Toncoin [TON] rallied by 2% over the last 24 hours, with the crypto up by 12.5% over the past week of trading. This bullish momentum was likely driven by Telegram’s move to launch its self-custodial wallet in the US.

Founder of investment firm Skybridge Capital, Anthony Scaramucci, also commented on the token recently. Speaking to Altcoin Daily, the Wall Street financier picked Toncoin as one of his top three picks for 2026.

Telegram network growth over time would drive more demand for TON, he posited, while also admitting to buying the token when it was priced at $7.50. TON was trading at $1.72, at the time of writing.

Source: TON/USDT on TradingView

The imbalance on the 1-day timeframe from November served as a supply zone throughout December. It was breached at the start of the new year, sparking interest from traders and investors.

Should you buy TON too?

Source: Santiment

The on-chain metrics were not too encouraging for potential investors. The Open Interest has climbed since October, but it’s still well down from its peak in August. In fact, the mean coin age has not trended higher since October – A worrying sign.

This reflected a lack of network-wide accumulation. Instead, there were frequent sell-offs, driven by panic or profit-taking. The MVRV has been rising too, but still negative. It meant that TON holders of the past three months were, on average, facing minor losses.

Token Terminal data showed that the weekly TON active user count has been flat over the past year after a rapid spike towards the end of 2024.

Source: Santiment

Finally, the supply distribution revealed that only small Toncoin holders were buying and holding. The larger cohorts were selling, as evidenced by the falling number of wallets holding 1k or more TON.

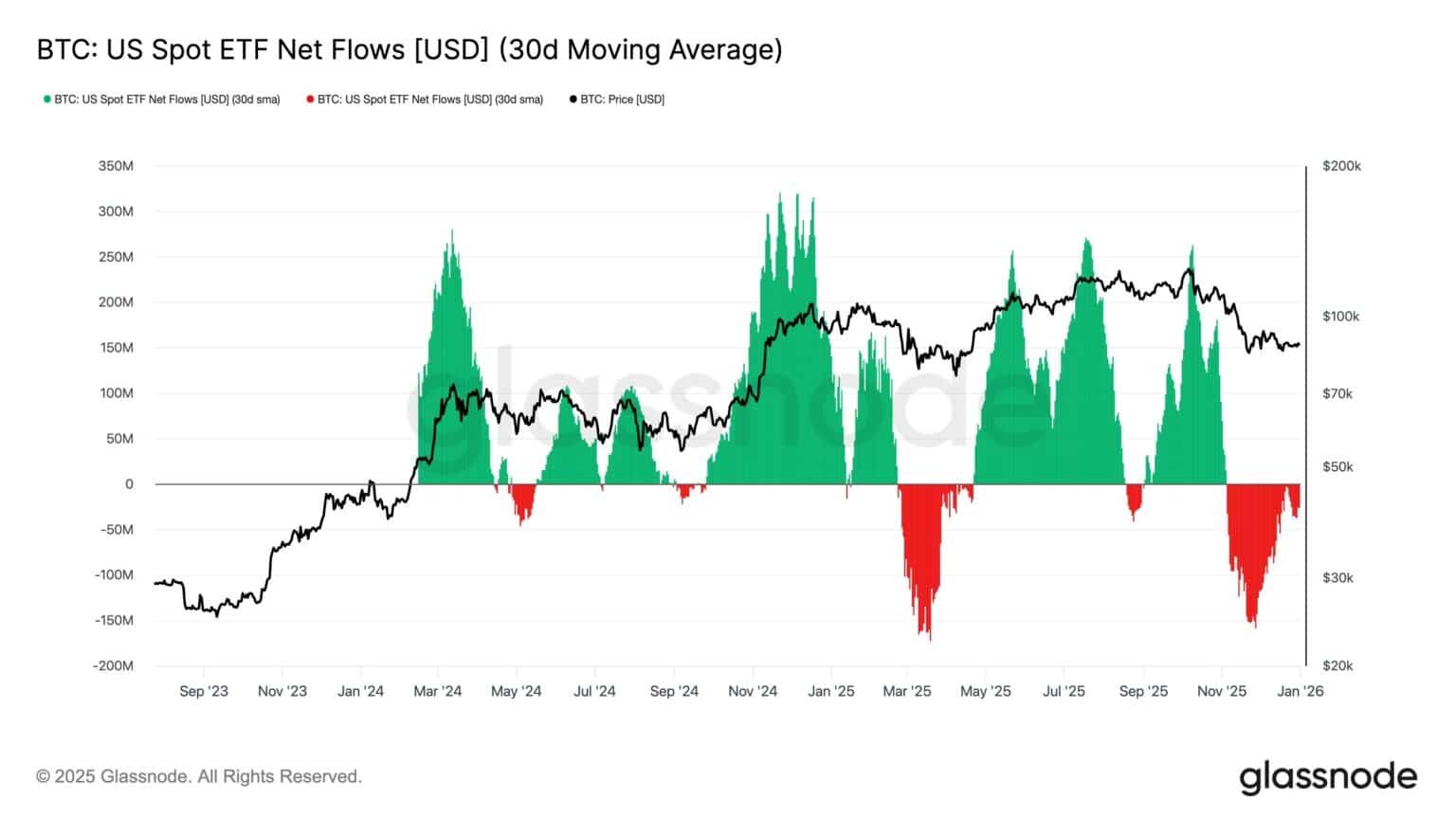

Investors must also consider the altcoin market’s general underperformance in 2025. Except for the June-September window, Bitcoin has been a stronger asset, and ETFs and digital asset treasuries can make it harder for altcoins to seize public imagination than in previous cycles.

Overall, Toncoin does not show significant promise in its price action or on-chain metrics to convince investors to buy the token. It could see a short-term bounce from the $1.70 support to reach the retracement levels at $1.89 and $2.01 though.

Final Thoughts

- TON’s recent momentum driven by Telegram’s move to launch its self-custodial wallet in the US.

- Skybridge Capital’s founder also hyped up the altcoin recently.

Source: https://ambcrypto.com/toncoin-climbs-above-december-resistance-at-1-7-time-to-buy-it-now/