Crypto Market Sees Sharp Price Drop After Shifting Investor Signals

This article was first published on The Bit Journal.

The crypto market faced fresh turbulence this week, surprising traders who expected January’s recovery to continue. Confidence faded quickly after a strong start to the month, raising new questions about how digital assets might react to shifting economic signals.

According to early estimates from an industry data platform, United States Bitcoin Spot ETFs saw heavy outflows over two sessions. More than $700 million in withdrawals erased earlier inflows that had lifted Bitcoin above $94,000. That sudden pullback triggered a steep price drop, and the shift spread across the broader crypto market.

ETF Outflows Spark Rapid Reversal Across Major Coins

Investors watched ETF trends closely because those products shaped the recent recovery. One market commentary, linked through an analytical dashboard, explained that institutions slowed accumulation after a week of intense activity. The explanation aligned with Bitcoin’s slide to 90,000 dollars, confirmed on a public price tracker available through a verified market tool.

A second linked research source highlighted how ETF outflows often trigger a chain reaction during sensitive macro moments. This pattern made the price drop feel sharper and more sudden.

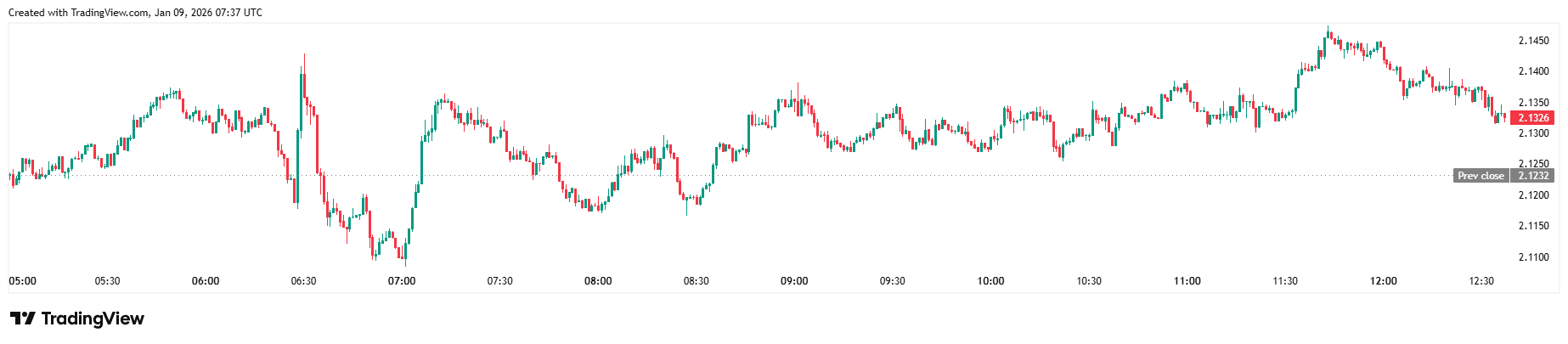

Ethereum and XRP mimicked the weakness. Ethereum fell from 3,300 to just below $3,000. XRP dropped from $2.40 to about $2.00. Both looked equally sorry in afterthought, but XRP 50-day moving average and often acts as a cushion during volatile times. For analysts this area could invite buyers if the broader sentiment improves.

