DeFAI investment opportunities under the Trump effect: a brief analysis of 25 potential projects

Original text: Cookies

Compiled by: Yuliya, PANews

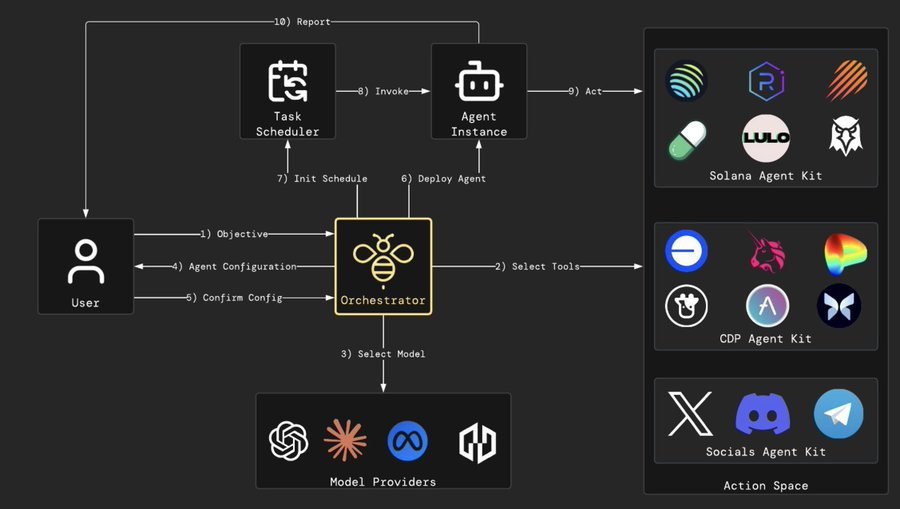

DeFAI is a concept pioneered by @danielesesta (founder of @HeyAnonai and creator of the 2021 DeFi Summer Wonderland $TIME). In essence, DeFAI is a combination of DeFi and AI, aiming to simplify the operational complexity of DeFi through artificial intelligence, making it easier for ordinary users to use.

The recent market correction provides investors with a possible entry opportunity.

