Ondo Finance to Launch Tokenized U.S. Stocks on Solana in 2026

This article was first published on The Bit Journal.

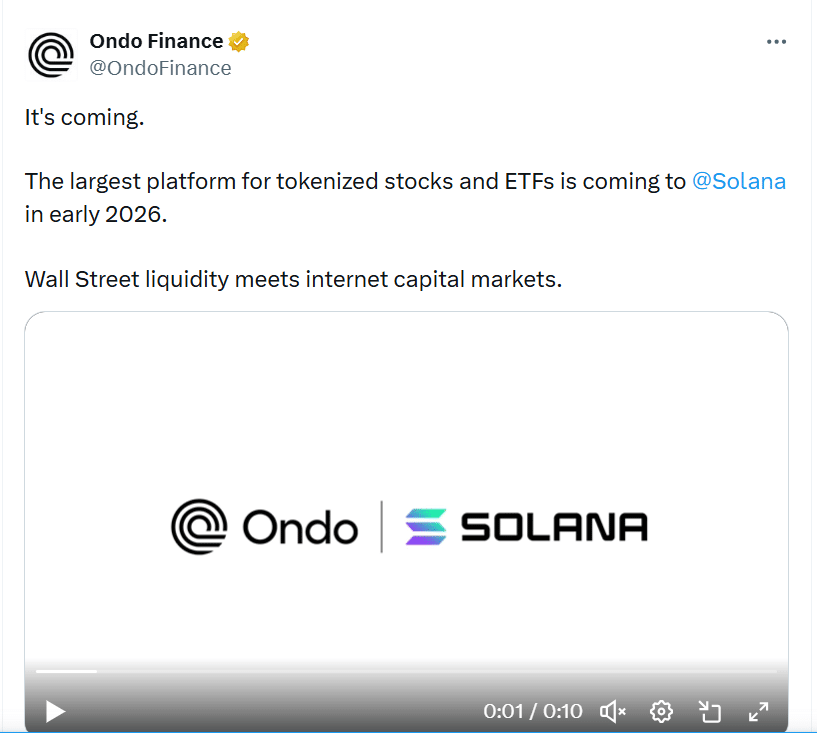

The Ondo Finance Solana launch is planned for early 2026 and will bring U.S. stocks and ETFs in tokenized form to the Solana blockchain. After launching on Ethereum in September, Ondo Finance now wants to make traditional financial assets more accessible on-chain.

This will allow investors from anywhere in the world to trade stocks, treasuries, and ETFs at any time through its Global Markets platform. The expansion shows the company’s continued effort to connect traditional Wall Street markets with blockchain technology.

What is the Ondo Finance Solana launch about?

The Ondo Finance Solana launch will give investors access to tokenized stocks, ETFs, and other financial assets on Solana’s fast and scalable blockchain. By turning traditional assets into on-chain products, the platform allows trading and settlement 24/7, making it easier to access than normal market hours.

Ondo Finance to Launch Tokenized U.S. Stocks on Solana in 2026 4

Ondo Finance to Launch Tokenized U.S. Stocks on Solana in 2026 4

Ondo Finance described the launch as bringing Wall Street liquidity to internet capital markets, showing how the platform connects traditional financial markets with blockchain technology.

This expansion also strengthens Solana’s role as a growing hub for tokenized financial assets and broadens Ondo Finance’s multi-chain presence, following earlier launches on Ethereum and BNB Chain.

How did Ondo Finance build up to this Solana expansion?

Before the Ondo Finance Solana launch, the company debuted its Global Markets platform on Ethereum in September 2025. This initial rollout offered more than 100 U.S. stocks, treasuries, money market funds, and ETFs.

The company planned to expand to over 1,000 tokenized assets within a few months, marking a rapid growth trajectory. In October, Ondo Finance extended the platform to BNB Chain as part of its multi-chain strategy. Analysts note that Ondo Finance currently leads the tokenization sector, controlling $357 million of tokenized public stocks out of a total $670 million market.

Ondo Finance to Launch Tokenized U.S. Stocks on Solana in 2026 5

Ondo Finance to Launch Tokenized U.S. Stocks on Solana in 2026 5

Why is Solana important for tokenized stocks and ETFs?

The Ondo Finance Solana launch strengthens Solana’s transformation from a payments-focused blockchain into a broader financial infrastructure layer. Solana has attracted large institutions that are exploring tokenization.

Major companies like JPMorgan have issued commercial paper on Solana, while Franklin Templeton runs a prominent tokenized money market fund on the network. Experts say Ondo Finance’s move adds further credibility to Solana’s ability to host real-world financial products.

How did the market react?

