Cardano Didn’t Fail On Scalability, Says Hoskinson — Leios Coming In 2026

Charles Hoskinson used a Nov. 5 video address to rebut a renewed wave of criticism that Cardano has “failed on scalability,” centering his response on two pillars: Hydra, Cardano’s off-chain scaling stack, and Leios, a forthcoming Ouroboros upgrade that he says now has a complete design and a clear path to mainnet in 2026.

Hoskinson’s remarks were framed as a direct answer to a thread by Cyber Capital CEO Justin Bons alleging Cardano is capped at “23 transactions per second,” dismissing the impact of batching, fee markets, Hydra, and the Ouroboros Leios roadmap, and concluding that Input Output Global (IOG) has shifted focus to a new chain. “You’re entitled to an opinion, but you’re not entitled to your own facts,” Hoskinson said, calling the conclusion “blatantly wrong” and “pathetic” for ignoring public specifications and ongoing engineering work. He pushed back on claims that Leios had been abandoned: “There exists a CIP. We have the blueprint. We know how to do it.”

Cardano Has Not Failed On Scalability

Central to his argument is that Leios has moved from research to a fully specified implementation track. Hoskinson held up the CIP for Ouroboros Leios, emphasizing that the end-to-end design was completed only this year after “years of paper writing, prototyping, and simulation.”

In his telling, the protocol aims to thread the industry’s core dilemma of decentralization, security, and throughput without leaning on centralized shortcuts. “What do we care about in this industry? Do we care about decentralization or not?” he asked, warning that once systems optimize around cheap, high-throughput configurations with heavy hardware demands, “no one has any incentive to change the status quo.”

Hydra, he argued, is already live and delivering practical capacity gains that critics are “discounting.” As evidence, he cited the Glacier drop, saying “33.6 million accounts were loaded into that thing and we were able to operate no problem at all,” and that Hydra continues to “evolve and get more advanced.” While he did not present throughput figures beyond disputing the 23 TPS narrative, the thrust of his rebuttal was that Cardano’s scaling arc is cumulative: Hydra now, Leios next.

On Leios timelines, Hoskinson was unambiguous. “Yes, it will ship in 2026. No if, ands, or buts about it,” he said, adding that IOG has instituted “a 24/7 implementation, a follow-the-sun model to get Leios out in market faster.” He also previewed a dedicated Leios website “before the end of the month” to publish daily updates as the network “march[es] towards it,” and claimed “more than a dozen companies” are engaged in implementation work alongside multiple node clients. His message to the broader ecosystem was equally pointed: “In 2026, we’re going to find a path to get linear Leios on Cardano,” urging operators to “hold off on the adoption” of nodes that don’t support Leios so the feature can be activated network-wide.

Beyond scaling mechanics, the address veered into governance and industry structure. Hoskinson asserted Cardano targets “50% Byzantine resistance” while preserving decentralization, contending that no major chain—he named Bitcoin and Ethereum among others—has achieved at-scale decentralization without trade-offs. He linked scaling work to the project’s self-image as one of the few ecosystems “carrying on our backs the original dream of Satoshi,” warning that industry consolidation around ETFs, bank custody, and centralized stablecoins risks “put[ting] the chains on humanity for the rest of time.”

Marketing, Not The Technology

Hoskinson located Cardano’s bottleneck not in research or engineering but in go-to-market. “Our problem is not our technology… Our problem right now is marketing and adoption, deal making and partnerships,” he said, criticizing entities in the ecosystem that he claims received “hundreds and hundreds and hundreds of millions of ADA” or “over a billion” for adoption efforts that have been “pulling teeth.” He credited a new foundation-driven initiative—presented by critics as a “pivot” away from Cardano—as having already attracted listings, integrations, and a path to “tier one stables,” insisting such work ultimately routes back to Cardano usage.

The tone throughout was combative, reflecting frustration with narratives he sees as moving the goalposts. “Leios is going to ship. It’s a real thing. It exists. Look at CIP 164,” he said. “When we turn it on, they’ll move the goalpost and it will be something else.”

He portrayed the coming year as a campaign to close the engineering loop and reorient on adoption: “We have the technology. We have the ecosystem. We just have to invest heavily in [marketing and adoption]… and we will.” The message to skeptics was unvarnished—“You can’t discount Hydra… you can’t discount the progress made with Leios.”

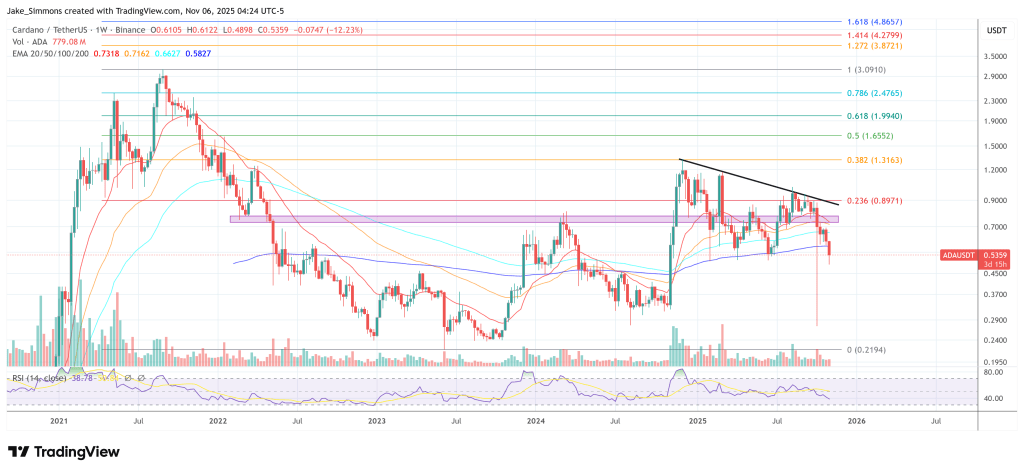

At press time, ADA traded at $.05359

You May Also Like

Turbulent Times: Crypto Firm’s $100 Million Sale Under Clouds of Legal Controversy

What’s Happening In Crypto Today: BTC Retests $85k, ETH Consolidates Above $2.7k