The GameFi-cation of Trading: Fortuva Announces New Update Blurring the Line Between Markets and Gaming

Fortuva today announced a significant update to its on-chain, high-frequency prediction market platform, introducing enhanced automation capabilities and expanded reward mechanisms designed to improve user participation and streamline gameplay. The new release incorporates upgraded auto-play functions, refined activity-based incentives, and improved round execution—marking one of the platform’s most comprehensive feature rollouts to date.

It’s not traditional trading.

It’s not gambling.

It’s not standard gaming.

It represents a newly emerging format.

Prediction Markets: An Established Concept Entering a New Phase

Prediction markets have existed for centuries, from papal elections in the 1500s to event-focused activity in the 1980s. Their strength comes from the “Wisdom of the Crowd,” where collective input often outperforms individual judgment.

The continued growth of major Web3 event-based platforms shows the strong demand for this category.

Fortuva’s latest update advances this model — adding automation, structured round formats, user-driven strategy settings, and crypto-native incentives.

Fortuva’s Gameplay Loop

A Fortuva round lasts 3 minutes. Users:

- Choose UP or DOWN

• Lock in their SOL bet

• Wait for the candle to close

• Winners split the pooled SOL

Because there are hundreds of rounds per day, the pacing feels closer to interactive play than traditional chart monitoring. This new update highlights Fortuva’s focus on creating a streamlined, fast-moving system.

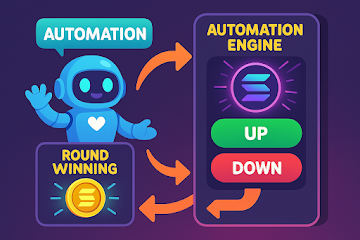

Automation Engine: Play While AFK

The updated Fortuva Automation Engine now enables users to:

- Auto-enter rounds

• Auto-claim winnings

• Auto-apply strategies

• Play 24/7 without manual clicks

This transforms Fortuva into a semi-idle, semi-strategy model where user-selected settings guide ongoing participation.

FN Token: Turning Activity Into Rewards

Every action in Fortuva earns FN:

- Joining rounds

• Winning rounds

• Consecutive activity

• High-volume betting

• Comeback multiplier after losses

FN supports progression elements, activity cycles, reward tiers, and future integrations designed around long-term engagement.

Security & Transparency

Fortuva is fully on-chain, built on Solana, and uses:

- Pyth price feeds

• HashEx-audited smart contracts

• Transparent round histories

• On-chain settlement & prize distribution

No centralized adjustments.

No hidden mechanics.

Just real-time market data.

Why Users View It as a Hybrid Format

Fortuva brings structured decision-making into a fast environment where participants apply familiar tools such as pattern observation and candle behavior evaluation — all within an interactive, rapid setting.

Users also benefit from:

- Instant rounds

• High engagement

• Leaderboards

• Automation

• Rewards

• Digital identity elements

This positions Fortuva at the intersection of market-based participation and interactive, on-chain activity.

The Hybrid Future Is Emerging

As Web3 users increasingly look for:

- Faster action

• More transparency

• On-chain automation

• Fair systems

• Social-driven competition

Fortuva’s latest update introduces features aligned with this next wave of on-chain ecosystems.

It’s transparent.

It’s high-frequency.

It’s skill-based.

It’s designed for participation.

Experience Fortuva

Play Now: https://app.fortuva.xyz

Twitter: https://x.com/MetaFortuva

Telegram: t.me/fortuva_official

Discord: https://discord.gg/fortuva

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

The post The GameFi-cation of Trading: Fortuva Announces New Update Blurring the Line Between Markets and Gaming appeared first on Live Bitcoin News.

You May Also Like

Top Altcoins To Hold Before 2026 For Maximum ROI – One Is Under $1!

UBS CEO Targets Direct Crypto Access With “Fast Follower” Tokenization Strategy