Trading time: Currently, institutions dominate the Bitcoin market, retail investor participation is still low, and the market expects Bitcoin to break through $120,000 in June

1. Market observation

Keywords: NXPC, ETH, BTC

Initial jobless claims for the week ended May 10 remained at 229,000, in line with market expectations, while the producer price index (PPI) unexpectedly fell in April and retail sales stagnated. After the release of these data, market expectations for the Fed to cut interest rates twice before the end of 2025 have warmed up, the US dollar index fell slightly, and US stock futures rose in the short term. Andrew Tyler, head of JPMorgan Chase's markets department, said that the core elements of the current bull market remain, including the resilience of macro data, improved corporate earnings and easing trade conditions. He believes that despite the increased risk of a correction, the S&P 500 index may hit an all-time high of 6,144 points this quarter. Regarding the 10-year US Treasury yield breaking through 4.5%, Tyler believes that this is not entirely negative, and points out that the stock market usually takes 1-2 months to digest the high yield. JPMorgan Chase has raised its forecast for the 10-year US Treasury yield at the end of 2025 from 4% to 4.35%, mainly based on higher real GDP growth expectations and lower inflation expectations. In addition, Fed Chairman Powell mentioned in the latest meeting that the Fed is adjusting its monetary policy framework to cope with major changes in inflation and interest rate environment after the epidemic. He mentioned that the previously formulated policy framework is no longer applicable to the current environment, and warned that there may be more frequent and lasting supply shocks in the future, which poses severe challenges to the economy and the central bank.

Bitcoin has been fluctuating around the current price for a week, and trading volume remains sluggish. Analyst FilbFilb is optimistic that its trend is extremely bullish, and although it may fall below $100,000 in the short term, the overall trend is favorable for bulls. The market generally expects Bitcoin to challenge the historical high of $110,000 and may reach $120,000-150,000 in June. He also pointed out that ETH/BTC needs to rebound to the key level of 0.03 to drive a recovery in the altcoin market. JPMorgan analysts predict that Bitcoin may continue to outperform gold in the second half of 2025. Arthur Hayes is more radical, predicting that the return of foreign capital and the massive depreciation of US bonds will drive Bitcoin to $1 million by 2028, although there may be tactical short-selling opportunities in the short term.

As MicroStrategy continues to increase its holdings of Bitcoin, institutional investors regard MicroStrategy shares as an effective target for indirect Bitcoin layout. Institutions such as the California Pension Fund and the Saudi Arabian Central Bank are increasing their holdings of related assets, while Jim Chanos, a well-known Wall Street short, has adopted a strategy of simultaneously bullish Bitcoin and shorting MicroStrategy. In addition, Brazilian listed company Méliuz, Japanese listed company Remixpoint, cross-border e-commerce DDC Enterprise and other companies are also actively increasing their holdings of Bitcoin. 10x Research pointed out that Bitcoin's recent rise is mainly driven by institutional accumulation rather than retail speculation. As long as the price remains above $101,000, the long-term bullish trend will continue. Matrixport analysis also shows that the current rise in Bitcoin is mainly driven by institutional and corporate buyers, and retail participation is still low. Historical experience shows that retail funds often enter the market in the late stage of the market, becoming the last push before the local top.

As Ethereum's short-term surge fell back, the altcoin market is facing a sharp correction. Believe's ecological token LAUNCHCOIN has adjusted after rising for nearly a week, and its current market value has dropped to $200 million. The top projects GOONC and YAPPER fell 69% and 52% respectively. In the past 24 hours, the new project $WATCHCOIN, as the first "watch and earn" application, plummeted at the opening, and its market value dropped to $17 million. Although it raised more than $8 million in SOL through pre-sales, the founder's historical controversy and oversupply risks have caused concerns. It is worth noting that the former FBI director of the United States posted a picture of "8647" made of shells on Instagram, which triggered widespread discussion, but the current market value of the 8647 token on the relevant chain is only about $600,000.

