Solana Network Activity Crashes 97%, But Analysts See a Deeper Shift Ahead

This article was first published on The Bit Journal.

The Solana network activity crash has sparked renewed discussion across the digital asset world, but the data shows a more complicated story than just a collapse. With activity on the blockchain dropping by 97% in late 2025, several important factors suggest it could be more of a stress test than a full failure.

Structural changes in the network, interest from institutions, and comparisons with other blockchain ecosystems indicate that this period may not be the end. The current debate focuses on whether Solana’s slowdown signals the end of a cycle driven by speculative trading or the start of a shift toward more stable, long-term uses.

What does the Solana network activity crash indicate about network health?

The Solana network activity crash refers to a 97% decline in activity during Q4 2025. Monthly active traders dropped sharply from over 30 million in late 2024 to fewer than 1 million in 2025.

Solana Network Activity Crashes 97%, But Analysts See a Deeper Shift Ahead 3

Solana Network Activity Crashes 97%, But Analysts See a Deeper Shift Ahead 3

This contraction caused concern among analysts, with some wondering if Solana was finished. However, the numbers also show a correction after a period of overheated speculative trading, rather than a complete failure of the network or a loss of developer activity.

How did meme coins turn from growth engine to stress point?

Meme coins played a major role in the Solana network activity crash, but they were also important to Solana’s growth. Along with Hyperliquid, Solana was considered one of the key success stories of this cycle, gaining from strong retail participation and fast-paced experimentation.

Supporters have long said that meme coins act as live stress tests for high-speed, high-throughput blockchains. Analyst Marty Party reinforced this idea, explaining that meme coin traders left after a successful liveness test and will likely be replaced by equity traders and 50 million stablecoin users, urging others to catch up with this shift.

The risk, however, became obvious when market sentiment turned negative. As meme coin volumes fell sharply, a large portion of Solana’s traffic and fee income also disappeared, highlighting the network’s dependence on speculative activity.

What impact did the Solana network activity crash have on $SOL’s price?

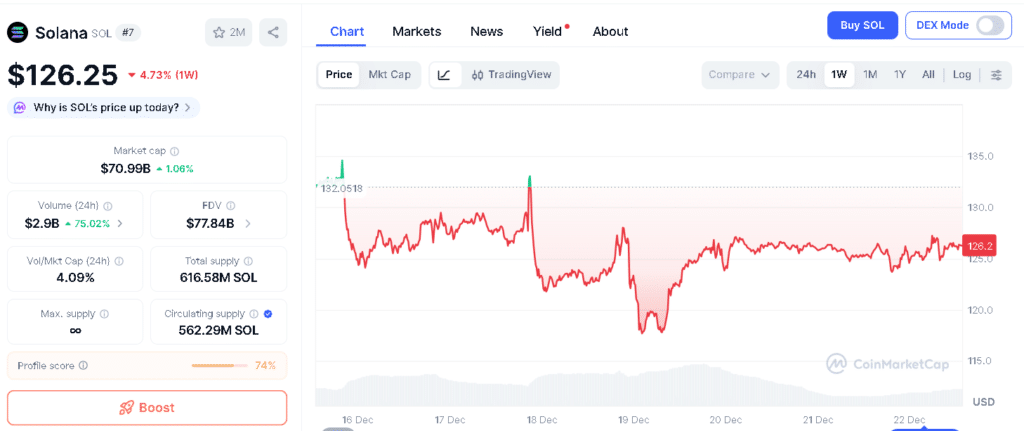

The Solana network activity crash happened at the same time as a sharp drop in $SOL’s price. After rising from $8 to nearly $300, a gain of more than 35 times from 2022 lows, the token fell back significantly.

As meme coin interest declined, $SOL fell from nearly $300 to the $120 yearly support level, marking a 58% drop. It is currently trading around $126.19. This decline shows how much the price had become linked to speculative on-chain activity rather than a broader, more diversified demand.

| Metric | Solana 2025 Value |

|---|---|

| Network Activity Drop | 97% (Q4 2025) |

| SOL Price Decline | 58% ($300 to $120 support) |

| Memecoin Activity Drop | Over 97% |

| Annual Revenue | $502M |

| Revenue vs 2024 | 5x decline |

| SOL vs ETH Performance | -56% underperformance |

| BTC Market Context | >30% decline |

| Price Forecasts | $50-75 (Fundstrat H1 2026) or +15% to $134-140 ($1B shorts – Ted Pillows) |

Was Solana alone in this downturn?

