Bitcoin Miner Revenues Hit Two-Month Low, Selling Activity Remains Muted: CryptoQuant

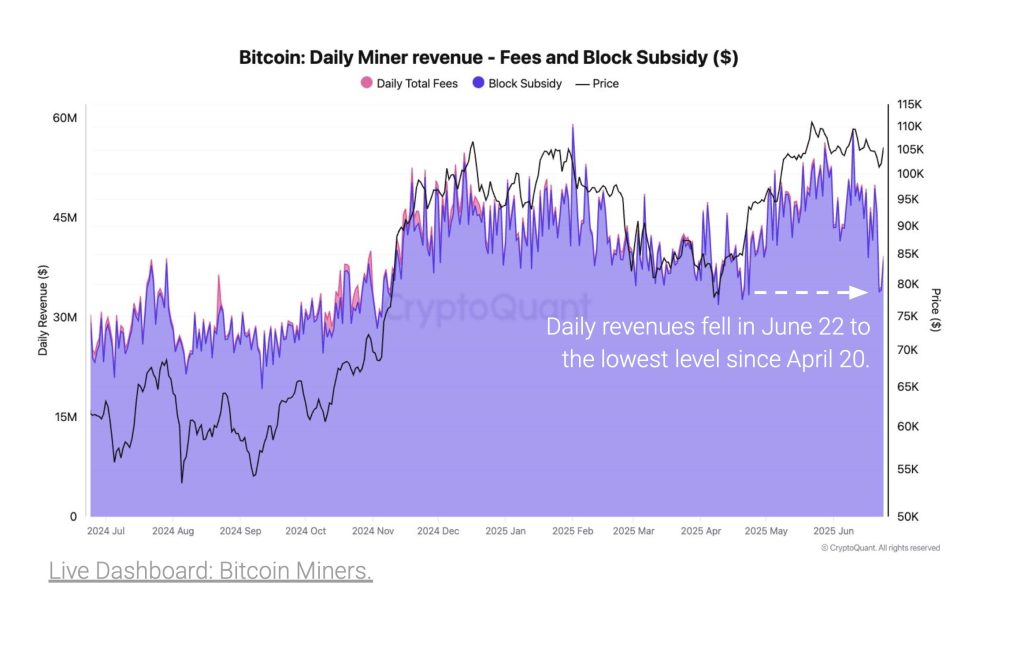

Bitcoin miner revenues have fallen to their lowest levels in two months, according to analysts at on-chain and market data CryptoQuant.

On June 22, daily earnings dropped to $34 million, a level not seen since April 20, 2025. The downturn is mainly being attributed to reduced transaction fees and a decline in the market price of Bitcoin.

The combination of these factors is leading to an environment where miners are experiencing some of the lowest compensation rates recorded in the past year. As reported in CryptoQuant’s weekly analysis, miners are currently “the most underpaid they have been in the last year.”

Hashrate Falls, But Miner Selling Stays Low

Despite the drop in revenue, miners have not responded with increased selling. CryptoQuant reports that Bitcoin outflows from miner wallets have steadily decreased, falling from a peak of 23,000 BTC per day in February to around 6,000 BTC today.

This represents a significant reduction in selling activity, especially given the recent price volatility. Notably, the network’s hashrate has experienced a 3.5% drawdown since June 16, marking the largest decline in nearly a year.

However, this drop in computational power has not translated into heightened liquidations by miners. In addition, so-called “Satoshi-era” miners have sold only 150 BTC so far in 2025, compared to nearly 10,000 BTC in 2024.

Miner Reserves Grow Despite Lower Income

CryptoQuant analysts also note that instead of selling, miners are increasing their reserves. Addresses holding between 100 and 1,000 BTC have grown their combined holdings from 61,000 BTC on March 31 to 65,000 BTC as of late June. This is the highest level of reserve accumulation by this group of miners since November 2024.

The steady accumulation trend suggests that most miners are not facing immediate financial stress, even amid falling revenues. Their continued reserve growth indicates a long-term outlook and confidence in future price recovery, rather than capitulation under current market conditions.

Overall, while Bitcoin miner revenues have declined to a two-month low, there is no evidence of widespread selling pressure in response. CryptoQuant’s findings portray a mining sector that, though underpaid by recent standards, remains resilient and strategically focused on long-term accumulation.

You May Also Like

Bitcoin ETFs Outpace Ethereum With $2.9B Weekly Surge

CME Group to launch options on XRP and SOL futures