2. Key data (as of 12:00 HKT on May 16)

(Data sources: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN)

-

Bitcoin: $103,957 (+11.19% YTD), daily spot volume $33.867 billion

-

Ethereum: $2,576.41 (-22.44% YTD), with daily spot volume of $25.421 billion

-

Fear of Greed Index: 69 (Greed)

-

Average GAS: BTC 0.6 sat/vB, ETH 0.88 Gwei

-

Market share: BTC 62.1%, ETH 9.4%

-

Upbit 24-hour trading volume ranking: XRP, NXPC, BTC, ETH, DOGE

-

24-hour BTC long-short ratio: 1.0141

-

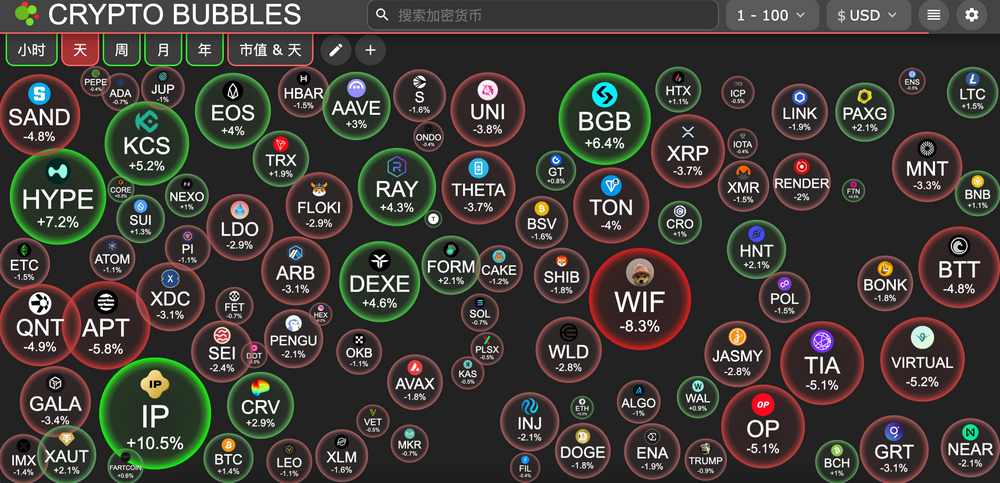

Sector ups and downs: The crypto market fell across the board, SocialFi fell 3.49%, and GameFi rose 2.45%

-

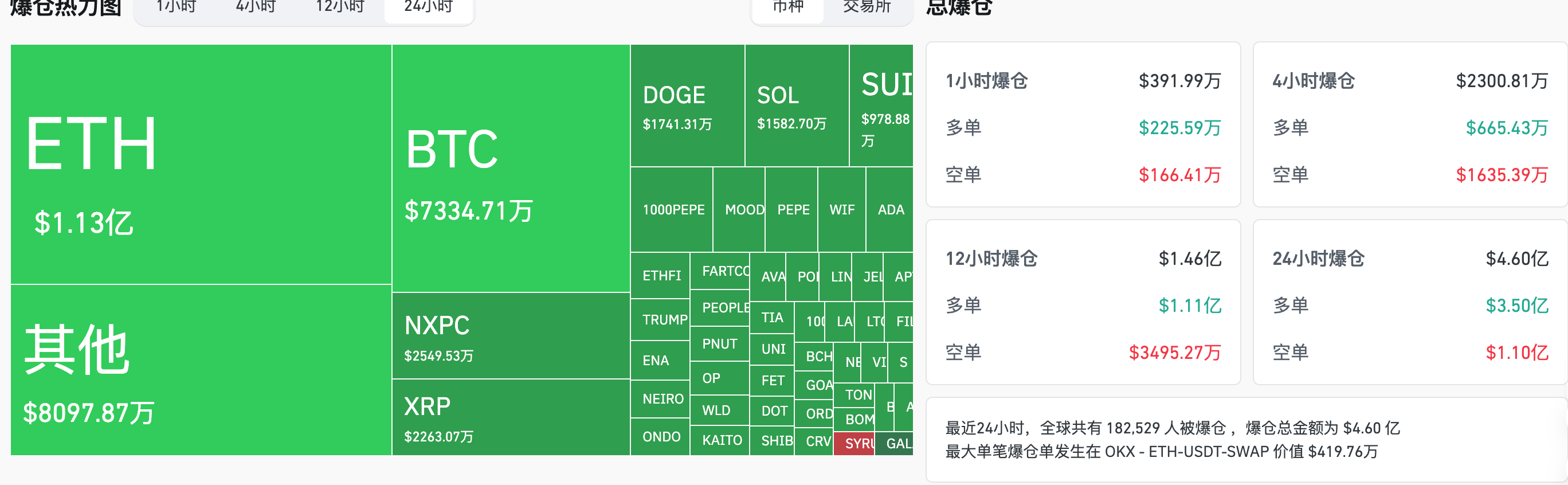

24-hour liquidation data: A total of 182,529 people were liquidated worldwide, with a total liquidation amount of US$460 million, including BTC liquidation of US$73.3471 million, ETH liquidation of US$113 million, and NXPC liquidation of US$25.4953 million.

