Multiple drivers behind Sui's rise: from Pokémon collaboration rumors to DEX trading volume surge

Author: Frank, PANews

Recently, Sui governance tokens and their ecosystem have experienced a remarkable surge, with the SUI token itself rising by more than 75% in a week, far exceeding the market performance during the same period. Behind this phenomenon are complex driving factors, including speculative enthusiasm caused by market rumors, significant changes in capital flows, and continued improvement in the fundamentals of the ecosystem. In this article, PANews deeply analyzes the capital trends, key news catalysts, on-chain data performance, and potential risks of this round of SUI's rise, and strives to fully interpret the logic behind this ecological carnival.

Hot money poured into the exchange, and contract positions surged

Judging from the on-chain fund flow in recent months, Sui's fund changes are not obvious. In a three-month period, Sui's funds showed a net outflow of 32 million US dollars, which is not a high amount. Further observation of the on-chain fund flow changes in the past month and the past week shows that Sui's fund flow has changed very little, and it has not even ranked in the top 20 among public chains.

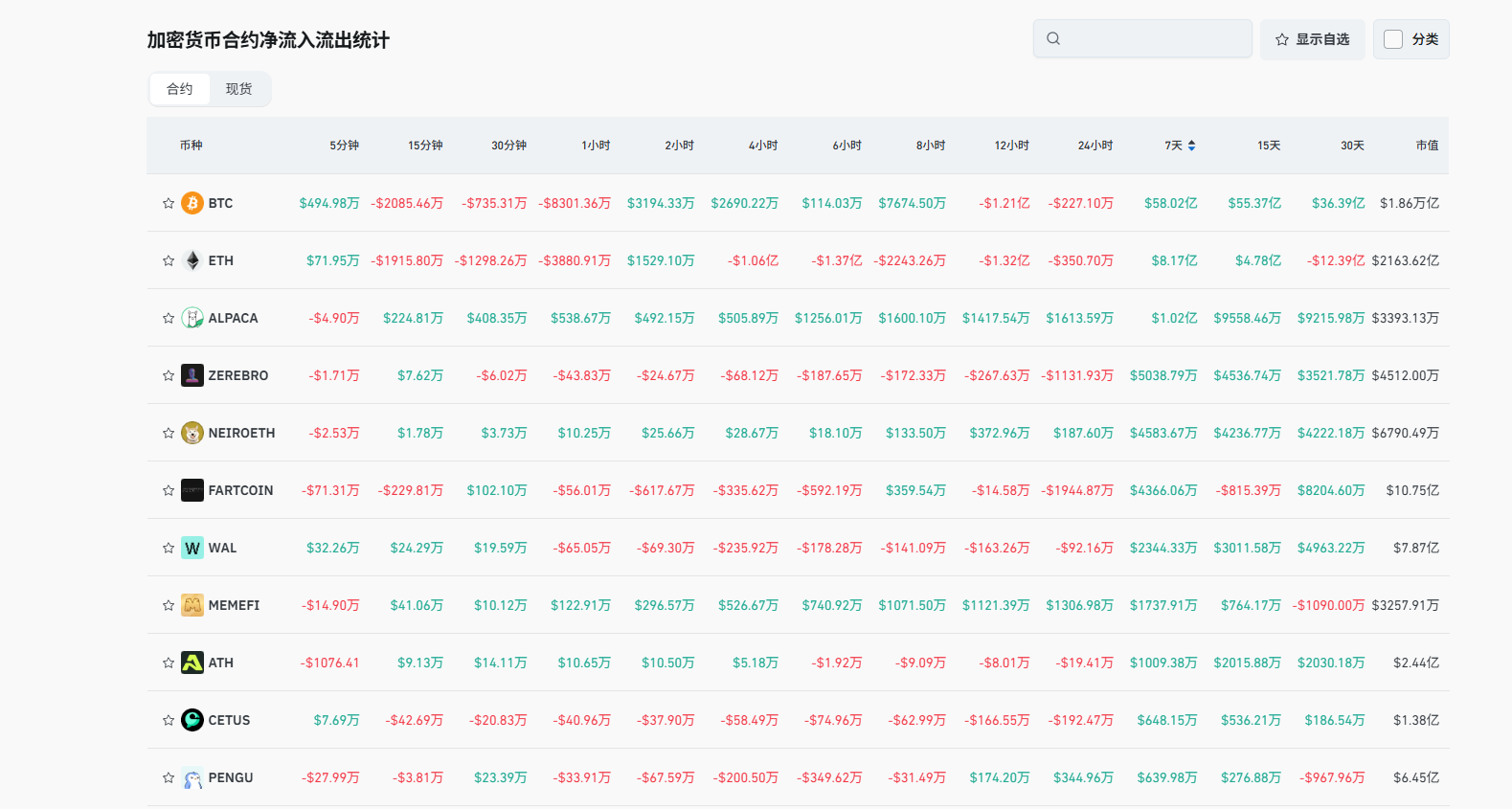

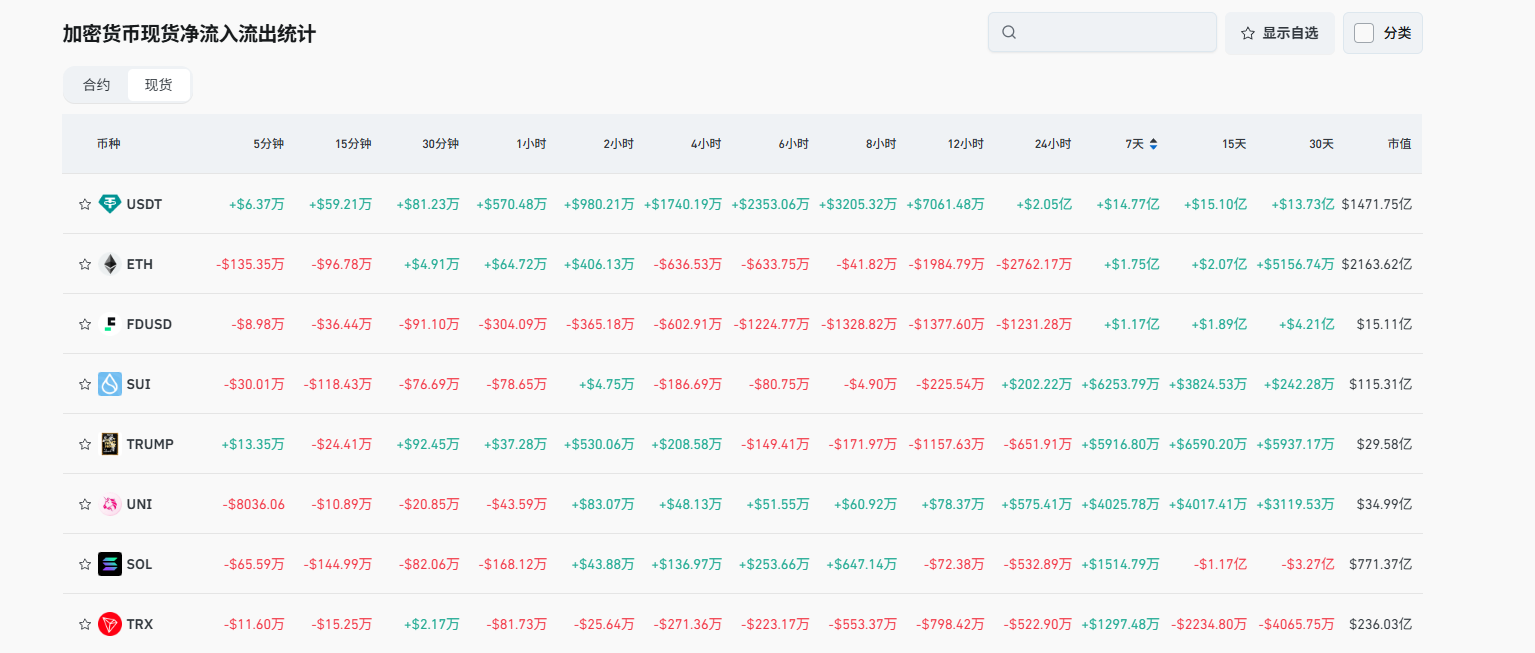

However, in terms of the flow of funds in the exchange, the influx of funds into the Sui ecosystem is more obvious. According to Coinglass data, in the past seven days, the inflow of spot funds into SUI reached 62.86 million US dollars, ranking fourth among all currencies, second only to USDT, ETH, and FUSD. In the ranking of funds inflow of contracts in the past seven days, several ecological tokens of the Sui network, such as WAL, MEMEFI, and CETUS, also ranked among the top ten, which further reflects the activeness of funds in the Sui ecosystem.

