Bloomberg: Have U.S. Treasuries really lost their safe-haven appeal?

By Alice Atkins & Liz Capo McCormick, Bloomberg

Compiled by: Felix, PANews

Investors often flock to U.S. Treasuries to escape financial market turmoil, and they have rebounded during the global financial crisis, 9/11 and even during the U.S.'s own credit rating downgrade.

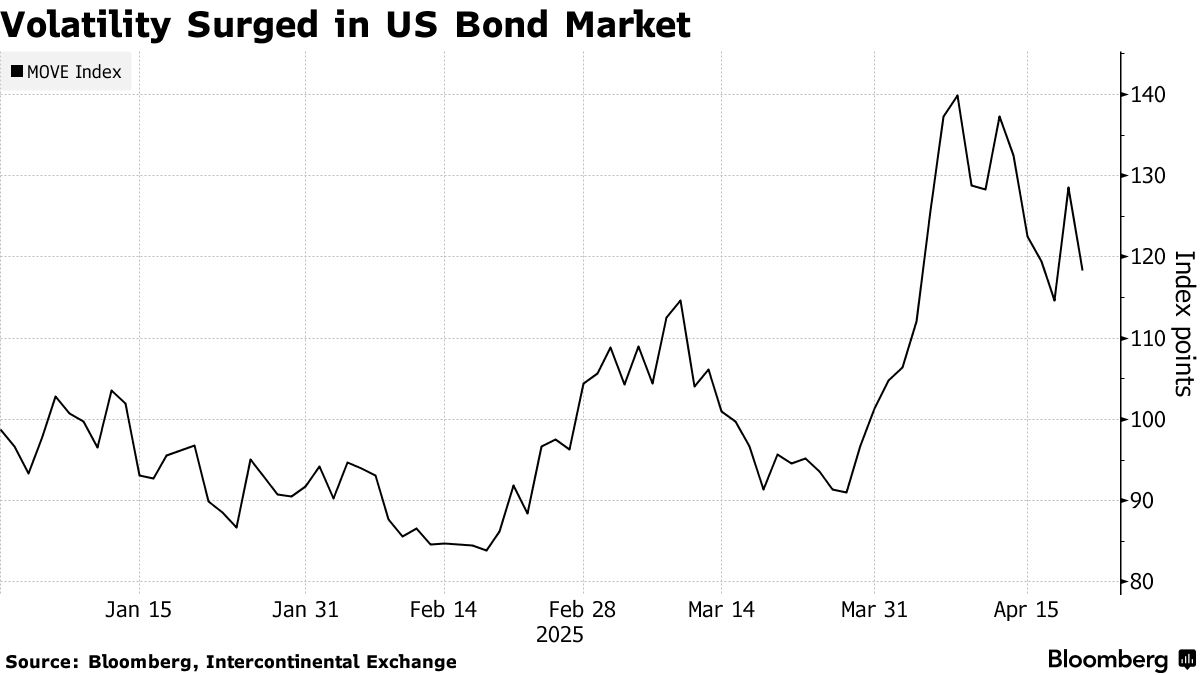

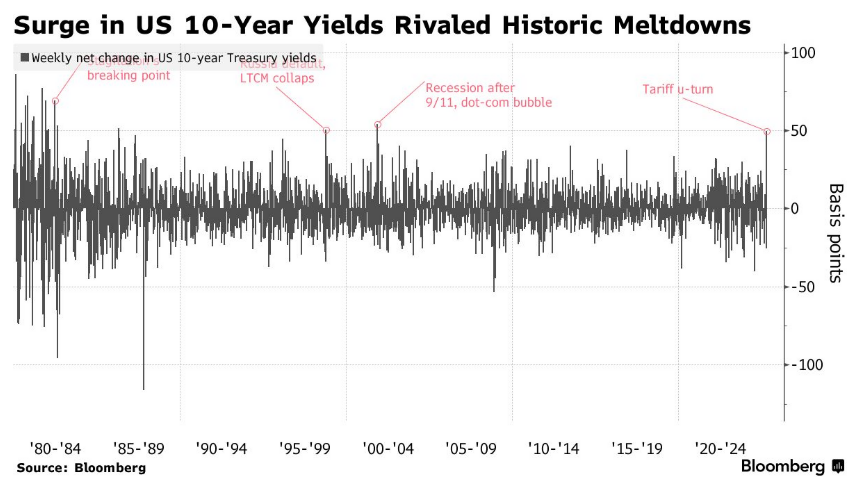

Yet in early April, amid the chaos unleashed by President Trump’s imposition of “reciprocal” tariffs, something unusual happened. As risk assets like stocks and cryptocurrencies tumbled, Treasury prices, instead of rising, fell along with them. Treasury yields posted their biggest weekly gain in more than two decades.