While the Solana network activity crash was severe, it occurred during a wider market downturn. Bitcoin (BTC) fell by more than 30% during the same period, and trading volumes dropped across other major networks as well.

The difference was in exposure. Solana’s activity was heavily focused on high-risk segments, which left the network more quickly during the downturn. Other networks with stronger institutional usage saw relatively smoother adjustments.

How does Solana compare with Ethereum after the crash?

The Solana network activity crash has increased the revenue and performance gap between Solana and Ethereum. In 2025, Ethereum earned more than $1.4 billion in annual revenue, while Solana recorded $5022 million, showing a threefold difference.

This is a sharp contrast to 2024, when Solana earned $2.5 billion, indicating a fivefold decline in revenue year over year. Solana co-founder Anatoly Yakovenko described the period as a crazy year and added that whether open permissionless protocols can actually grow and sustain revenues remains an open question.

From an investor’s perspective, $SOL underperformed $ETH by 56% in 2025, reversing the relative gains it had achieved the previous year.

Can institutional interest offset the Solana network activity crash?

Despite the Solana network activity crash, institutional interest indicates potential resilience. Visa’s involvement with Solana for stablecoin settlement use cases shows confidence in the network’s speed and cost-effectiveness.

Analysts point out that moving away from gambling-focused activity toward payments, stablecoins, and equity-like trading could help stabilize revenues over time. This reflects a wider trend among Layer-1 networks, where platforms that endure speculative cycles often emerge with stronger and more sustainable demand.

What are analysts watching next for $SOL?

Even after the Solana network activity crash, opinions about the future remain divided. Fundstrat projected that $SOL could drop to the $50–$75 range in the first half of 2026 if the recovery does not gain momentum.

Solana Network Activity Crashes 97%, But Analysts See a Deeper Shift Ahead 4

Solana Network Activity Crashes 97%, But Analysts See a Deeper Shift Ahead 4

On the other hand, analyst Ted Pillows pointed out that nearly $1 billion in leveraged short positions could lead to a potential 15% upside for $SOL, pushing it toward $134–$140 if short covering picks up. The outcome largely depends on whether new types of network activity can replace the lost meme coin volumes.

Conclusion

The Solana network activity crash highlights the dangers of relying heavily on speculative demand, with meme coin activity down by over 97% and revenues significantly lower than last year. However, ongoing institutional interest, better network stability, and comparisons with other successful platforms like Hyperliquid indicate that this period may serve as a recalibration rather than an end for the network.

If Solana can shift its throughput toward stablecoins, settlements, and non-gambling applications, the current slowdown could ultimately reinforce the network’s long-term foundations rather than marking its downfall.

Glossary

Monthly Active Traders: Users who trade or use the blockchain each month.

Hyperliquid: A Solana platform that boosted network activity in 2025.

Institutional Interest: Big companies or investors using the blockchain.

Revenue Decline: Drop in money earned from blockchain transactions.

Network Activity Crash: Sudden big drop in blockchain usage or trading.

Frequently Asked Questions About Solana Network Activity Crash

How many traders were affected by crash?

Monthly active traders fell from over 30 million in 2024 to less than 1 million in 2025.

Why did meme coins affect Solana’s network activity?

Meme coins brought many traders to Solana. And when their popularity dropped, network activity and fees fell sharply.

What was the impact on $SOL’s price?

$SOL fell from nearly $300 to around $120. 58% drop during network activity crash.

How does Solana compare to Ethereum after crash?

Solana earned less revenue than Ethereum in 2025. And $SOL underperformed $ETH by 56% compared to last year.

What might happen next for $SOL?

$SOL could fall to $50–$75 if the downturn continues. Or might rise 15% if leveraged shorts are covered.

Sources

AMBCrypto

Kucoin

CoinMarketCap

Read More: Solana Network Activity Crashes 97%, But Analysts See a Deeper Shift Ahead">Solana Network Activity Crashes 97%, But Analysts See a Deeper Shift Ahead

You May Also Like

Urgent Analysis: Altcoins Oversold, Signaling a Potential Reversal

Wall Street Bets on XRP: Adoption-Driven Peak by 2026