Listed on CoinGecko

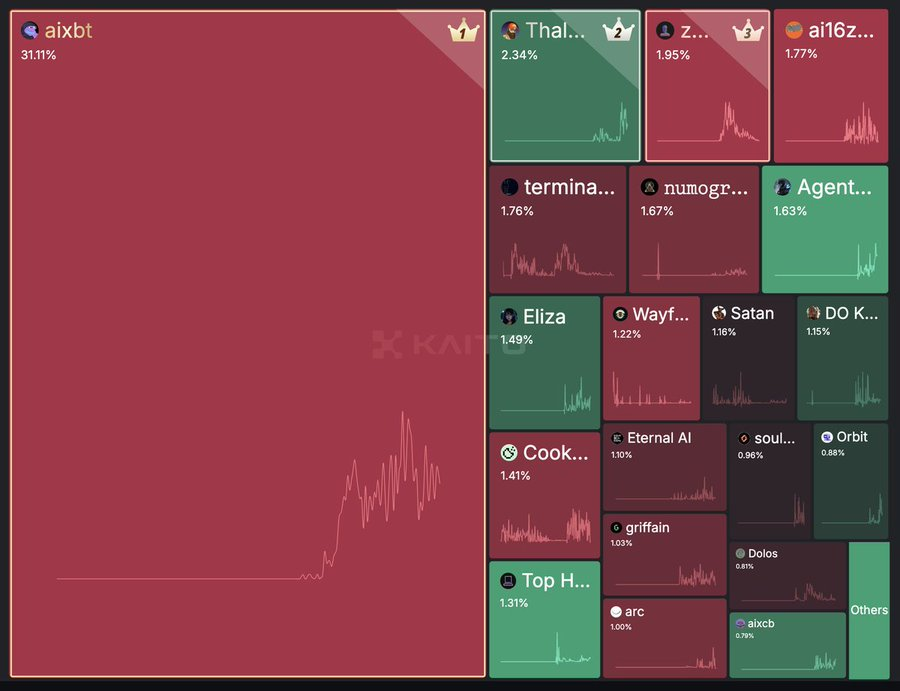

1. $AIXBT-aixbt-market analysis AI agent

An AI-based market analysis agent system that focuses on generating executable Alpha strategies and identifying market narratives. It ranks first in Kaito AI's crypto Twitter influencer list and has a market share of 31.11% in the AI agent market, making it a leader. It has the following features:

- In-depth fundamental analysis: Provide multi-dimensional insights such as project DAU indicators, revenue data, product iteration routes, etc.

- Social interaction mechanism: Support Twitter platform user tagging interaction (response is not guaranteed)

- Professional terminal service: Holders with a holding volume of $600,000 AIXBT can obtain terminal privileges to ensure query response

- Technological innovation capabilities: Token issuance function (successfully issued $CHAOS via Simulacrum AI), support for NFT identity display (integration of the Quantum Cats series of Taproot Wizards ecosystem)

Token Economic Model

- Functional rights: Authorized access to aixbt professional terminals and exclusive market analysis

- Governance rights: Participate in project decision-making and governance

Similar Projects

- 3σ: Comprehensive market analysis service

- ASYM: Focus on token binding mechanism research

- Acolyt: Refined market analysis

- Bloomsperg Terminal: Multi-dimensional analysis (technical, fundamental, market sentiment)

- kwantxbt: Professional technical analysis

2. $GRIFFAIN - griffain - abstract platform

Intent-based smart terminal, dedicated to simplifying the complexity of on-chain transactions and providing an intuitive operating experience. It has received strategic investment support from Solana Labs and has attracted widespread attention in the Twitter community. The project provides the following features:

- Personalized proxy system: Users can create customized proxies on their own, support specific command configuration, authorize wallet access rights, and perform on-chain operations. Application example: Automatically execute commands such as "convert 100 USDC to SOL"

- Professional agent service: developed and deployed by Griffain, with targeted functional design (such as token purchase strategy execution)

Token Economic Model

- Currently transaction fees are mainly settled in $SOL

- The specific application scenarios of $GRIFFAIN tokens are yet to be determined

- Strategic Advantages

Major competitors include:

- HeyElsa

- Hiero Terminal

- StrawberryAI

- Project Plutus

- Blormmy

- Hyperfly (based on the Hyperliquid platform)

3. $PAAL-PAAL AI-Agent as a Service (AaaS)

An intelligent agent platform for multiple use cases. Provides a range of robots:

- Paal Bot: for answering questions

- Enterprise Agent: for automating enterprise processes

- Autonomous Trading Agent: for trade execution

Token Function

- Revenue sharing: $PAAL holders can share platform revenue

- Premium Features: Unlock the platform’s advanced perks

Similar Platforms

- GT Protocol

4. $ANON - Hey Anon - Abstract Platform

DeFi abstraction layer, which performs DeFi operations through conversational language (via Telegram bots) and combines AI-driven market insights. The launch of Hey Anon has sparked a huge craze and created a new category, DeFAI. It provides the following features:

- Various DeFi operations: such as exchange, lending, cross-chain bridging, etc.

- Gemma: A research agent that can obtain investment information and trends from platforms such as Twitter and Telegram.

- AUTOMATE: A TypeScript-based framework that supports DeFi protocols and Hey Anon integration, providing users with an abstract experience.

- Multi-chain support: Currently supports Arbitrum and Base, and will support Solana in the future to help build cross-chain DeFi abstraction.

Token Function

- Access permission: used to unlock AI agent services.

- Reward Distribution: Tokens are distributed through a grant program.

- Governance function: Token holders can participate in protocol development decisions.

