Bitcoin Technical Analysis: Demand at $82K Holds Key to Short-Term Bias

Bitcoin remains under structural pressure as price continues to trade within a well-defined corrective environment. Recent price action shows hesitation and compression rather than trend continuation, suggesting the market is waiting for a decisive catalyst before the next directional move.

Technical Analysis

The Daily Chart

On the daily timeframe, Bitcoin is still respecting a broader descending structure following the recent impulsive selloff. The price is currently confined between a well-defined demand zone in the $82K–$80K range and a major resistance band near $95K–$96K. The repeated failure to reclaim the mid-range resistance highlights persistent sell-side control, while the lower highs structure confirms that bullish momentum remains weak.

The market is now trading closer to the lower half of the range, where buyers have previously stepped in to defend the price. However, the absence of strong bullish displacement from this zone suggests that demand is reactive rather than initiative-driven. As long as BTC remains below the $95K resistance and the descending trend structure stays intact, the daily bias remains neutral to bearish, with consolidation or gradual downside continuation still favored.

Source: TradingView

Source: TradingView

The 4-Hour Chart

The 4-hour chart provides clearer insight into the current market behavior. The primary cryptocurrency is consolidating within a tight range following a prolonged selloff, forming a compression zone below the rising short-term wedge and overhead resistance. This price action reflects equilibrium between buyers and sellers rather than accumulation, as BTC repeatedly fails to break higher with conviction.

Recent upside attempts have been rejected quickly, indicating that supply remains active on minor rallies. At the same time, downside pressure has slowed near the $85K–$86K region, where short-term demand continues to absorb sell orders. This price behavior suggests a range-bound environment, with liquidity being built on both sides before an expansion. A clean breakdown below the consolidation would open the path toward the $82K demand zone, while a sustained reclaim above the short-term resistance would be required to shift the intraday bias to the bullish side.

Until such a decisive breakout occurs, however, the 4-hour structure supports continued choppy price action and liquidity-driven moves rather than trend development.

Source: TradingView

Source: TradingView

Sentiment Analysis

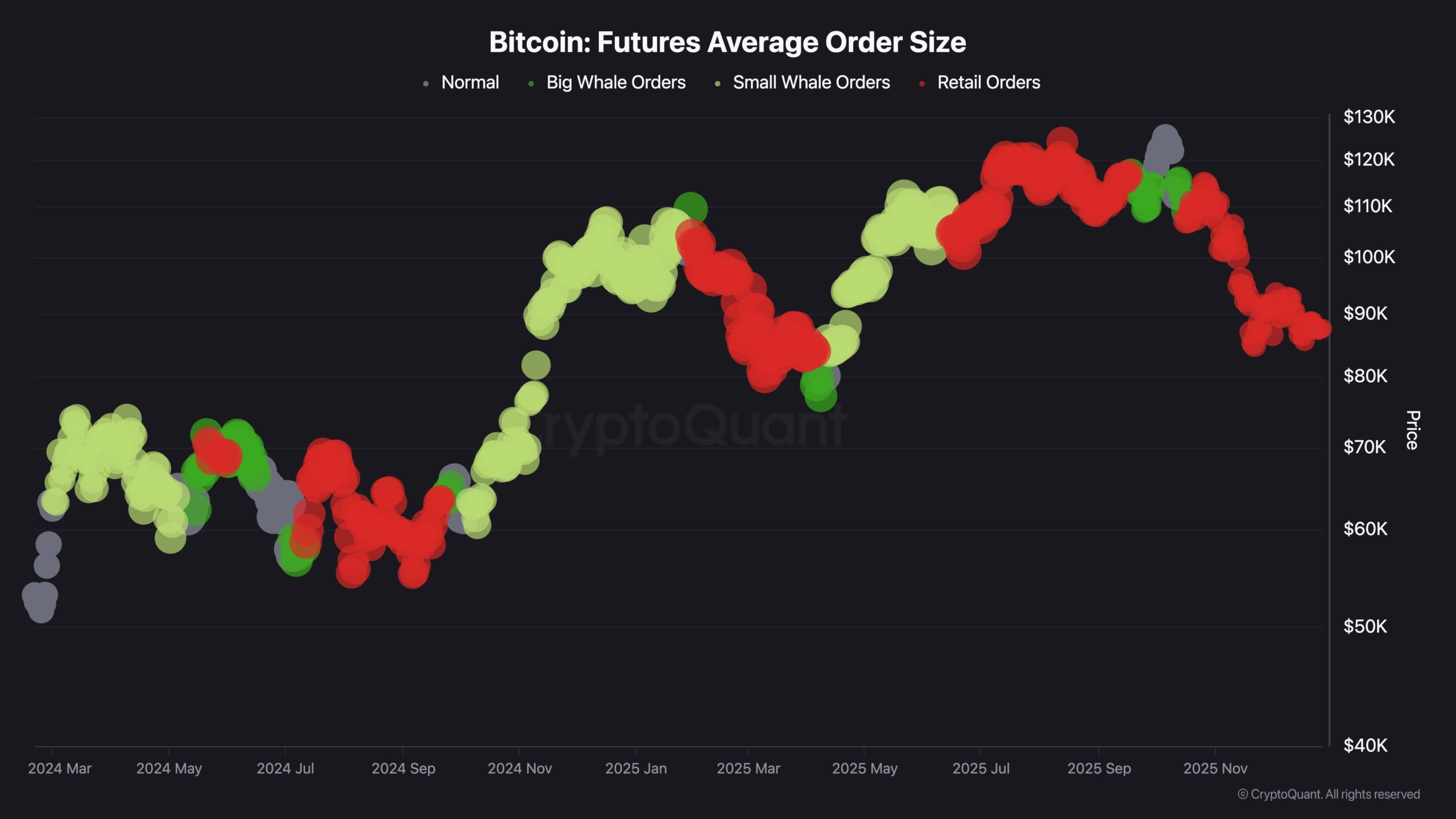

The futures average order size data highlights a clear shift in market participation, with recent activity increasingly dominated by smaller traders. As price oscillates below recent highs, the chart shows a visible rise in retail-sized orders, while whale activity has notably cooled off. This behavior typically reflects late-stage participation, where smaller traders become more active after major directional moves have already played out.

During the earlier bullish phases, larger order sizes were more consistently present, indicating stronger institutional or whale involvement driving price expansion. In contrast, the current environment shows a lack of sustained large orders, suggesting that smart money participation has either paused or moved into a more defensive stance. Without consistent whale-sized orders entering the market, upside momentum tends to weaken, leaving the price more vulnerable to volatility and downside pressure.

The dominance of retail-sized futures orders around the current price region reinforces the idea that recent rebounds are not being supported by strong conviction from larger players. Historically, this type of order flow imbalance often precedes extended consolidation or further corrective moves, as retail-driven rallies struggle to absorb overhead supply. Unless a clear resurgence in large order activity emerges, the on-chain structure continues to align with a cautious to bearish short-term outlook for Bitcoin.

Source: CryptoQuant

Source: CryptoQuant

The post Bitcoin Technical Analysis: Demand at $82K Holds Key to Short-Term Bias appeared first on CryptoPotato.

You May Also Like

Gold continues to hit new highs. How to invest in gold in the crypto market?

USDC Treasury mints 250 million new USDC on Solana