Source: Tradingview

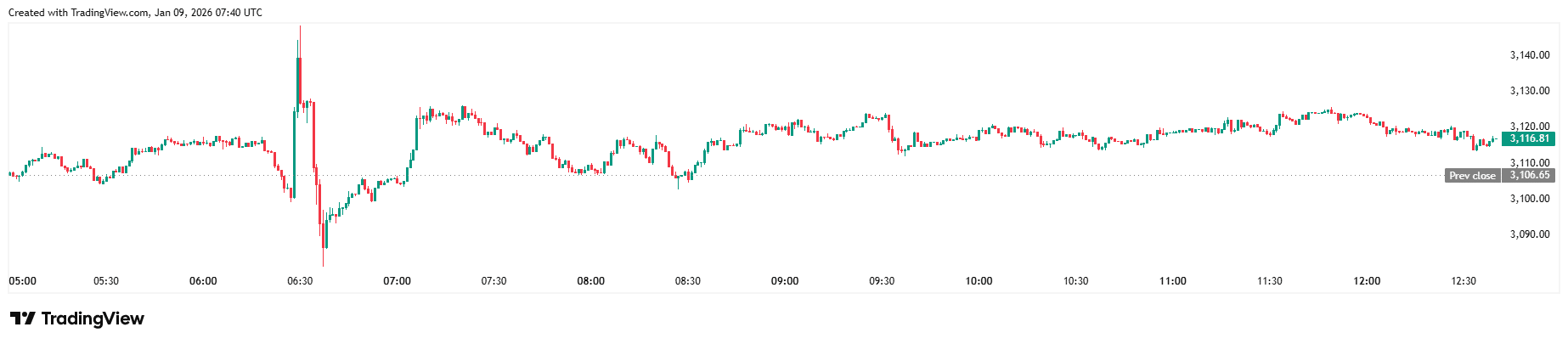

Source: Tradingview

Rate Pause Expectations Add Pressure to Fragile Sentiment

The crypto market also reacted to rising expectations that the Federal Reserve may pause rate cuts at the upcoming meeting. A public macro probability tool showed odds climbing above 86 percent. This shift prompted caution among investors and deepened the recent price drop.

Such rate expectations matter because they influence liquidity. When borrowing stays expensive, appetite for risk assets weakens. Traders then avoid placing large bets, especially when major economic reports approach.

The Jobs Report and new inflation figures arriving this month added another layer of uncertainty. Students, financial analysts, and developers followed these updates because they often set short-term direction for Bitcoin, Ethereum, and other large-cap tokens. Market watchers said the crypto market could remain sensitive until those numbers clear.

Technical Patterns and Support Zones Shape Market Anxiety

Ethereum continued to trade inside a large triangle formation that began late last year. A break above the upper trend line could open a path toward 3,600 dollars. A price drop below 2,900 dollars may weaken support and trigger more selling.

Source: Tradingview

Source: Tradingview

XRP traders focused on the 2-dollar level. A published analysis suggested that whale accumulation earlier in the year remained strong. Large holders often react faster than retail buyers, which can soften the impact of a price drop when the crypto market cools.

Bitcoin also hovered around its short-term support range. Analysts believed that holding this area may prevent deeper losses. If buyers return after ETF behavior stabilizes, the crypto market could rebuild momentum heading into February.

Conclusion

The crypto market showed once again how quickly sentiment can change when ETF flows, macro expectations, and technical signals collide. Heavy withdrawals led to a sharp price drop, but several assets still held key support zones.

As economic data arrives and rate expectations settle, traders may find clearer direction. The next phase could shape how the crypto market performs through the rest of the month.

Glossary of Key Terms

Support Level: A price area where buying interest often increases.

Outflow: Movement of funds out of an investment product.

Volatility: Large swings in asset prices within short periods.

Liquidity: Ease of buying or selling an asset without significant price changes.

FAQs About Crypto Market

Why did Bitcoin fall this week?

ETF outflows and rate concerns triggered a sharp price drop.

Did Ethereum mirror Bitcoin’s movement?

Yes. Ethereum reacted to ETF weakness and macro uncertainty.

Why does the Fed outlook matter?

Rate decisions affect liquidity, which shapes the crypto market.

Can XRP bounce back?

The 2-dollar support zone may attract buyers if conditions improve.

References

Coinmarketcap

Tradingview

Read More: Crypto Market Sees Sharp Price Drop After Shifting Investor Signals">Crypto Market Sees Sharp Price Drop After Shifting Investor Signals

You May Also Like

Nasdaq and CME Launch New Nasdaq-CME Crypto Index—A Game-Changer in Digital Assets

USDC Treasury mints 250 million new USDC on Solana