Bitcoin volatility drops to third-lowest level since 2012 amid rise in BTC treasury companies

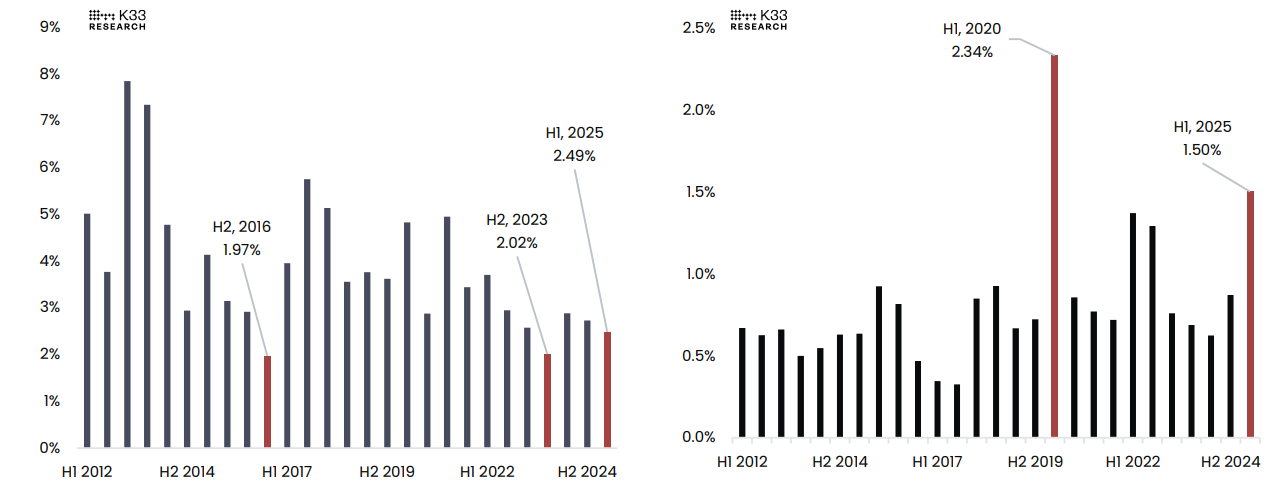

- Bitcoin recorded its third least volatile H1 since 2012 despite a rise in macro tensions, reflecting growing market resilience.

- BTC's trading volumes have remained muted in recent weeks, dropping by 4% last week.

- The slowdown comes amid a rise in Bitcoin treasury companies, with Sequans raising $384 million to establish a BTC reserve.

Bitcoin (BTC) trades above $108,000 on Tuesday following a steady decline in its volatility in the first half of the year, marking the third-lowest H1 volatility since 2012. The decline comes despite increased Bitcoin treasury adoption among publicly traded companies, with NYSE-listed Sequans Communications (SQNS) raising $384 million to fund its Bitcoin treasury.

Bitcoin volatility falls to multi-year lows amid increased treasury holdings

Bitcoin's volatility hit its third-lowest H1 level on record this year, marking one of the calmest periods for the asset since 2012, according to a K33 Research report on Tuesday.

The top crypto's day-to-day volatility has also remained muted since May 22, following a continued decline in implied volatility across the options market. This is more noticeable in the one-month and three-month at-the-money implied volatilities, which have declined to levels last seen in October 2023.

"BTC's general lack of direction continues to enforce a neutral directional bias in options, as skews remain near neutral across tenors," wrote K33's Head of Research, Vetle Lunde.

The top crypto asset's stability during this time highlights a growing resilience amid broader macroeconomic disruptions. It also reflects a growing divergence from US equities, as the S&P 500 recorded its second most volatile H1 over the same period, added Lunde.

BTC vs. S&P 500 180-day volatility. Source: K33 Research

Meanwhile, Bitcoin's trading volumes have seen little momentum, reflecting a slowdown in market activity. Average daily volume last week fell to $2.1 billion, a 4% decline from the previous week. Funding rates have also remained modest on the derivatives market, reflecting a cautious sentiment among investors despite Bitcoin trading near its all-time high, the report states.

The drop in Bitcoin's trading activity comes amid a rise in the number of companies launching a BTC treasury reserve.

Sequans Communications, a Paris-based semiconductor firm backed by the French government, stated on Tuesday that it has raised $384 million through a combination of debt and equity private placements to fund its new Bitcoin treasury initiative. The company plans to collaborate with Bitcoin-focused financial platform Swan Bitcoin to facilitate the initiative.

"We believe bitcoin's unique properties will enhance our financial resilience and create long-term value for our shareholders," said Sequans CEO Georges Karam. "Our intention is to continue acquiring bitcoin in the future, using excess cash generated from our core business operations and additional proceeds."

Sequans joins a growing list of publicly traded firms adopting Bitcoin as their primary treasury reserve asset in a bid to boost shareholders' returns. These companies now hold a combined reserve of 852,309 BTC, according to data from BitcoinTreasuries. Business intelligence software firm Strategy (formerly MicroStrategy), which popularized the BTC treasury playbook, accounts for 70% of that figure.

Bitcoin is changing hands at $108,600 on Tuesday, maintaining a 0.7% gain over the past 24 hours at the time of publication.

You May Also Like

Bitcoin ETFs Outpace Ethereum With $2.9B Weekly Surge

CME Group to launch options on XRP and SOL futures