DFINITY to Publish White Paper on Mission70: Targeting 70% ICP Inflation Reduction in 2026

- DFINITY plans to cut ICP inflation by 70% this year, as shown in its latest Mission70 Whitepaper.

- ICP expands in the blockchain space, focusing on artificial intelligence and enterprise partnerships.

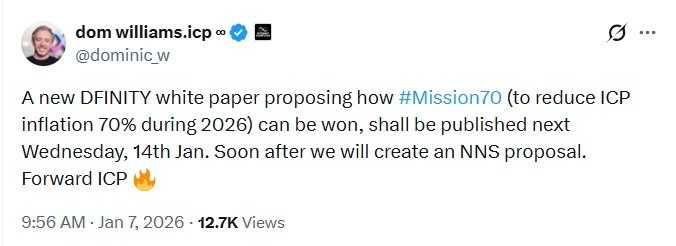

Dominic Williams, founder of Internet Computer Protocol (ICP), shared details about the release of an incoming white paper on Mission70. The DFINITY whitepaper proposes Internet Computer blockchain inflation reduction by 70% in 2026.

Key Objective of DFINITY Mission70

In an X post, Williams noted that the DFINITY whitepaper is scheduled for release on January 14, 2026. This document shows how it will achieve all its goals for the new initiative.

Its key objective is to reduce ICP token inflation by 70% or more this year. Primarily, the ICP inflation comes from newly minted tokens rewarded to node providers and governance participants. Driven by these rewards, current inflation has been reported at around 14% annually in recent data. For a while, community members have expressed concerns about high inflation as it dilutes token value. However, it can be offset by strong on-chain usage.

After releasing the white paper, DFINITY plans to submit a formal proposal to the Network Nervous System (NNS). It is described as an on-chain governance system, allowing ICP stakers to vote for or against changes. If passed, it would implement the inflation-reduction changes directly on the protocol.

The Mission70 Showcase | Source: Dominic Williams

The Mission70 Showcase | Source: Dominic Williams

The post from Dominic Williams quickly gained support from some community members. Some said it signals confidence that Mission70 will strengthen the tokenomics and drive adoption of ICP. Others noted that Mission70 is what ICP needs to shift into deflationary territory and fuel real growth in 2026.

ICP Developing as a Top Public Blockchain

In addition to the proposed DFINITY whitepaper, Dominic Williams earlier discussed his 2026 roadmap. As detailed in our last news piece, Williams said ICP will focus on adoption and accessibility. He added that ICP has moved beyond theory into real-world execution.

According to the founder, the AI-led development is now directly embedded into the protocol, rather than as an add-on. Furthermore, Internet Computer Protocol is preparing towards self-writing applications and the development of Web3-native no-code tooling. Other key priorities include the rollout of “mass-market cloud engines,” as explained by Williams.

Meanwhile, blockchain analytics platform Santiment recently highlighted ICP as one of the best crypto projects in the AI and Big Data development space. In a previous article, we discussed that the ICP December updates focused on enterprise partnerships with Microsoft Azure, Google Cloud, Facebook, and Instagram.

Currently, the ICP token is trading at $3.3, demonstrating a 2.8% decrease over the previous day. Despite the decline, investors are still bullish about long-term price growth. With its massive price drop, there is an expectation for the coin to test the $7.4 mark, as noted in our earlier post. This is possible, seeing how most altcoins are in a recovery mode.

]]>You May Also Like

Real Estate Tokenization: Why Legal Architecture Matters More Than Technology

Fed Makes First Rate Cut of the Year, Lowers Rates by 25 Bps