Best Crypto to Buy Now: ASTER, DEXE, MNT Today’s Top Crypto Gainers

There are multiple emerging cryptos that have made their way to the top gainers list. Among them, there could be one that is counted as the best crypto to buy now.

ASTER has surged by over 4% in the last 24 hours, while MNT’s growth has been upwards of 5%. In the case of DeXe, the growth has been minimal at 1.9%. However, there was a brief spike that pushed the DeXe price up by 4%.

With so many new cryptos now emerging as top performers, investors have plenty of options to look into. But which one of them could bring the most gains?

Top Gainers of the Day: Mid to High-Cap Picks Focused on Use Cases

The cryptos that have made it to the top gainer spot today are all utility focused.

ASTER

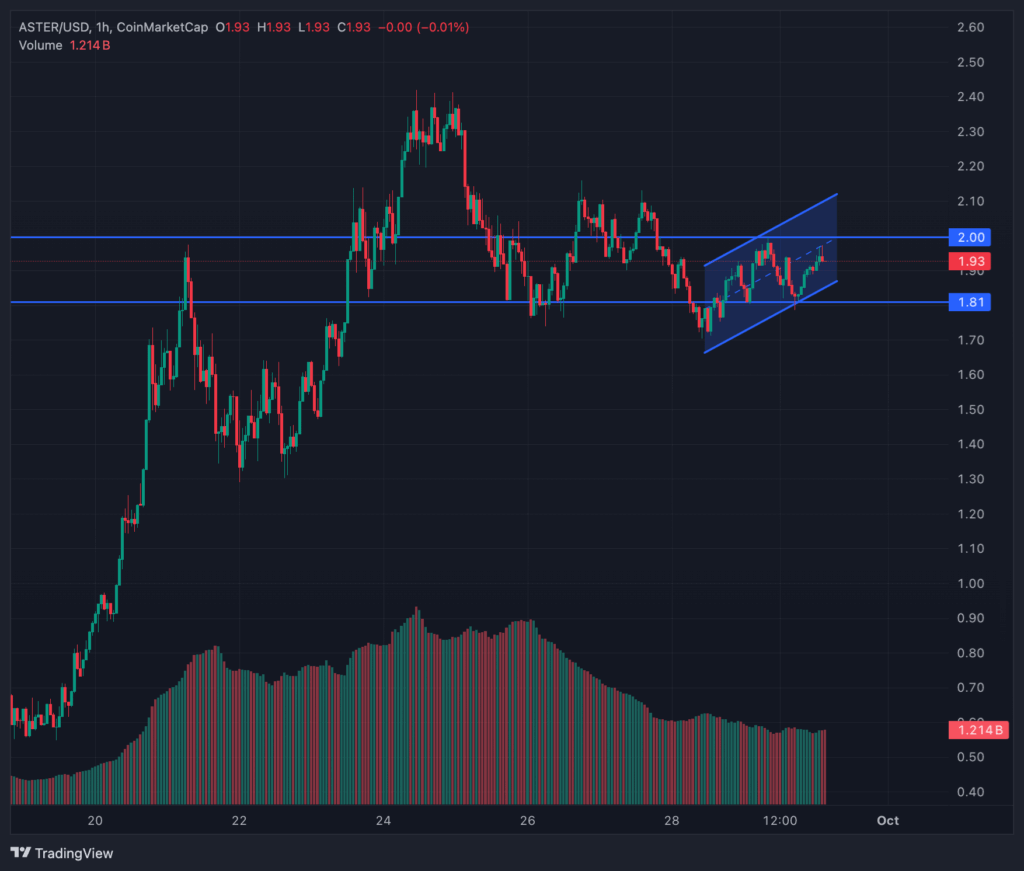

Leading the biggest gainer of the day is ASTER. The utility crypto has surged by over 4% in the last 24 hours and is currently trading around $1.92. The token’s market cap is above $3.19 billion.

The hourly chart shows that the ASTER price has been following a rising channel. However, its immediate resistance is $2 and the immediate support is $1.81.

ASTER is a cryptocurrency powering a decentralized perpetual exchange of the same name. So far, it has recorded a trading volume of over $1 trillion and has acquired over 3 million users.

When it comes to why this crypto has gained traction, it could be attributed to the renewed interest in the cryptocurrency market and investors seeking utility-focused investment options. ASTER being decentralized is another one of the key factors responsible for the token’s growth.

DEXE

The second cryptocurrency to have made it to the top gainer’s spot is DEXE. DEXE has surged by close to 2% in the last 24 hours. However, it went through a momentary spike that pushed its price past the $10 mark. At the time of writing, the crypto is trading around $9.43. This mid-cap crypto has a market cap of close to $800 million.

The daily charts make it clear that DeXe has gone through similar levels of price action multiple times before, which highlights that it is one of the most volatile assets.

