Hyperliquid Price Prediction: HYPE Steadies at $27 Amid Plans to Remove Assistance Fund

Highlights:

- HYPE steadies at $27, marking a slight 1% rise over the past 24 hours.

- The HYPE derivatives market suggests a bullish interest as the open interest spikes 2%.

- The Hype Foundation has proposed a validator vote to permanently remove the assistance fund supply from circulation.

Hyperliquid (HYPE) price is currently exchanging hands at $27, marking a slight 1% increase over the past 24 hours. Hyperliquid Foundation has initiated a validator vote to lower supply by burning the assistance fund that contains more than 37 million Hype tokens. This possibility of supply-reduction stimulus has improved the bullish mood in the derivatives market, as the open interest surged 2%.

Hyperliquid Foundation will withdraw 37.11 million HYPE tokens, which are 3.71% of the total amount, from the address of its assistance fund. The perpetual-focused exchange was an automatic process of converting the trading fees it generated to buy its native token with the assistance fund.

There was no private key, which meant that the assistance fund address could not be held in any way, and a hard fork was required to unlock the funds. However, in case the vote passes the burn, it will make a social agreement that no protocol upgrades will be allowed to reach this address. The findings shall be released on December 24, according to the weighted consensus of the stakeholders.

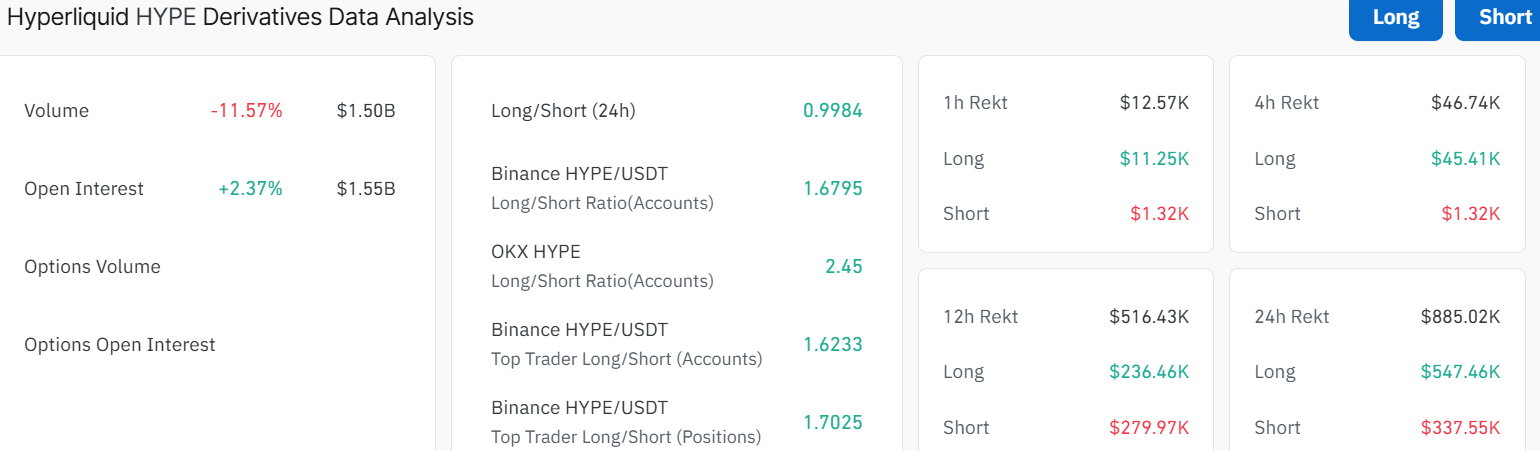

On the other hand, the bullish sentiment has increased on the derivatives side by the abrupt announcement of a possible uptake decrease. The data provided by CoinGlass indicates that the Open Interest (OI) has soared by 2.37% within the past 24 hours, reaching $1.55 billion, which means that the value of the active positions is on the rise.

HYPE Derivatives Data: CoinGlass

HYPE Derivatives Data: CoinGlass

HYPE Steadies at $27 as Bulls Aim for a Breakout to $29

The HYPE/USD 1-day chart shows the price is hovering around $27.11 within a parallel falling channel. The Hyperliquid price has re-entered a short-term consolidation zone, and is currently facing resistance by the 50 SMA at $35 and the 200-day at $41. This recent outlook signals a bearish trend in the HYPE market.

The Relative Strength Index (RSI) at 34.20 sits below the RSI-based MA at 37.05, indicating caution. There is still some potential for movement in either direction. The Moving Average Convergence Divergence (MACD) is bearish, soaring below the signal line (orange). This further signals a bearish grip in the market.

HYPE/USD 1-day chart: TradingView

HYPE/USD 1-day chart: TradingView

The falling channel is a bullish reversal pattern if the HYPE token breaks out to the upside. Otherwise, it can usher the price to lower levels if bears remain persistent. In the short term, Hyperliquid’s price may test the $26-$23 support level if the bears continue their campaign. A break below the zones could drag it to the recent low of $17, where bargain hunters might swoop in.

However, if bulls reclaim the $29 immediate resistance, the token could see a rebound toward $35, especially if the entire market turns green again. The $35-$41 zone will be a key point to watch. If buyers hold it, Hyperliquid will be back in a bullish trend.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

CryptoMiningFirm turns phones, computers into passive crypto income tools