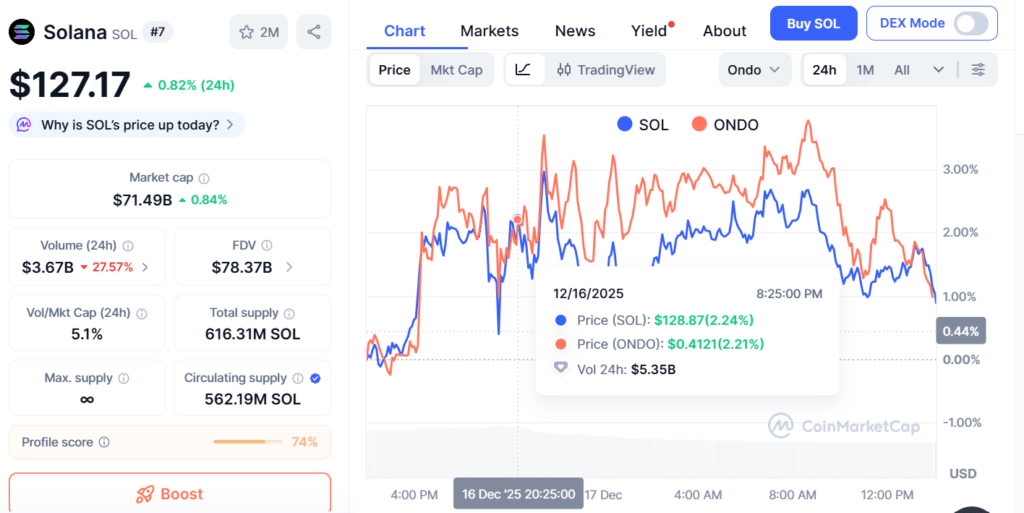

Despite the announcement, short-term price reactions were limited. $ONDO is trading around $0.4079, up 0.91% in the past 24 hours but down 17.75% over the past week, even as total value locked reached a new high of $1.92 billion.

Speculative trading has also slowed, with open interest falling to just over $114 million, near a 12-month low. Market analysts note that short-term price changes do not necessarily reflect the platform’s long-term fundamentals.

What does this mean for Solana and investors?

The Ondo Finance Solana launch had little effect on $SOL’s price in the short term. Solana is currently trading around $127.52, up 1.34% over the past 24 hours, while its 24-hour trading volume is $3.66 billion, down 27.68% from the previous day.

Investor activity remains notable, showing sustained interest in Solana’s growing ecosystem despite short-term fluctuations. Analysts say this indicates continued confidence in the network’s role as a hub for tokenized financial assets.

Can Ondo Finance maintain its lead in tokenized equities?

As the Ondo Finance Solana launch approaches, competition in the tokenized equities sector is intensifying. The tokenized real-world asset market is projected to reach $16 trillion by 2030. Ondo Finance currently leads the tokenized public stocks segment, controlling $357 million of a $670 million market.

Ondo Finance to Launch Tokenized U.S. Stocks on Solana in 2026 6

Ondo Finance to Launch Tokenized U.S. Stocks on Solana in 2026 6

Backed Finance follows with $160 million, while Securitize and WisdomTree are also among the top five. Backed Finance’s recent acquisition by Kraken could create new competitive pressures, as Kraken plans to integrate tokenized assets into its platform.

How significant is this expansion?

The Ondo Finance Solana launch is being seen by experts as part of a larger shift toward financial markets that never close. A digital assets analyst said the move is about bringing Wall Street liquidity into modern internet-based infrastructure, reflecting exactly what Ondo Finance has been aiming for.

Right now, the market for tokenized real-world assets sits at $18.6 billion, with Ethereum controlling more than 65%. By moving onto Solana, Ondo Finance could help spread that market across multiple blockchains as more institutional investors get involved.

Conclusion

Ondo Finance Solana launch in early 2026 will be an important step in bringing U.S. stocks, ETFs, and other financial assets to blockchain. It will allow investors around world to trade tokenized equities anytime. Through Ondo Finance’s Global Markets platform.

Building on its earlier expansions on Ethereum and BNB Chain, this launch is set to strengthen Ondo Finance’s role as a leader in the tokenized equities space. By leveraging Solana’s fast and low-cost network expansion will bridge traditional Wall Street markets with blockchain technology.

Glossary

Ondo Finance: Platform that turns stocks, ETFs, and treasuries into digital tokens.

Tokenized Stocks: Digital versions of real company shares for blockchain trading.

Tokenization: Converting real-world assets into digital tokens on a blockchain.

Global Markets Platform: Ondo Finance’s platform for trading tokenized assets anytime.

Treasuries: Government bonds that can be digitized and traded on blockchain.

Frequently Asked Questions About Ondo Finance Solana Launch

What is Ondo Finance Solana launch?

Ondo Finance Solana launch will let people trade tokenized stocks, ETFs. And other financial assets on the Solana blockchain.

Why is Solana used for this launch?

Solana is fast, scalable, and allows 24/7 trading, making it ideal for tokenized financial assets.

What assets will be available on Solana?

U.S. stocks, treasuries, ETFs, and other tokenized financial assets will be available.

What is the benefit of trading tokenized assets on Solana?

Trading on Solana allows investors to buy and sell assets anytime, even outside normal market hours.

How does this launch affect Solana’s ecosystem?

It strengthens Solana as a hub for tokenized financial assets and attracts more investors to the network.

Sources

Cryptonews

Coindesk

Read More: Ondo Finance to Launch Tokenized U.S. Stocks on Solana in 2026">Ondo Finance to Launch Tokenized U.S. Stocks on Solana in 2026

You May Also Like

Eric Trump bets Fed rate cut will send crypto stocks skyrocketing

Laura L. Lott Named New Executive Director of the National Art Education Association