In terms of the contract's position data, the holdings of SUI tokens began to surge on April 21, increasing from US$700 million to US$1.419 billion in just one week. This figure is already close to the previous high of US$1.5 billion.

In addition to SUI, most tokens in its ecosystem also saw a sharp rise within a week. Among the Sui ecosystem tokens included in Coingecko, 35 tokens have increased by more than 100% in the past week, accounting for 20% of Sui ecosystem projects, and 37.5% of the tokens have increased by more than 50%, which can be said to be a comprehensive bloom.

From the perspective of funds, this rise is a comprehensive collective boost to the Sui ecosystem. Although most projects have not made any actual positive progress, the price fluctuations on the market are very obvious.

Multiple positive factors boost market sentiment

On April 21, almost all mainstream tokens began to rebound synchronously. Sui's initial rebound also started with the rhythm of the market, and then a lot of good news came out. However, it is difficult to confirm whether these news are the "engine" of Sui's surge or a "smoke bomb" released to cooperate with the price increase.

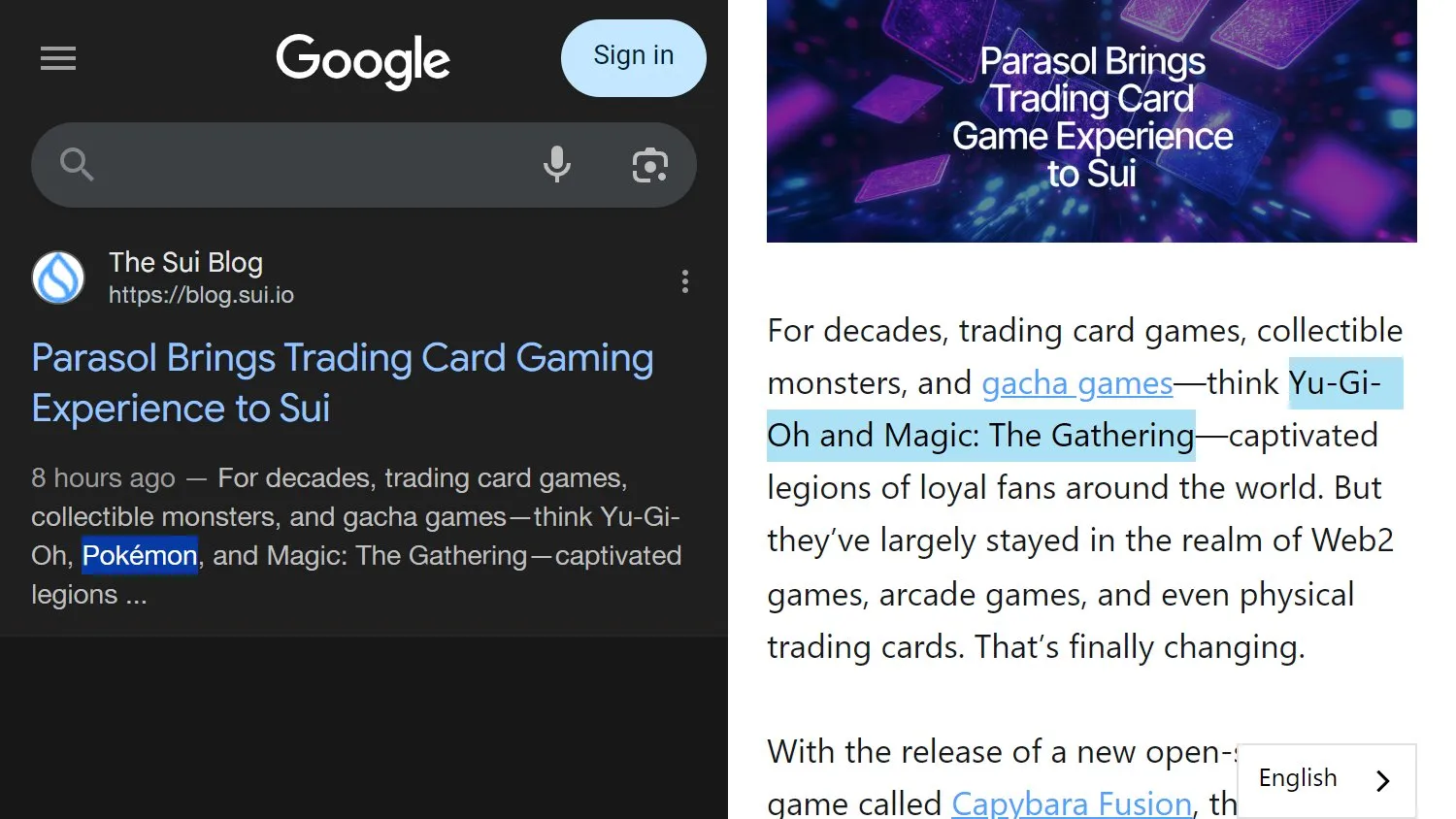

On the one hand, Sui has been rumored to have multiple ecological cooperation. For example, the rumor of Pokémon cooperation: the rumor began on April 23, 2025, when the Pokémon HOME app updated its privacy policy and listed "Parasol Technologies" as one of the authorized developers allowed to receive user data. Parasol Technologies is a blockchain game studio that was acquired by Sui's core development team Mysten Labs in March 2025. This direct connection quickly ignited the market's imagination, and crypto opinion leaders and social media users speculated that Pokémon might plan to integrate its IP into the Sui blockchain. The market narrative focuses on potential NFT integration or blockchain-based collectibles, and may even be related to Pokémon HOME's newly launched "medals" feature.

It is worth noting that the Sui Foundation’s official blog post about Parasol’s launch of a collectible card game on Sui, published on April 23, did not mention Pokémon. However, a user claimed that an earlier version of the blog mentioned Pokémon NFTs but was subsequently deleted by the editor, further fueling market speculation.