-

BTC medium- and long-term trend channel: upper channel line ($102098.66), lower channel line ($100076.91)

-

ETH medium and long-term trend channel: upper line of the channel ($2351.39), lower line ($2304.82)

*Note: When the price is higher than the upper and lower edges, it is a medium- to long-term bullish trend; otherwise, it is a bearish trend. When the price passes through the cost range repeatedly within the range or in the short term, it is a bottoming or topping state.

3. ETF flows (as of May 15)

-

Bitcoin ETF: +$115 million

-

Ethereum ETF: -$39,785,900

4. Today’s Outlook

-

Solayer will unlock tokens in the second quarter, 100% of which will be used for ecological incentives and growth

-

Coinbase Suspends Trading of Movement (MOVE) Tokens

-

Decentralized Computing Network Acurast to Launch Token Sale on CoinList

-

Terra: Deadline to submit loss claims to the Terraform Liquidation Trust is May 17

-

Resolv: Registration for the RESOLV Token Creation Event Closes on May 17

-

Arbitrum (ARB) will unlock approximately 92.65 million tokens on May 16, accounting for 1.95% of the current circulation and worth approximately $42.7 million.

-

Immutable (IMX) will unlock approximately 24.52 million tokens on May 16, accounting for 1.35% of the current circulation and worth approximately $17.9 million.

-

ApeCoin (APE) will unlock approximately 15.6 million tokens on May 17, accounting for 1.95% of the current circulation and worth approximately $10.3 million.

-

Avalanche (AVAX) will unlock approximately 1.67 million tokens on May 17, accounting for 0.4% of the current circulation and worth approximately $41.3 million.

-

Melania Meme (MELANIA) will unlock approximately 26.25 million tokens on May 18, accounting for 6.63% of the current circulation and worth approximately $10.4 million.

The biggest increases in the top 500 stocks by market value today: NXPC up 80.26%, MASK up 14.91%, XCN up 14.43%, PRIME up 14.35%, and MERL up 13.85%.

5. Hot News

-

A whale deposited 49,858 SOLs to Kraken in the early morning, with a loss of 3.11 million US dollars

-

The two addresses transferred a total of 11.11 million LDO to CEX in the past three days, and continued to transfer out 19.41 million LDO 5 hours ago

-

The Omni Foundation has repurchased 6.77 million OMNI tokens from early investors, accounting for 6.77% of the total supply

-

Jetcraft to accept cryptocurrency for private jet transactions

-

The Compound team-associated address deposited 250,100 COMP to Coinbase Prime, equivalent to approximately $11.2 million

-

Wintermute received 10 million MIRAI 7 hours ago, equivalent to about 105,000 US dollars

-

US Lawmakers to Hold Final Vote on Stablecoin GENIUS Act on May 19

-

Cross-border e-commerce DDC Enterprise launches Bitcoin reserve strategy, aiming to reach 5,000 BTC within 36 months

-

FTX will begin distributing more than $5 billion to creditors under bankruptcy plan on May 30

-

Sonic Labs terminates five-year exclusive market-making partnership with Wintermute and turns to MM++ solution to support DeFi ecosystem

-

0x acquires competitor Flood in an effort to expand DEX aggregator market share

-

Movement Labs was revealed to have privately promised advisors up to 10% of token allocation

-

The number of initial jobless claims in the United States for the week ending May 10 was 229,000, while the expected number was 229,000.

-

Hong Kong Family Office Avenir Group Holds $691 Million Worth of BlackRock’s Bitcoin ETF

-

Galaxy Digital transferred 17.82 million ENA to Binance, or faced a floating loss of $2.64 million

-

Binance Wallet to Launch 17th TGE: Alaya AI (AGT)

-

Arthur Hayes: Bitcoin is expected to rise to $1 million by 2028, but there may be tactical shorting opportunities in the short term

-

Ukraine Plans to Launch Strategic Bitcoin Reserve Under New Crypto Law

You May Also Like

Trump foe devises plan to starve him of what he 'craves' most

3 Crypto Trading Tips That Work