Deutsche Digital Assets and Safello Launch Staked TAO ETP — New Wave of Crypto Products?

Deutsche Digital Assets (DDA), a European crypto asset manager, has teamed up with Safello, the Nordic cryptocurrency exchange, to launch the Safello Bittensor Staked TAO exchange traded product (ETP).

The product will use Deutsche Digital Assets white-label crypto ETP platform and will begin trading on the SIX Swiss Exchange under the ticker STAO.

According to the firms’ the Safello Bittensor Staked TAO ETP will give investors a regulated way to gain exposure to Bittensor (TAO) — a blockchain network combining decentralized artificial intelligence (AI) and open-source machine learning.

The ETP is backed 100% by physically held TAO stored in cold custody with a regulated crypto custodian, STAO offers a compliant structure for investors seeking to diversify portfolios through a trusted and transparent framework.

Staked Returns Meet Institutional Standards

The new ETP is a total return product that tracks the Kaiko Safello Staked Bittensor Index (KSSTAO Index) and carries a maximum management fee of 1.49%.

In addition to accessing TAO’s price performance, investors in STAO will earn staking rewards — with returns accumulated into the product’s NAV. Those rewards are reinvested, allowing compound growth within a regulated exchange-traded format.

“The launch of the Safello Bittensor Staked TAO ETP underlines our conviction in decentralized AI,” said Emelie Moritz, CEO of Safello. “Bittensor is a prime example of how decentralized technology and AI are converging to reshape the future of value creation.”

A Step Forward for Europe’s Crypto ETP Market?

Deutsche Digital Assets white-label ETP platform backs a generation of regulated digital asset products. Through this platform, Safello said it also gains access to DDA’s regulatory infrastructure, index management, and exchange listing capabilities.

“We are excited to announce the launch of the Safello Bittensor Staked TAO ETP through our collaboration with Safello,” said Maximilian Lautenschläger, CEO and founder of Deutsche Digital Assets. “By leveraging our platform, we enable partners to bring innovative crypto strategies to market efficiently while ensuring full regulatory compliance and robust index tracking.”

Merging DeFi, AI, and Traditional Finance

The launch of STAO marks a significant milestone for both the digital asset and AI sectors. By bridging decentralized machine learning with regulated capital markets, the ETP highlights the growing investor appetite for AI-integrated blockchain ecosystems.

With its listing on the SIX Swiss Exchange and a total expense ratio of 1.49%, the Safello Bittensor Staked TAO ETP reflects a broader trend: investors demanding institutional-grade access to DeFi and AI-driven assets — all within the safeguards of traditional financial infrastructure.

As decentralized AI becomes a cornerstone of Web3 innovation, products like STAO may define a new wave of regulated crypto investment opportunities blending staking, intelligence, and compliance under one banner.

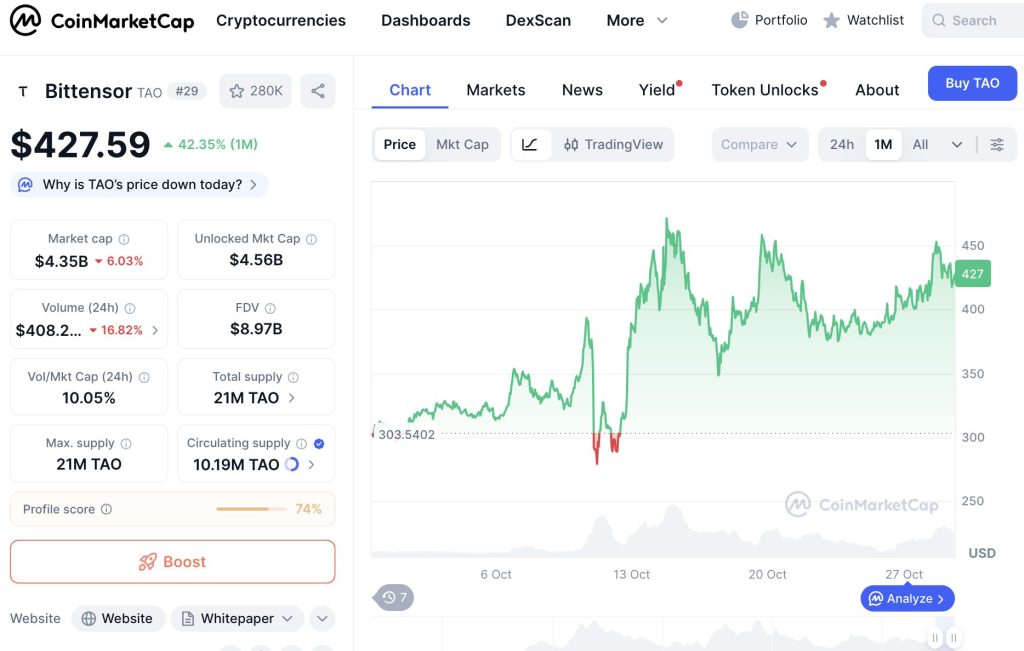

Bittensor (TAO) Climbs 42% in October

Bittensor’s native token, TAO, is up 42.35% over the past month, trading at $427.59 according to CoinMarketCap. The AI-powered decentralized network continues to attract strong investor interest amid growing enthusiasm for crypto projects merging artificial intelligence and blockchain.

TAO’s market capitalization now stands at $4.35 billion, with a fully diluted valuation (FDV) of $8.97 billion, positioning Bittensor among the top 30 crypto assets by market cap. Trading volume in the past 24 hours reached $408 million, suggesting sustained liquidity and investor participation despite recent market corrections across the broader digital asset space.

You May Also Like

Stellar (XLM) Powers IRL’s Stealth Crypto Onboarding at Major Cultural Events

Ringgit strength seen extending lower – MUFG