Onyxcoin Price Prediction: 290 Million Whale Buying Gives Critical Hint

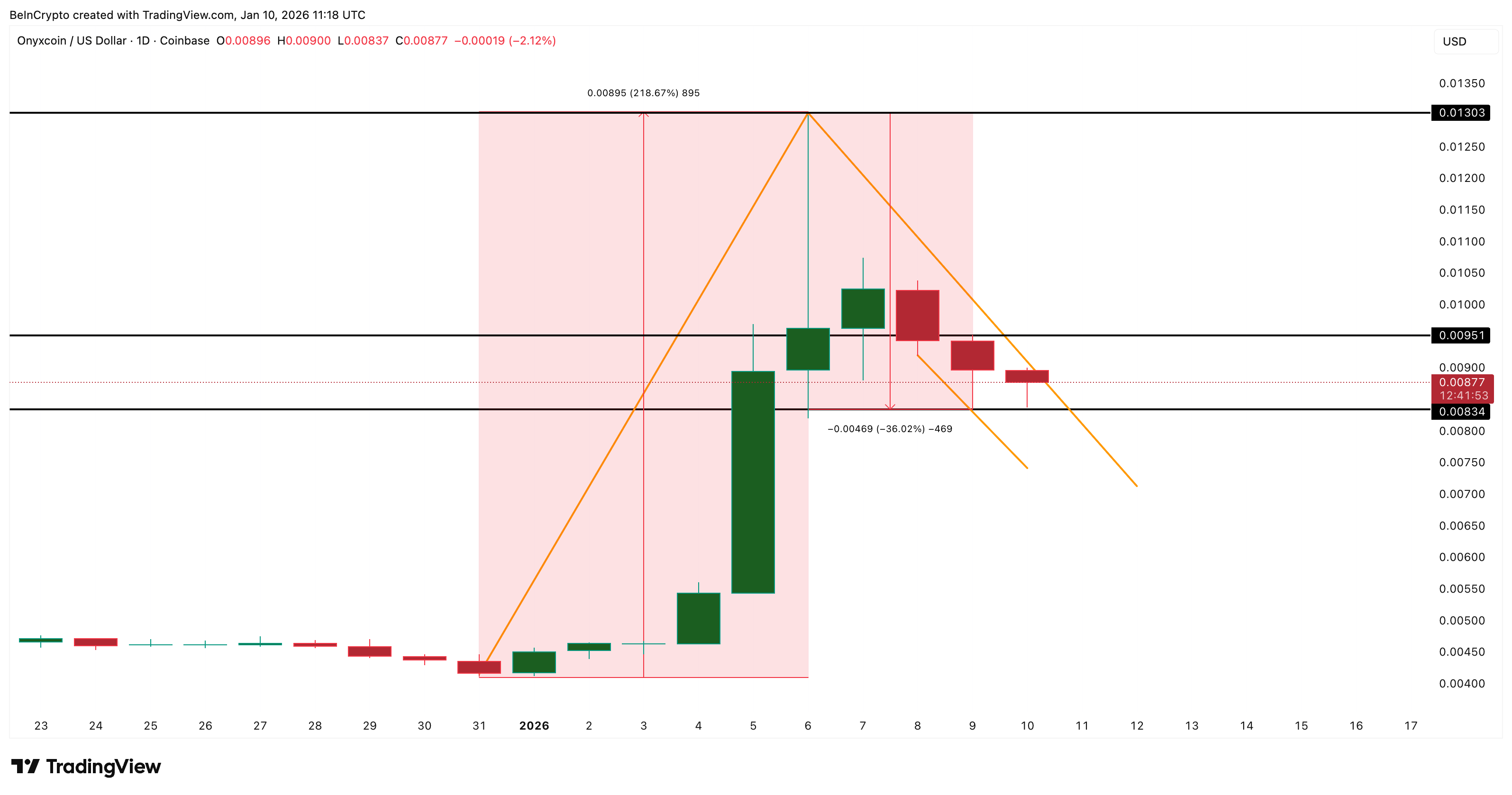

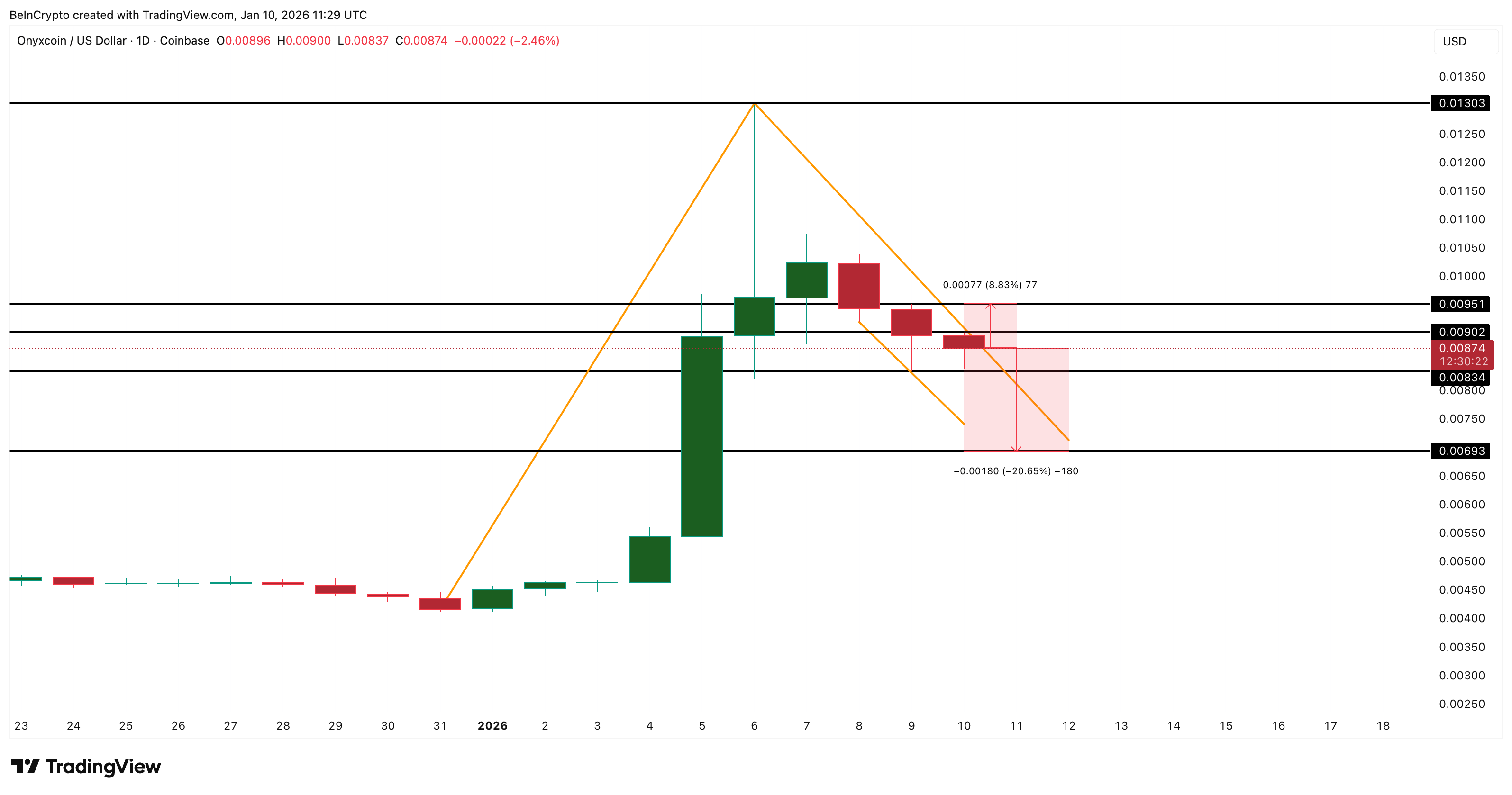

Onyxcoin price remains one of the strongest movers this month, but recent action tells a more nuanced story. XCN is still up nearly 97% over the past seven days, yet that headline gain hides a sharp shakeout. Since January 6, the token has corrected by roughly 36%, after briefly touching $0.0130.