Another example is the xMoney/xPortal collaboration: On April 24, Sui announced a partnership with financial platform xMoney and crypto super app xPortal. The core of this collaboration is the launch of a Sui-branded virtual Mastercard in Europe, which is integrated into the xPortal app with 2.5 million users. Users can add the virtual card to ApplePay or GooglePay and use SUI and other cryptocurrencies to pay at tens of thousands of merchants, just as easily as using cash. The physical card is scheduled to be launched later in 2025.

On the other hand, the ETF narrative is also considered to be one of the important factors driving Sui's rise. Recently, the news that 21Shares established the "SUI ETF" legal trust entity was spread. This news is actually not a new development. According to the Delaware company registration information, the "21SHARES SUI ETF" legal trust entity No. 10058451 was established on January 7, 2025, and the registration type is a general legal trust. With the recent exposure of this news, it seems to provide support for the rise of SUI.

In addition, there have been a lot of good news about the Sui network in the past one or two months. For example, the Athens Stock Exchange Group announced on April 16 that it had completed the technical design of building an on-chain fundraising platform on Sui; Nautilus launched a verifiable off-chain privacy solution for Sui on April 15; Canary Capital submitted an application for the SUI ETF, etc.

In general, Sui's recent progress in Web3 games, privacy, development environment and other fields has brought together a positive overall situation. In this regard, it is different from Sui's previous outbreak caused by a single message.

The airdrop event led to a surge in DEX trading volume, facing the dual pressure of token unlocking and application construction

Since April, the DEX transaction volume of the Sui network has remained at a high level, especially on March 29, when it hit a historical peak of US$998 million, and then exceeded US$400 million in daily transaction volume for many days. The leading DEX project in the ecosystem, Cetus Protocol, has driven the growth of the entire ecosystem, with its transaction volume increasing by 84.5% in the past week, and the token CETUS has nearly doubled in a week.