DeXe is a new protocol for developers, a storehouse of smart contracts that developers can download, modify, and implement in their own projects. There is a wide variety of contracts available, including DAO contracts, governance contracts, treasury contracts, and launchpad contracts.

Its growth may have been the result of macroeconomic conditions pushing the market upwards.

MNT

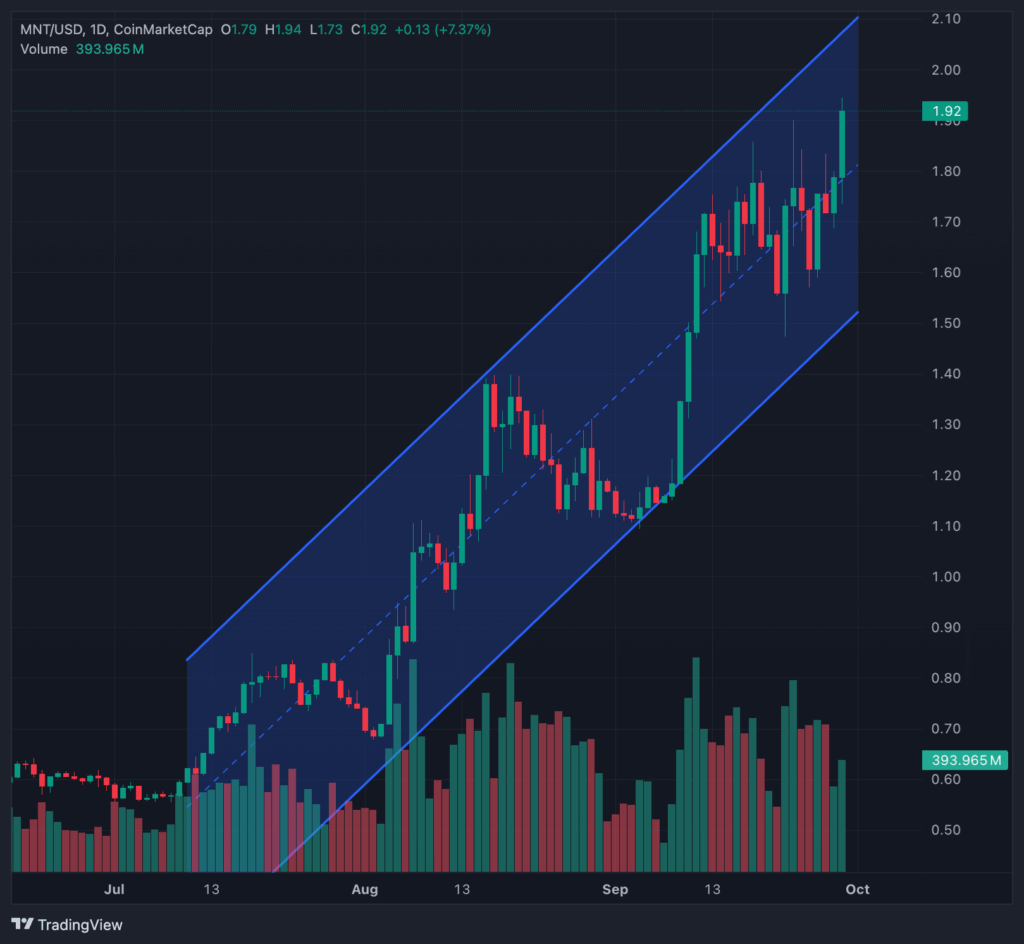

Mantle (MNT) has also made it to the top crypto gainers list of the day and has surged by over 5% in the last 24 hours. It is currently trading above the $1.83 level and has a market capitalization close to $6 billion.

The daily chart reveals that Mantle’s growth has been part of a similar surge-consolidation phase. It is following a rising channel, which indicates that Mantle may continue to be part of the news as a leading crypto gainer.

All of these top crypto gainers have managed to maintain a constant presence in the market due to their unique attributes. However, when it comes to finding the best crypto to buy now, investors should instead focus on crypto ICOs.

Best Crypto to Buy Now: Top 3 Picks

Here are the top crypto ICOs that investors are focusing on currently.

Best Wallet Token

Best Wallet Token powers Best Wallet, one of the leading decentralized cryptocurrency apps designed to give investors a safe and versatile trading experience. With the top crypto gainers of the day being mostly utility-focused projects, tokens like Best Wallet Token can attract strong attention from investors looking for real functionality instead of hype.

Best Wallet offers a wide range of use cases. Users can buy and sell crypto directly using fiat, swap between tokens quickly, and stake assets for passive rewards. One of its strongest features is the Token Launchpad, which allows early access to presales of promising low-cap cryptos that could become the next big movers. On top of this, the wallet provides portfolio management tools and seamless integration with multiple blockchains.

