Polymarket Lures Bettors With Highest 4% Yield Amid Kalshi’s Weekly Volume Surge

Polymarket has introduced a new incentive for prediction market participants, offering a 4% annualized yield on certain long-term positions. The reward, which is paid out daily, is designed to keep long-term pricing accurate and is currently funded through the Polymarket Treasury.

According to the exchange, the yield applies to positions in a set of political and geopolitical markets, including the 2028 U.S. presidential race, the balance of power in the 2026 midterms, and leadership outcomes in countries such as Russia, China, Turkey, Israel, and Ukraine.

Positions are valued based on the number of “Yes” and “No” shares held and the most recent mid-price, with rewards distributed after an hourly random sampling of accounts. The 4% rate is variable and may be adjusted or capped at the company’s discretion.

Prediction Market Rivalry Heats Up as Kalshi Tops Polymarket by Volumes

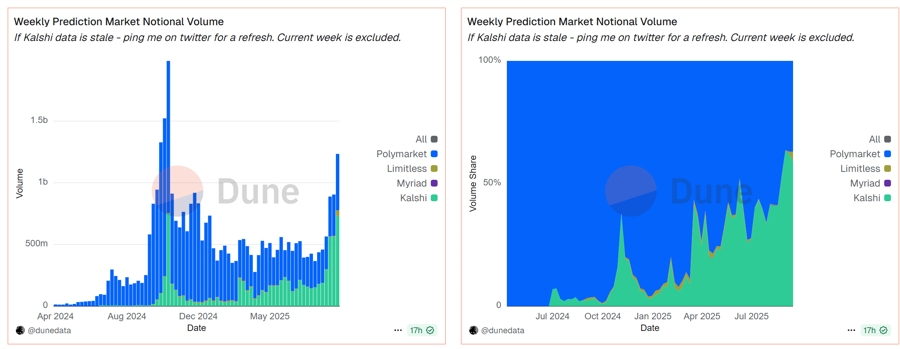

While Polymarket’s new holding rewards seek to attract long-term bettors, competitor Kalshi has been dominating in terms of trading activity. For three consecutive weeks, Kalshi has posted higher volumes than Polymarket, recording $728 million in trades last week.

That figure is nearly 60% higher than Polymarket’s volume and close to Kalshi’s record $749 million during the run-up to the 2024 U.S. presidential election.

Source: Dune Analytics

Source: Dune Analytics

Data from Dune Analytics shows that between September 11 and 17, Kalshi captured 62% of total on-chain prediction market volume, with more than $500 million in trades and $189 million in open interest.

Polymarket, by comparison, registered $430 million in trading volume and $164 million in open interest over the same period.

Analysts note that Polymarket’s higher open interest relative to volume reflects longer-term positions, while Kalshi’s lower ratio points to faster turnover and more active trading.

The competition between the two platforms shows diverging strategies. Kalshi, operating as a CFTC-authorized exchange, has capitalized on regulated event-based contract trading in the U.S.

Polymarket, meanwhile, has historically catered to international users through blockchain-based markets but is expanding in the U.S. following its acquisition of the regulated exchange QCX. The company also recently launched earnings-based prediction markets in partnership with Stocktwits.

Despite the differences in structure and oversight, both platforms continue to grow, with Kalshi solidifying its lead in weekly volume and Polymarket focusing on user retention through higher yields and long-term markets.

CFTC Clears Polymarket for U.S. Return as Kalshi Faces State Lawsuit

The prediction market space is entering a new phase as regulators in the U.S. take divergent approaches to two of its biggest players.

On September 3, the CFTC cleared Polymarket to re-enter the U.S. through a no-action letter covering event contracts.

The move marks Polymarket’s official return after a 2022 settlement forced it to block American users.

CEO Shayne Coplan hailed the clearance as “a green light” for U.S. operations, noting that it gives the company space to scale legally. The breakthrough comes as Polymarket pursues a valuation of up to $10 billion, more than triple its last known $1 billion valuation in June.

The firm rose to prominence after its markets accurately predicted Donald Trump’s 2024 victory, drawing major institutional backing and user growth.

While Polymarket is regaining ground, rival Kalshi is facing legal hurdles. On September 13, Massachusetts Attorney General Andrea Joy Campbell filed a civil lawsuit accusing Kalshi of running unlicensed sports betting disguised as “event contracts.”

The suit alleges that between January and June 2025, 70–75% of Kalshi’s $1 billion in wagers came from sports markets, rivaling licensed operators like DraftKings. Regulators say the platform allowed underage betting and lacked safeguards required by state law.

As Polymarket moves forward with regulatory cover, Kalshi’s future could hinge on a growing clash between state gambling laws and federal commodities oversight.

You May Also Like

Trump foe devises plan to starve him of what he 'craves' most

3 Crypto Trading Tips That Work