Uniswap Protocol v2 and v3 Set for Fee Activation After UNIfication Passes

The Uniswap protocol fee switch is expected to go live later this week after a governance proposal crossed the required voting threshold. The decision represents one of the most meaningful upgrades in Uniswap’s history.

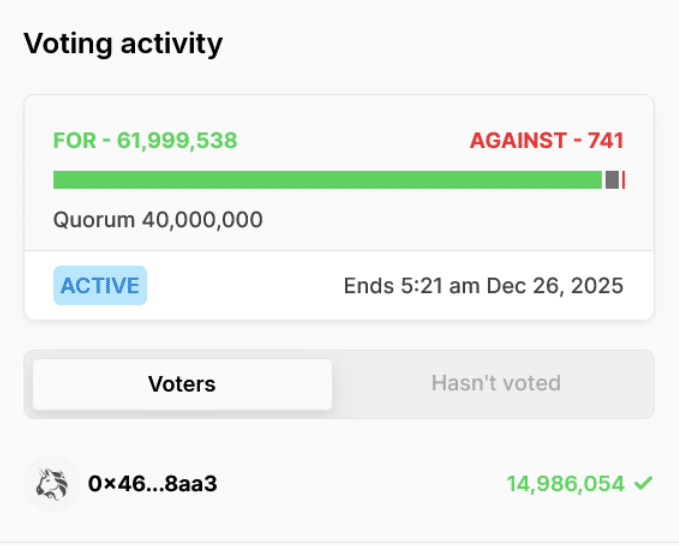

Voting momentum built quickly after the proposal opened on Dec. 20. More than 62 million votes were cast in favor as of early Monday. That total exceeds the 40 million votes needed to approve the Uniswap protocol fee switch. Voting is scheduled to end on Christmas Day.

UNIfication Proposal Advances Toward Activation

The proposal, known as UNIfication, introduces protocol-level fees for Uniswap v2 and v3. The changes will activate on the Unichain mainnet.

Uniswap Labs CEO Hayden Adams said approval would trigger a two-day timelock. Once that period ends, the Uniswap protocol fee switch will activate automatically.

Source: UniSwap

Source: UniSwap

Governance Vote Signals Strong Alignment

The vote shows broad consensus among UNI holders. Only a very small number of votes opposed the proposal. A limited share abstained.

Also Read: UNI plots fee switch and 100M burn as Uniswap price firms up

Large token holders overwhelmingly supported the Uniswap protocol fee switch. The outcome suggests confidence in the long-term impact of the change.

Activation Timeline and Safeguards

After voting closes, the protocol will enter a mandatory delay period. This timelock is part of Uniswap’s governance framework.

It allows for final review before execution. When the delay ends, fee switches on Uniswap v2 and v3 will turn on. The Uniswap protocol fee switch will then begin operating on-chain.

UNI Token Burn and Supply Impact

A key element of the proposal is a major token burn. The Uniswap Foundation plans to burn 100 million UNI from its treasury. This reduces overall supply.

The move is designed to improve token scarcity. Many observers see the Uniswap protocol fee switch as a shift toward stronger supply discipline.

Liquidity Provider Incentive Changes

The proposal also introduces a Protocol Fee Discount Auctions system. The mechanism aims to improve returns for liquidity providers. It changes how protocol fees are distributed.

Uniswap expects this system to support deeper liquidity. The Uniswap protocol fee switch is central to this new incentive structure.

Market Response to the Proposal

UNI’s price reacted positively during the voting period. The token gained around 25% after voting began. It recently traded near $6.26 and down by 1.23% over the past day..

That move helped UNI recover from a prolonged decline. Earlier news of the Uniswap protocol fee switch proposal in November also drove a sharp rally.

Uniswap’s Scale in DeFi Markets

Uniswap remains the largest decentralized exchange by total volume. It has processed more than $4 trillion in trades since launching in 2018.

UNI ranks among the top 40 tokens by market capitalization. Because of this scale, the Uniswap protocol fee switch has wider implications for decentralized finance.

Influential Voters Back the Measure

Several well-known industry figures supported the proposal. These include Variant founder Jesse Walden. Synthetix and Infinex founder Kain Warwick also voted in favor.

Former Uniswap Labs engineer Ian Lapham backed the change. Their support added credibility to the Uniswap protocol fee switch.

Builder Funding and Growth Plans

The Uniswap Foundation addressed concerns from developers early in the process. It confirmed that grant programs would continue. A new Growth Budget is planned.

The budget involves distributing 20 million UNI. The Foundation said the Uniswap protocol fee switch would not reduce support for builders.

Conclusion

The activation of the Uniswap protocol fee switch marks a major shift in how the protocol operates. It links governance decisions to token economics more directly.

The upgrade combines token burns, revised incentives, and ongoing ecosystem funding. These changes signal a new phase in Uniswap’s evolution.

Also Read: Uniswap Breaks EVM Boundaries with Solana Integration

Appendix: Glossary of Key Terms

Uniswap protocol fee switch: A mechanism that enables protocol-level fee collection on Uniswap.

UNIfication: A governance proposal designed to activate protocol fees and adjust token economics.

UNI token: The governance asset used for voting and ecosystem incentives on Uniswap.

Unichain: The network where the fee switch is scheduled to activate first.

Governance vote: A token-holder decision process used to approve protocol changes.

Timelock period: A delay that allows review before approved upgrades take effect.

Token burn: The permanent removal of tokens from circulation to reduce supply.

Frequently Asked Questions About Uniswap Protocol Fee Switch

1- What is the Uniswap protocol fee switch?

It is a mechanism that enables protocol-level fees and changes how value flows through Uniswap.

2- When will it activate?

Activation is expected shortly after voting ends, following a two-day timelock.

3- How many UNI tokens will be burned?

The proposal includes burning 100 million UNI from the Uniswap Foundation’s treasury.

4- Will developer grants continue?

Yes. The Foundation plans a Growth Budget funded with 20 million UNI.

Reference

CoinTelegraph

Read More: Uniswap Protocol v2 and v3 Set for Fee Activation After UNIfication Passes">Uniswap Protocol v2 and v3 Set for Fee Activation After UNIfication Passes

You May Also Like

MFS Releases Closed-End Fund Income Distribution Sources for Certain Funds

BlackRock boosts AI and US equity exposure in $185 billion models