That pullback has not broken the structure. Instead, the XCN price is now consolidating within a bullish flag after rebounding over 4% day-on-day, while large holders step in and selling pressure fades. The key question is whether XCN will be able to initiate the explosive breakout it has been seeking for a while now.

Bullish Flag Holds as Key Signs Emerge

On the daily chart, Onyxcoin is consolidating inside a classic bull flag pattern. A bull flag forms after a strong vertical move, followed by a downward-sloping range that allows price to cool without breaking the broader trend. XCN is currently trading close to the upper boundary of this flag, suggesting pressure is building.

A breakout above the key resistance at $0.0095 could kickstart the 218% breakout path, the pole’s measured move.

XCN Breakout Structure: TradingView

XCN Breakout Structure: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Moving averages add context. An Exponential Moving Average, or EMA, gives more weight to recent prices and helps track short-term trend shifts. Onyxcoin’s 20-day EMA is now rising toward the 100-day EMA, signaling a potential bullish crossover if momentum holds.

EMA Support: TradingView

EMA Support: TradingView

The 200-day EMA is especially important here. During the previous rally that began at the end of December, XCN accelerated once the price reclaimed this long-term trend line. Price is again hovering near that same level. A clean move above the 200-day EMA would strengthen the flag breakout case and confirm that buyers remain in control.

So far, the price has not broken the bullish pattern despite the 36% dip that started on January 6. This appears to be a consolidation, not a rejection.

Whale Accumulation Grows as Selling Pressure Fades

On-chain data supports the bullish setup.

Following the XCN price correction on January 6, whales began accumulating. Wallets holding large Onyxcoin balances increased their combined holdings from roughly 42.26 billion XCN to about 42.55 billion XCN. That is an addition of nearly 290 million XCN tokens during consolidation.

Onyxcoin Whales Buying The Dip: Santiment

Onyxcoin Whales Buying The Dip: Santiment

At current prices, that accumulation represents roughly $2.6 million in buying pressure. More importantly, it started right as price pulled back, suggesting whales were buying the dip rather than exiting strength.

Exchange data supports this view. Exchange inflows, which track the number of tokens sent to exchanges and often signal selling intent, peaked on January 6. That spike aligned with the price drop. Since then, exchange inflows have collapsed from around 1.53 billion XCN to roughly 51 million XCN, a near 97% dip.

XCN Inflows Slow Down: Santiment

XCN Inflows Slow Down: Santiment

This sharp decline signals that selling pressure has dried up. Fewer coins are moving to exchanges, and more supply is staying off-market. Combined with whale accumulation, this creates a supply-tight environment that favors continuation rather than breakdown.

Key Onyxcoin Price Levels That Decide the Breakout

The first Onyxcoin price level to watch is $0.0090, which aligns closely with the 200-day EMA. Holding above this level keeps the bullish structure intact and increases breakout odds.

The real trigger zone sits near $0.0095. A daily close above this level would confirm a breakout from the upper flag trend line. If that happens, the price could retest $0.0130, the recent local high and first major resistance.

On the downside, $0.0083 is the key support. Losing this level would weaken the flag structure and suggest that consolidation is failing. Below that, $0.0069 becomes critical. A sustained move under this zone would invalidate the bullish setup entirely.

Onyxcoin Price Analysis: TradingView

Onyxcoin Price Analysis: TradingView

For now, the Onyxcoin remains in balance. The XCN price is consolidating, whales are accumulating, and selling pressure has cooled sharply. Whether this turns into an explosive breakout depends on how the Onyxcoin price reacts around the flag resistance and long-term moving averages.

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

XRP Holds $1.88 Fibonacci Support as 3-Day Chart Signals Bullish Continuation

Russians ask government hotlines whether pensions are paid in crypto

Crypto-related questions about pension payments are reaching Russia’s Social