Sanctions-Defying Ruble-Backed Stablecoin Explodes to $500M – Is This Russia’s Answer to the Dollar?

A new Russian-linked stablecoin, A7A5, has surged to a $500 million market capitalization, becoming the world’s largest non-U.S. dollar stablecoin despite multiple international sanctions.

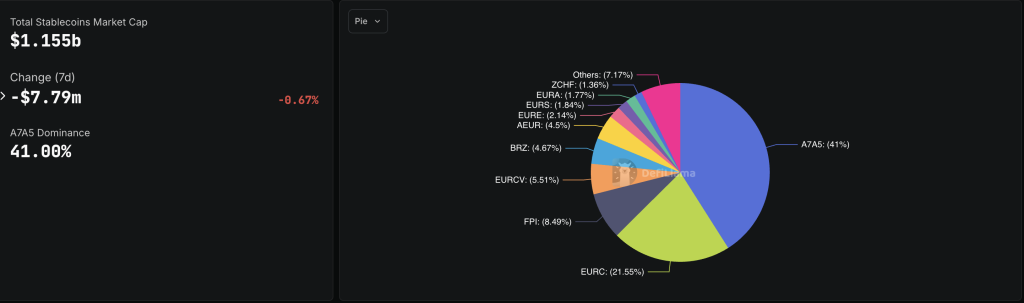

The stablecoin, issued in Kyrgyzstan and pegged 1:1 to the Russian ruble, now accounts for roughly 43% of the total $1.2 billion non-dollar stablecoin market, according to data from CoinMarketCap and DeFiLlama.

Source: DefiLlama

Source: DefiLlama

Its rapid ascent has raised alarms among Western regulators who believe the project could be helping Russia skirt financial restrictions imposed after its 2022 invasion of Ukraine.

“Digital Ruble” A7A5 Skyrockets 250% as Sanctioned Russian Bank Backs Stablecoin

A7A5 was launched in February by A7, a cross-border payments firm owned by Moldovan fugitive banker Ilan Shor and Russia’s state-owned lender Promsvyazbank (PSB). Both entities are under U.S., U.K., and European Union sanctions.

The token was introduced as a “digital ruble” backed by fiat deposits in Kyrgyz banks, offering holders a daily passive income equivalent to half the interest on those deposits.

Initially issued on Ethereum and Tron, A7A5 positioned itself as a tool for international settlements with Russian trade partners.

Soon after its debut, blockchain investigators linked the project to Grinex, a crypto exchange viewed as the successor to the sanctioned Russian platform Garantex. The U.S. Treasury sanctioned Garantex and related entities in August, identifying Shor as a co-owner of A7A5’s issuer, alongside Promsvyazbank.

The U.K. followed with sanctions against several Kyrgyz banks, citing evidence that Moscow was using the stablecoin network to bypass the Western financial system.

Despite these sanctions, A7A5’s market value remained stable through the summer before exploding in late September. On September 25, its market cap jumped by $350 million in a single day, a 250% increase, overtaking Circle’s euro-pegged EURC as the leading non-dollar stablecoin.

Blockchain data from Elliptic shows that more than 41 billion A7A5 tokens were in circulation by September 26, with total transaction volumes exceeding $68 billion.

The project’s Telegram channel celebrated the milestone, claiming A7A5 had “proven that a national digital currency can be not only an alternative to the dollar but also a driver of global change.” However, Western authorities view it differently.

TRM Labs Flags $1B Daily Flows Through A7A5 as EU Weighs Sanctions

Earlier today, Bloomberg reported that the European Union is preparing to impose new sanctions on A7A5, prohibiting any transactions involving the token by EU-based entities.

The proposal would also target several banks in Russia, Belarus, and Central Asia, accused of facilitating crypto-related payments tied to Moscow.

A7A5’s growth coincides with Russia’s push to develop alternatives to the SWIFT payment system, from which it was excluded in 2022. Analysts say the stablecoin offers a practical workaround for Russian companies struggling with delayed cross-border payments.

According to public filings, firms using A7A5 can settle international transactions within five working days, far faster than the weeks or months typically required through traditional banking routes.

Data from blockchain analytics firms Elliptic and TRM Labs suggest that A7A5 is now transacting more than $1 billion daily, with total transaction volume surpassing $41 billion by late August.

TRM Labs also warned that the stablecoin may be facilitating the purchase of dual-use goods, items with both civilian and military applications, through trade routes involving China and Central Asia.

The Centre for Information Resilience (CIR) reported that nearly 78% of A7A5’s transactions in August flowed through Chinese jurisdictions. CIR also noted that A7A5 has expanded its presence in Africa, establishing offices in Nigeria and Zimbabwe.

A7A5 drew international attention at the Token2049 conference in Singapore last month, where company executive Oleg Ogienko appeared on stage. Its presence at the event sparked debate over compliance standards at crypto industry gatherings, with calls for tighter rules to prevent sanctioned entities from gaining exposure.

Although A7A5 claims independence from Shor and PSB, regulatory documents indicate both remain heavily involved. Shor, wanted in Moldova for a $1 billion fraud known as “the theft of the century,” retains a 51% ownership stake in A7, with PSB holding the remaining 49%.

PSB, which serves Russia’s defense sector, was sanctioned by the U.S. and its allies in 2022.

Despite skepticism about its transparency and concentration of activity, A7A5’s momentum continues to build.

The token has attracted roughly 24,000 holders, with over $100 million in USDT liquidity added to its decentralized exchange in recent weeks.

You May Also Like

Galaxy Digital’s 2025 Loss: SOL Bear Market

Why This New Trending Meme Coin Is Being Dubbed The New PEPE After Record Presale