Japan Rate Hike Could Crash Bitcoin And Altcoins in the Next 48 Hours

The post Japan Rate Hike Could Crash Bitcoin And Altcoins in the Next 48 Hours appeared first on Coinpedia Fintech News

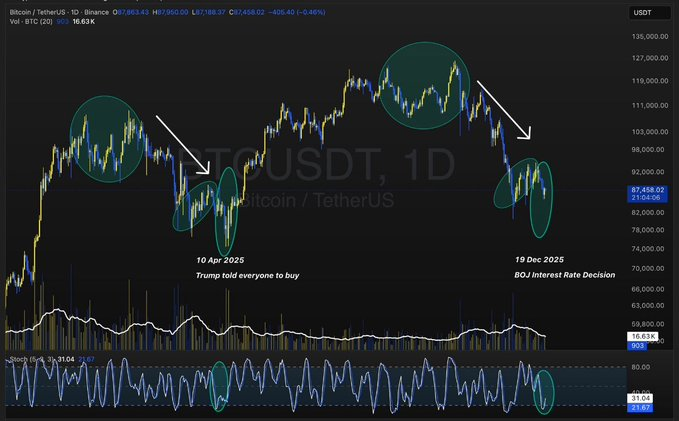

Cryptocurrency markets are facing heightened volatility as the Bank of Japan (BOJ) prepares to raise interest rates, a move that could have ripple effects on Bitcoin, Ethereum, XRP, and other digital assets globally.

BOJ Prepares Historic Rate Increase

Japan has maintained ultra-low interest rates for decades to stimulate economic growth through cheap borrowing. However, rising inflation and a weakening yen have prompted the BOJ to signal a rate hike. Economists predict a 0.25% increase from the current 0.5%, potentially reaching 0.75%, the highest level in decades.

Source: X

Source: X

The rate increase, although seemingly small, represents a major shift in Japan’s monetary policy and is expected to influence both local and global financial markets.

Why Crypto Investors Should Take Notice

Cryptocurrency markets thrive on liquidity, with cheap money fueling investments in high-risk assets. When central banks tighten monetary policy, borrowing costs rise and liquidity dries up. Historically, these conditions trigger sell-offs in speculative markets, including crypto.

Bitcoin often feels the first impact. During the 2022 U.S. Federal Reserve rate hikes, Bitcoin prices plunged from over $60,000 to under $20,000 in a matter of months. Analysts say a similar effect could be seen if the BOJ proceeds with the anticipated hike.

The Role of the Yen and Global Carry Trades

A stronger yen could also impact global carry trades. Investors often borrow yen at low rates to invest in higher-yielding assets such as U.S. stocks or crypto. A rate hike may reverse these trades, creating additional selling pressure in crypto markets.

“This is not isolated to Japan,” said one market analyst. “Japan is the world’s third-largest economy, so their moves create ripples.”

Current Market Trends

As of Dec 17, cryptocurrency markets are showing early signs of stress. Bitcoin is trading around $86,589, down over 1% in the past 24 hours. Ethereum has fallen to $2,834, losing more than 4% of its value. XRP is also under pressure, trading at $1.86 with a decline of nearly 4%. The total market capitalization of cryptocurrencies stands at $2.92 trillion.

You May Also Like

US Ranks #1 in CoinGecko Global Meme Coin Interest Report

Tether CEO Delivers Rare Bitcoin Price Comment