Wall Street is hyping up uranium prices. Will Uranium Digital use blockchain to promote the financialization of uranium?

Author: Zen, PANews

Uranium, known as "one of the most important metals in the world", is the heaviest native element found in nature and the main fuel for nuclear power generation. In the tide of global energy transformation, nuclear power is experiencing a revival, and uranium, as a core resource of this clean energy, is experiencing a continuous growth in market demand. Uranium trading is also becoming one of the hottest categories on Wall Street, attracting large financial institutions and hedge funds such as Goldman Sachs to join the game.

However, in sharp contrast to the importance of uranium is the backwardness of its market infrastructure, the lack of efficient spot trading mechanisms, low price transparency, and limited liquidity, which is far inferior to traditional commodities such as oil and natural gas.

How can the uranium market truly enter the modern financial system? This is exactly the problem that the American team Uranium Digital is trying to solve. Through blockchain technology, Uranium Digital is trying to build the world's first 24/7 all-weather, compliant uranium spot trading market, providing real-time pricing, physical and non-physical settlement, derivatives trading and other functions, so that uranium has the same market infrastructure as other commodities.

The global nuclear energy revival brings new opportunities to the uranium market

Driven by the growth of emerging economies, the global demand for electricity and energy is expected to increase significantly in the future. At the same time, the total limit on greenhouse gas emissions further highlights the importance of clean energy. With the continuous improvement of the nuclear industry in safety, production efficiency and reactor power in recent years, nuclear energy has become one of the core issues in the international community's energy policy discussions.

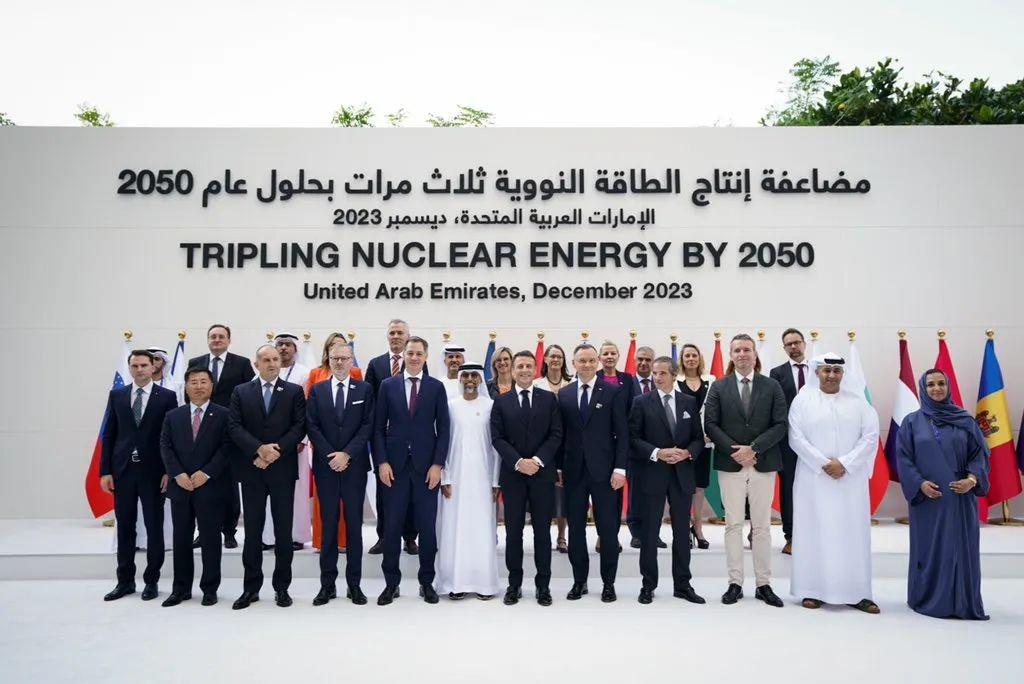

In December 2023, at the COP28 United Nations Climate Change Conference, 22 countries including the United States, Canada, and the United Kingdom jointly issued the "Triple Nuclear Energy Declaration", the core content of which included joint efforts to triple global nuclear energy capacity by 2050. Later, at COP29 held in 2024, the number of countries that pledged to support this goal increased to 31, and another 140 nuclear industry companies and 14 major global banks expressed their support. In March of this year, at the Global Energy Forum CERAWeek, Amazon, Google, Meta, Dow and other energy "big consumers" signed the "Large Energy User Commitment" to support the implementation of this goal. This is also the first time that major companies outside the nuclear energy field have jointly publicly supported the extensive and coordinated expansion of nuclear power.

22 countries launch declaration to triple nuclear energy by 2050

At present, the global nuclear power production capacity has been steadily increasing. At an event held by the Atlantic Council, a US think tank, in early February this year, Fatih Birol, director of the International Energy Agency, said that global nuclear power generation is expected to reach a record high in 2025, and more than 40 countries have formulated plans to build or expand nuclear capacity. According to the International Atomic Energy Agency report, as of September 2023, there are 410 nuclear power reactors in operation in 32 countries around the world, and another 57 nuclear power reactors are under construction.