Recent updates have made the platform even stronger, including Bitcoin swap support, Solana chain integration, and a gamified point system that rewards users just for engaging with the app. These improvements reflect the project’s commitment to continuous growth.

Best Wallet Token itself plays a vital role in the ecosystem. It lowers transaction fees, grants early access to presales, boosts staking rewards, and provides governance rights to its holders.

With over $16 million raised during its ICO, Best Wallet Token already carries the credibility of an established project. Given its blend of utility, constant updates, and proven ecosystem, Best Wallet Token could be considered the best crypto to buy now.

Bitcoin Hyper

Bitcoin Hyper is a utility-centric meme coin that has already raised upwards of $19 million in its presale, cementing itself as one of the most talked-about Bitcoin alternatives on the market. While Bitcoin has struggled to move beyond its narrative as a simple store of value, Bitcoin Hyper introduces new layers of functionality that could redefine how investors view Bitcoin-inspired assets.

At the core of Bitcoin Hyper are its use cases, which focus on scalability, interoperability, and real-world applications. It integrates features like payment support, decentralized applications, and meme-based community engagement, ensuring that it appeals to both retail traders and long-term investors.

From a technological standpoint, Bitcoin Hyper is positioned as the world’s first Bitcoin Layer 2 solution. It combines Ethereum-grade security, Solana Virtual Machine integration, the Lightning Network, and a canonical bridge, giving it the potential to handle fast and efficient transactions while maintaining strong decentralization.

By enforcing the idea that Bitcoin can evolve into more than a static “digital gold,” Bitcoin Hyper blends utility with meme-driven virality. This dual identity could help the project thrive both in short-term hype cycles and as a long-term infrastructure play.

Analysts, including those at 99Bitcoins, have expressed strong confidence in Bitcoin Hyper’s potential, with some even suggesting that it could go 100x upon launch

Maxi Doge

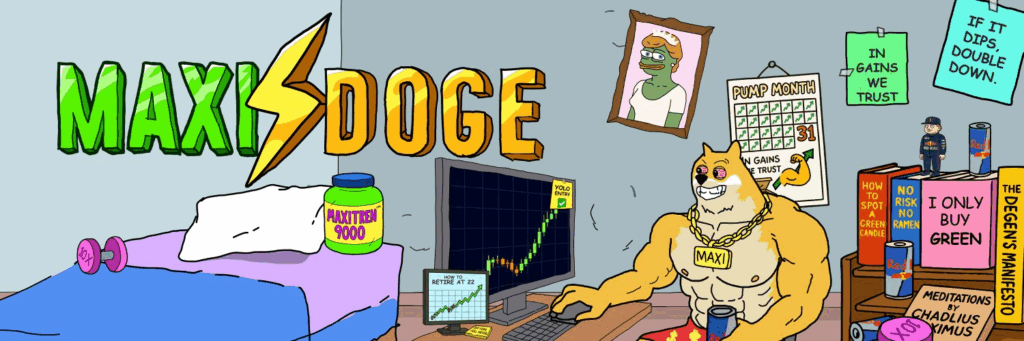

Maxi Doge, though a low-utility crypto, is increasingly being seen as one of the best cryptos to buy now thanks to how it fully embraces the memetic culture of the crypto space. Unlike Dogecoin, which has drifted away from its comedic roots into more altruistic tones, Maxi Doge plays directly on the community’s perception of Dogecoin — a token imagined as stronger, riskier, and more daring.

The project’s imagery stands out, portraying a “buff” version of Doge that aligns with today’s GenZ-driven meme culture. This visual approach gives Maxi Doge a distinct identity in a market oversaturated with copycat tokens.

Beyond aesthetics, Maxi Doge’s vision centers on leverage trading, offering opportunities for traders to pursue amplified gains. While this adds another layer of risk to investing, it also creates an inviting proposition for those willing to dive into the volatility of meme coins. The project is not shying away from risk; instead, it embraces it, which makes it resonate with the degen culture that powers much of meme coin trading.

Analysts like Borch Crypto have highlighted Maxi Doge as a high-potential project specifically because it leans into the memetic essence of crypto trading rather than trying to dilute it with excessive utility. So far, Maxi Doge has already raised over $2.6 million in its presale, underscoring growing investor interest.

Conclusion

The market is in the throes of Uptober, which is bringing many utility-centric cryptos to the forefront. The top ICOs mentioned in this article can be considered among the best crypto to buy now because of their mixed approach, focusing on both viral potential and utility.

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Wholecoiner Inflows to Binance Hit Cycle Lows, Signaling Reduced Sell Pressure

Coinbase Vs. State Regulators: Crypto Exchange Fights Legal Fragmentation