U.S. Treasuries, with a market size of $29 trillion, have long been seen as a safe haven in times of market turmoil, a unique advantage of the world's largest economy. For decades, it has helped the United States control borrowing costs. But recently, U.S. Treasuries have been trading more like a risky asset. Former Treasury Secretary Lawrence Summers even said that U.S. Treasuries are behaving like the debt of emerging market countries.

This has far-reaching implications for the global financial system. As the world’s “risk-free” asset, U.S. Treasuries are used as a benchmark for pricing everything from stocks to sovereign bonds and mortgage rates, while also serving as collateral for trillions of dollars in loans every day.

Here are some of the arguments investors and market forecasters have made to explain April's unusual volatility in U.S. Treasuries, as well as some potential alternative "safe havens."

Tariff-driven inflation

Even though Trump suspended most of the “reciprocal” tariffs for 90 days, the tariffs imposed on China are still much higher than previously expected. There are also tariffs on cars, steel, aluminum and various goods from Canada and Mexico, and Trump has threatened to impose more import tariffs in the future.

There are concerns that businesses will pass on the costs of those tariffs to consumers in the form of higher prices. An inflation shock would hit demand for Treasury bonds because it would erode the future value of the fixed-income payments they provide.

If soaring prices are accompanied by falling or zero growth in economic output (so-called stagflation), monetary policy will enter a new period of uncertainty and the Fed will be forced to choose between supporting economic growth and curbing inflation.

Chasing Cash

Some investors may have dumped Treasuries and other U.S. assets in favor of the ultimate safe haven: cash. As the Federal Reserve holds off on cutting interest rates, assets in money market funds have continued to surge, hitting a record high in the week ended April 2. Money market funds are often viewed as cash-like, with the added benefit of generating income over time.

Policy uncertainty

Investors demand higher returns when investing in politically turbulent, economically unstable countries. This is one reason why Argentine government bonds were yielding as much as 13% in mid-April.

Trump's unexpected political strategies and aggressive tariff policies make it difficult to predict how friendly the investment environment in the United States will be in a year.

Another factor driving money into the U.S. is the perceived strength of the U.S. judicial system and other state institutions to constrain the U.S. government and ensure a degree of policy continuity. Trump’s willingness to challenge lawyers who stand in his way and to bend the Federal Reserve and other independent institutions to his will could undermine some confidence in the checks and balances that have helped make the U.S. the world’s largest destination for foreign investment.

Financial pressure

In the mid-1970s, the U.S. dollar replaced gold as the world's reserve asset, and central banks rushed to buy U.S. Treasury bonds to store their dollar reserves. U.S. Treasury bonds are seen as a solid investment because the federal government has never defaulted on its debt repayment commitments.

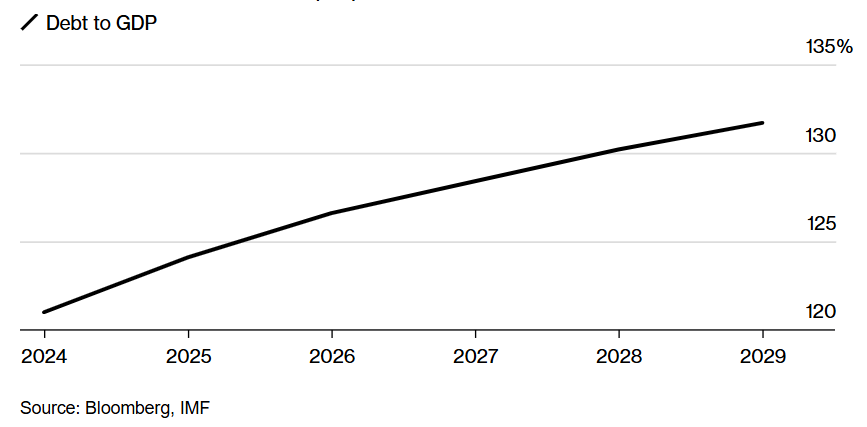

The U.S. national debt currently accounts for 121% of GDP. When Trump took office, he bet on reducing the budget deficit by stimulating economic growth through tax cuts, and recently he hinted that tariff revenues would also help reduce the budget deficit.

But there are concerns that his policies will only add to the national debt. In addition to the additional tax cuts he plans, Trump is trying to make permanent the tax cuts enacted during his first term. If the tariffs push the economy into a recession, the government could face pressure to spend more.

In light of this, Mike Riddell, fixed income investment manager at Fidelity International, said the spiraling upward in U.S. Treasury yields could signal "capital flight" as foreign investors become increasingly reluctant to finance the U.S. deficit. "The global 'bond vigilantes' are clearly still active."

U.S. debt levels are expected to rise

The International Monetary Fund predicts that by 2029 , the US debt will account for 131.7% of GDP .