In addition, another important contributor is Kriya. On March 29, when Sui network transaction volume broke the record, Kriya contributed $780 million, accounting for a significant share of the day's transaction volume. This figure increased more than 100 times compared to $7.28 million the day before.

Taken together, the trading volume of these two DEXs skyrocketed on March 28, and the main reason may be the surge in trading volume caused by the Walrus airdrop. On March 27, the decentralized storage project Walrus, which raised $140 million in financing, released an airdrop, and the trading volume of the token reached $380 million on the same day. This may be the main reason for the recent increase in trading volume on the Sui network.

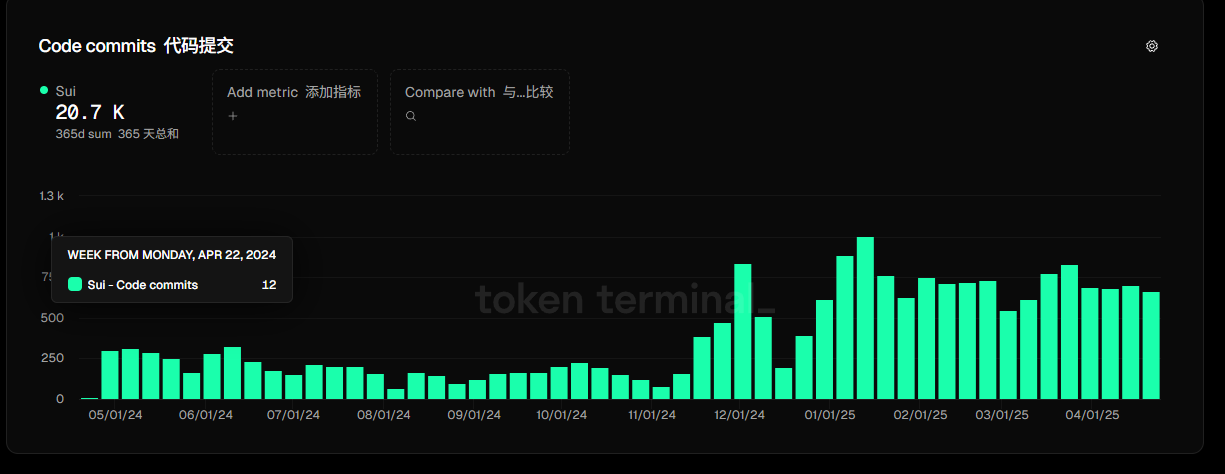

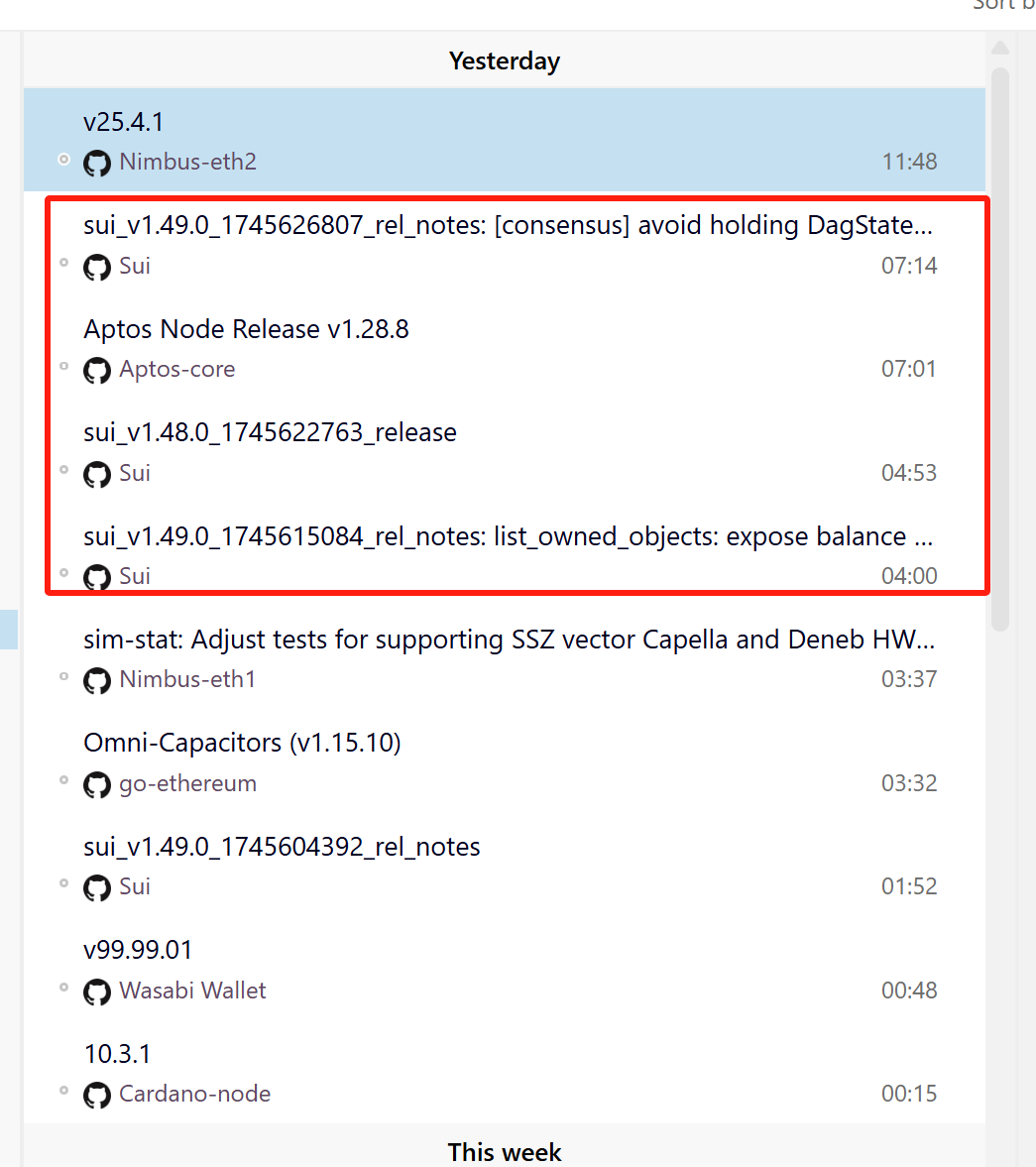

In addition, the activeness of developers is also one of the underlying reasons for the growth of the Sui network. On Github, the code submission of the Sui network has also been relatively frequent recently. Starting from December 2024, the frequency of code submission of the Sui network has reached a peak, basically maintaining more than 500 times per week, while the previous data was basically maintained at around 250 times. In comparison, the code submission frequency of Solana and Aptos is basically maintained at around 100.

However, in the process of the market's collective carnival, there are still several risk points that may be worth noting. On the one hand, the unlocking of SUI tokens is a continuous selling pressure, and tens of millions of tokens are released basically every week, making it the largest supplier in the market. These unlocked tokens are always a time bomb in the rising cycle of SUI tokens.

On the other hand, the rising structure of Sui ecology is currently mainly led by Dex or infrastructure projects, but MEME tokens or applications/games have not yet performed well, and tokens with a market value of more than 10 million are still basically early projects. From this perspective, if Sui is compared to a city, in this city, shopping malls with themes such as decentralized storage, DeFi, and games are built around projects such as Walrus, Deepbook, and Parasol. However, these shopping malls are still lacking some "Internet celebrity merchants" to further attract large-scale users to enter the market.

From this point of view, the recent surge in the SUI token and its ecosystem is the result of market speculation, capital influx, expectations of the contract market, and solid fundamental progress. However, while paying attention to the outstanding performance of Sui prices, we must also be wary of the selling pressure brought by the continuous unlocking of tokens, and pay attention to whether its application ecosystem can further prosper and give birth to popular applications that truly attract users. This will be the key to determining whether Sui can transform its current popularity into long-term value.

You May Also Like

Victra Named 2025 Recipient of Verizon’s Best Build Compliance Award

Stablecoins could face yield compression after Fed’s rate cut