Based on the continued increase in demand brought about by the global nuclear power recovery, as well as the impact of long-term capital expenditure shortages and strong supply rigidity and frequent disturbances, uranium prices have been favored by the market in the past few years. From the second half of 2023 to the beginning of 2024, uranium prices accelerated from $59/pound to a high of $107/pound. As supply shortages and prices continued to rise, physical uranium and related securities products were in high demand, and uranium trading once became the hottest category on Wall Street. Investment banks including Goldman Sachs and Macquarie and some hedge funds were actively involved in uranium trading.

Key Commodity Market Mechanisms with Uranium Lagging Behind

In the wave of global energy transformation, uranium, a key clean energy commodity, is matched with an extremely inefficient market. Today, the uranium market has an annual trading volume of about 190 million pounds, with a value of over 10 billion US dollars. However, due to the dominance of long-term contracts in uranium trading, futures prices are difficult to fully reflect the real supply and demand situation in the market, and the uranium market lacks the basic financial market facilities commonly available in other commodities, such as real-time spot pricing, financial and physical settlement, derivatives trading, and effective price discovery mechanisms in open markets.

At present, the trading mechanism of the uranium market is relatively backward, with low transparency, poor liquidity, and lack of the infrastructure that a modern financial market should have. Its main pain points include:

1. The spot market is missing and the trading threshold is high. Individuals and institutions who want to directly access the uranium market need to become licensed traders or brokers and purchase uranium products through over-the-counter (OTC) transactions. Another option is to invest in uranium-related ETFs or mining company stocks, but this does not provide real uranium price exposure;

2. Lack of financial instruments and lack of speculative trading space. The uranium market price fluctuates violently, and in theory it should be an ideal market for speculative traders. However, due to the lack of derivatives such as futures, forwards, swaps, and options, speculative capital is difficult to enter, limiting the market's trading depth and liquidity.

3. The price discovery mechanism is not transparent. The current uranium price is mainly determined by private bilateral agreements, and the price information is highly opaque, which affects the pricing efficiency of the entire nuclear fuel supply chain. In contrast, the financial transaction scale of the coal market is 7 times that of the physical market, and the natural gas market is even 23 times, while the uranium market has almost no similar financial market scale.

In this context, Uranium Digital, with blockchain technology as the core, is committed to building the world's first 24/7 all-weather, compliant, institutional-level uranium spot trading market, so that uranium has the same financial trading infrastructure as other commodities. Uranium Digital's concept has also quickly gained support from venture capital institutions - in December last year, Uranium Digital completed a $1.7 million Pre-Seed round of financing, led by Portal Ventures, Framework Ventures and Karatage, as well as multiple angel investors; in March this year, Uranium Digital announced that it had raised $6.1 million in seed round funds, led by Framework Ventures.

Uranium Digital Completes $6.1 Million Seed Round

Reshaping the Uranium Spot Market with Crypto Infrastructure

Uranium Digital is building a modern uranium trading market based on blockchain, which will give uranium the same trading mechanism and liquidity as other commodities. It is expected to be officially launched later this year. Uranium Digital adopts a dual-track model of physical settlement and non-physical settlement. Physically Settled is designed for licensed institutional traders and warehouse delivery is achieved through Uranium Digital's partners; Financially Settled is specifically for institutional and retail investors, allowing them to directly access uranium market prices without having to deal with complex regulatory processes.

In the derivatives market, Uranium Digital plans to launch derivatives such as futures, options, perpetual contracts, swaps, etc. to improve market liquidity and provide more trading strategies for institutional investors. Uranium Digital will also build the first uranium market price oracle (Oracle) to provide real-time and public uranium price data to change the current price opacity.

Due to the special nature of uranium, its transactions are strictly regulated, involving KYC/AML requirements, and the need to strictly track the whereabouts of each pound of uranium. Traditional trading systems are difficult to handle these requirements efficiently, and the traceability, transparency and decentralization of blockchain technology make it naturally suitable for the uranium market.

Blockchain can record every uranium transaction, making the flow from mines to end users clear at a glance, reducing the risk of illegal transactions. In addition, smart contracts can realize automated settlement, increase transaction speed and reduce human intervention, and the blockchain-based uranium market can provide verifiable real-time prices, improving market efficiency and fairness.

In the new era of nuclear energy renaissance, Uranium Digital plans to build the world's first modern uranium trading market, a transparent, efficient and liquid uranium market that can be participated by miners, traders, institutional investors and retail traders, which will allow this key clean energy commodity to truly enter the global capital market. However, this road is bound to be difficult, involving many participants, and there are still many challenges to successful operation.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

BlackRock boosts AI and US equity exposure in $185 billion models