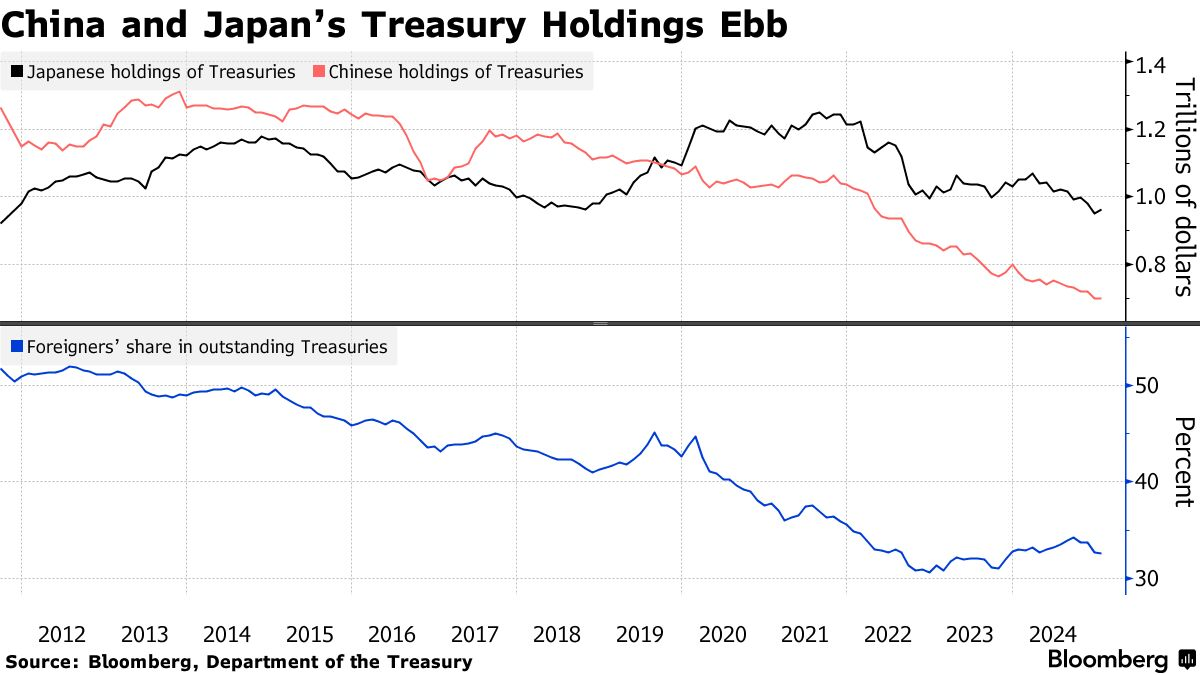

Foreign selling

While it’s hard to prove in real time, when Treasury prices fall, people often speculate that foreigners are selling. This time, some believe it’s a response to Trump’s tariffs. China and Japan are the largest holders of U.S. Treasuries. Official data show that the two countries have been reducing their holdings for some time.

The role of Beijing is hard to guess, given the secrecy surrounding Chinese trading. But strategists often point to China’s holdings of Treasuries as potential leverage against the U.S. — even if a big sell-off could drive down the value of China’s foreign exchange reserves.

Hedge Fund Trading

Basis trading, a popular hedge fund strategy that profits from the price difference between cash Treasuries and futures, may have contributed to the spike in Treasury yields in early April.

Such spreads are typically tight, so investors often use a lot of leverage to fund the trades. That can cause problems when market turmoil hits and investors rush to quickly unwind their positions to repay their loans. The risk is that it could set off a chain reaction that sends yields spiraling higher or, even worse, causes the Treasury market to grind to a halt, as happened when the basis trade was unwound in 2020.

Others point to the sudden collapse of popular bets that Treasuries would outperform interest rate swaps, which actually outperformed as banks liquidated bonds to meet clients’ liquidity needs and then added swaps to keep some exposure to a possible bond market rally.

If not U.S. Treasuries, what would it be?

Fund managers in Europe and Japan now find credible alternatives to buying U.S. Treasuries, which could entice them to shift allocations to markets with seemingly more stable policy outlooks. German bonds have been one of the main beneficiaries of the broader turmoil.

Gold, a traditional safe-haven asset, surged to an all-time high in April, outperforming almost all other major asset classes. Central banks have been hoarding the precious metal for some time in an effort to diversify their assets and reduce their reliance on U.S. dollar assets. However, unlike bonds, investing in gold does not bring fixed income. Investing in gold will only bring returns if you sell it when the price rises.

Ultimately, no investment offers as much liquidity and depth as the U.S. Treasury market, and a true exit from the market takes years, not weeks. However, some market observers believe that the market moves in April may indicate a shift in the global landscape and a reassessment of assets that are crucial to the U.S. economic dominance.

Related reading: From falling prices to fiscal woes, the ripple effects of the U.S. Treasury sell-off

You May Also Like

SBI VC Trade Adds Litecoin to Japanese Lending Program

Work Dogs TGE Is Running — Is WD About to Drop in Q2 After March 30?