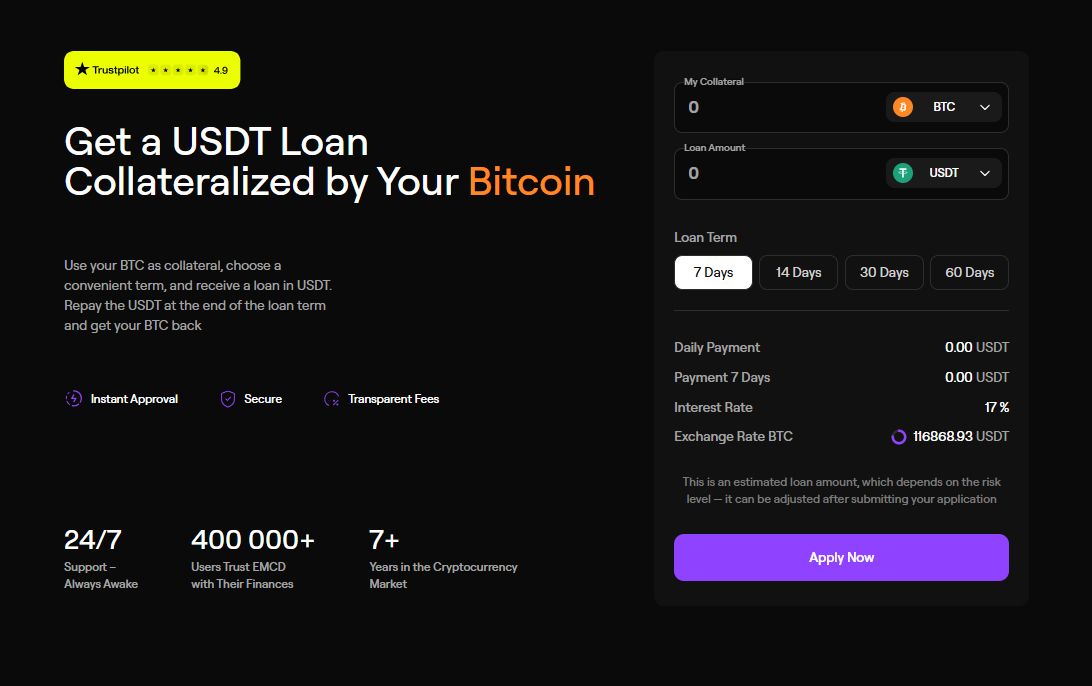

Step One: Choosing the Terms

Everything is straightforward in the personal account. I could see my collateral in BTC, the available amount in USDT, and term options: 7, 14, 30, or 60 days.

The system displayed a fixed fee — in my case, equal to 17% annually — plus the daily calculation and the total amount for the selected term.

After adding BTC as collateral and setting the parameters, a “Receive” button appeared, and ==within 15 minutes== the USDT was in my balance.

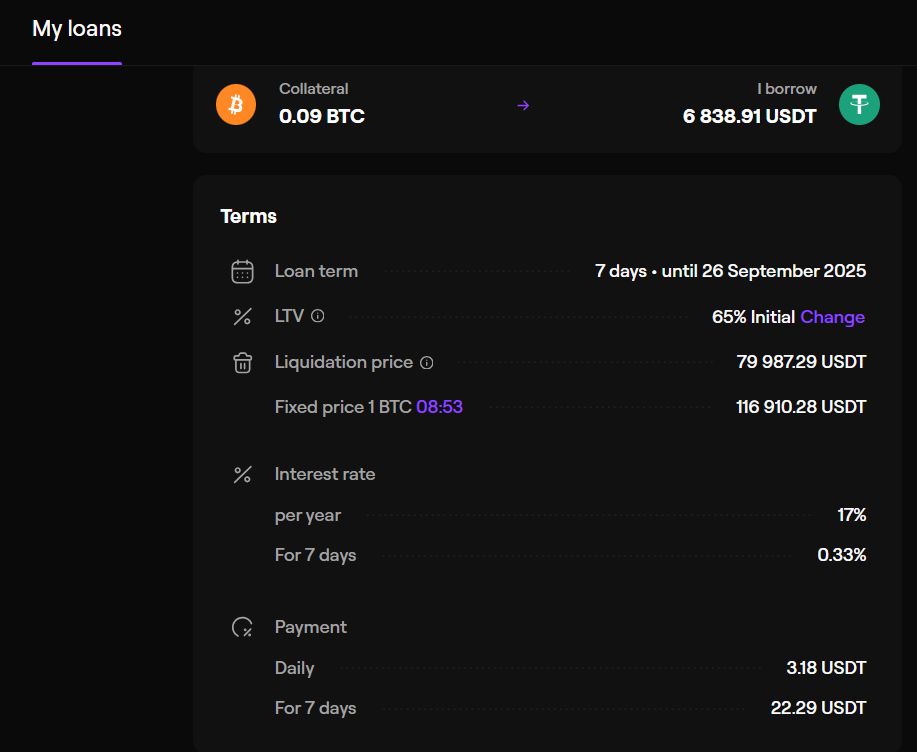

Step Two: Understanding LTV and Risk

One of the key parameters in OnLock is LTV (Loan-to-Value). It shows what portion of your BTC value you can access in USDT.

The lower the LTV, the lower the risk of liquidation. If BTC falls in price, LTV rises, and vice versa. That’s why it’s safer to keep some buffer.

Liquidation happens if the LTV exceeds 95%. In that case, the system uses part of the collateral to close the position.

The advantage with EMCD is that you get notifications and a 5-day grace period. This gives time to add more collateral or return part of the funds in advance. In other words, you stay in control of the risk instead of just watching the price move.

Step Three: Returning USDT and Unlocking BTC

You can close the position at any time. It’s enough to return the USDT plus the platform fee — and your BTC is released immediately.

Usually, this takes less than an hour since assets are stored in cold wallets. If there are no funds available, the system closes the position automatically at the market rate, but only after the term and the 5-day grace period expire.

Step Four: How to Use USDT

Once liquidity access is arranged, ==USDT can be used right away==. EMCD offers several options: move funds into Coinhold, EMCD’s reward service, with reward levels of up to 14% annually (depending on market conditions), or withdraw through P2P.

Final Thoughts: My OnLock Experience

OnLock by EMCD is a practical way to access funds without selling core assets. It works as a collateral-based liquidity model but stands out with simple terms, transparent fees, and timely notifications.

I received USDT in 15 minutes, kept my BTC, and could manage my risks flexibly.

For comparison: Arch, YouHodler, and Compound offer similar services, but their Trustpilot ratings are noticeably lower — Compound 3.2, YouHodler 3.8, Arch 4.8.

Complaints often mention delays and hidden fees. EMCD holds a ==4.9 rating==, and my experience confirms this: everything worked quickly, clearly, and without hidden conditions.

Of course, the main drawback remains — volatility risk. If bitcoin drops sharply, the position may be liquidated. But that’s true for the entire sector, not just EMCD.

In every other aspect, the tool proved genuinely convenient: it helps preserve your portfolio while giving you liquidity here and now.

Liked this story? Don’t miss the next one. Smash that Subscribe button and stay tuned for more hands-on crypto insights!

\ \ \n

\

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

SHIB Price Analysis for February 8