Ethereum Price: ETH Drops Below $3K as Bulls Defend Key Support

TLDR

- ETH consolidates near $3,000 as selling pressure eases after a volatile pullback

- On-chain data shows whales accumulating, with realized price rising toward current levels

- Weekly chart holds firm above the $2,700–$2,800 multi-year support zone

- Daily structure hints at accumulation, with upside toward $3,400–$4,000 if resistance breaks

Ethereum (ETH) price is consolidating near critical support after a volatile pullback that briefly pushed the token below the $3,000 level. Analysts have pointed to rising on-chain support, a resilient higher-timeframe structure, and signs of short-term accumulation. Together, these signals suggest the downside may be limited while upside targets between $3,400 and $4,000 remain in focus if momentum improves.

On-Chain Data Shows ETH Whales Building Support

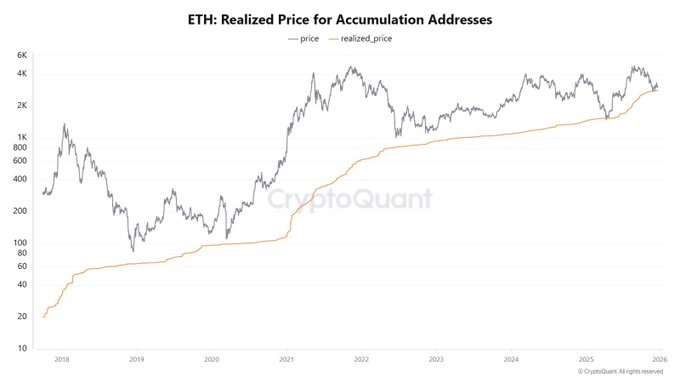

According to analyst Master of Crypto, on-chain data from CryptoQuant highlights a steady rise in the realized price for accumulation addresses. This metric tracks the average cost basis of long-term holders that continue adding to positions. The realized price has trended higher since 2018 and now approaches the $3,000 zone, reflecting sustained conviction among large investors despite market cycles.

Meanwhile, spot ETH is trading just above this realized price, a zone that has historically acted as strong support. When market price approaches the cost basis of accumulators, buying activity has tended to increase. Therefore, the continued rise in realized price suggests whales are still adding exposure at current levels. This behavior supports the view that recent weakness may represent consolidation rather than a trend reversal.

Ethereum Price Holds Above Multi-Year Support

Additionally, analyst The Crypto Professor focuses on the weekly ETH against the USD chart and its multi-year structure. After peaking near $4,800 in 2021, the crypto entered a prolonged corrective phase. A well-defined support band around the $2,700–$2,800 level has held multiple tests since 2023 and now underpins the current range.

Moreover, recent price action shows a strong advance earlier in 2025 followed by a controlled pullback into this same zone. Momentum indicators have cooled, reducing near-term overheating risk. Volume has also declined during consolidation, a pattern often associated with accumulation. As long as this support holds, analysts view the broader structure as constructive, with scope for a renewed move toward prior highs over time.

Ethereum Price Chart Signals Potential Markup Phase

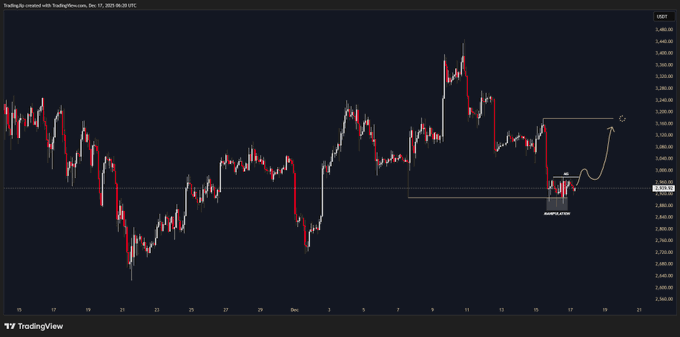

In addition, Jip Molenaar’s daily chart highlights short-term dynamics near a possible turning point. Following a decline from mid-2025 highs above $3,400, ETH price entered a sharp sell-off phase marked by increased volatility. This move is interpreted as a shakeout designed to remove weak positions and absorb supply.

The recent structure resembles a Wyckoff-style accumulation pattern, including a selling climax and quick recovery from a brief break below prior lows. Volume spikes during the decline, followed by lighter volume on rebounds, suggest absorption is taking place. Analysts noted that holding support near $2,900–$2,950 is critical. A decisive break above $3,100 on rising volume would strengthen the case for a move toward $3,400–$3,600, with $4,000 as an extension if momentum accelerates.

Overall, Ethereum price remains at a pivotal level where long-term accumulation, higher-timeframe support, and short-term structure intersect. While volatility may persist, analysts suggest that sustained trading above key support keeps the medium-term outlook constructive. More so, confirmation will depend on follow-through above nearby resistance and the wider market conditions in the weeks ahead.

The post Ethereum Price: ETH Drops Below $3K as Bulls Defend Key Support appeared first on CoinCentral.

You May Also Like

The Channel Factories We’ve Been Waiting For

Singapore Entrepreneur Loses Entire Crypto Portfolio After Downloading Fake Game