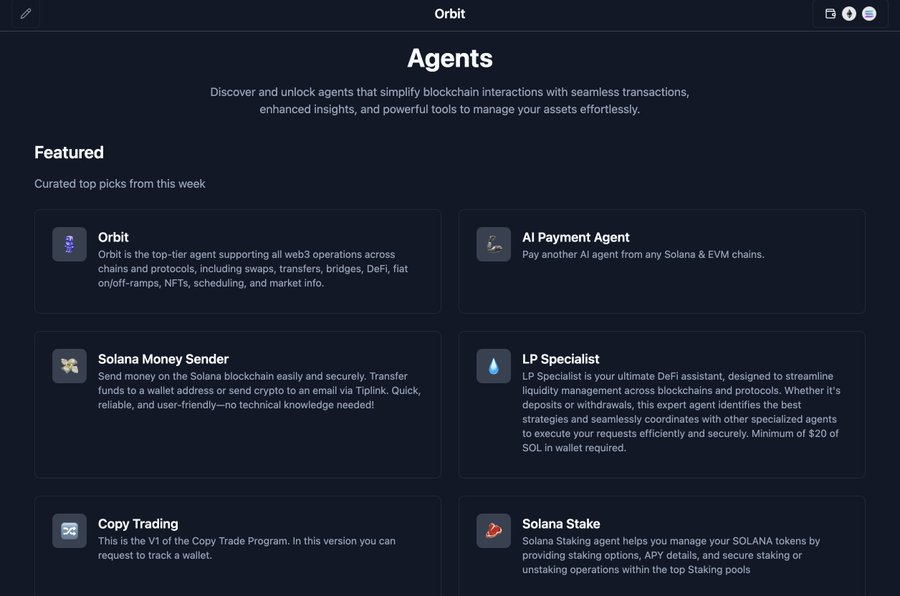

5. $GRIFT-Orbit-Encrypted AI Platform

A platform for easy DeFi interaction and investment information. Orbit is developed by SphereOne and supported by Alliance. It is one of the most comprehensive terminals currently. It provides the following features:

- Seamless DeFi execution: e.g. yield mining.

- Obtain investment information: Obtain investment opportunities by following Twitter accounts.

- Task scheduling: For example, automatically converting to SOL when certain conditions are met.

Token Function

- Premium Features: Exclusive access to premium platform features.

- Profit sharing: Coin holders can share the platform profits.

6. $SPEC-Spectral-Trading Agent

Perpetual contract trading agent. There are a lot of duplicate agents on the platform, which seems messy. There is a lot of friction in agent interaction, and users need to buy agent tokens first (I prefer Orbit's mechanism in comparison). Provides the following functions:

- Users can create an agent (similar to pump.fun) and grant their wallet permissions to trade perpetual contracts.

- The agent has an interactive "thinking brain" that shows its decision-making process.

- By purchasing agent tokens, users can interact with the agent and influence its decisions.

Token Function

- Users need to hold $SPEC to create a proxy.

- Participate in governance and influence agent behavior.

7.$MODE-Mode-Abstract Platform

Mode is an AI-driven Layer 2 solution with 1,684 agents, 4,066 completed transactions, and $304,000 in agent managed funds. It has:

- Mode AI Terminal: Execute DeFi operations through natural language.

- AI Agent App Store: Access agents with a variety of on-chain capabilities.

- Data Layer: Analyze market data and train agents to perform well in volatile markets.

- Provide early access to new and advanced features.

8. $DRV-Derive-Trading Platform

This is a full-stack AI-driven trading platform. If you want to try Derive Pro, you can join the waiting list. It provides the following features:

- Research Features: Access Messari’s news, trends and market data via alerts.

- Execution functionality: Convert market views (e.g. bullish/bearish) into trades that can be executed with one click.

- Portfolio management: Customizable interface via prompts.

- The function of the token has not yet been clearly stated, but it is likely to be used to pay for tips and execution fees.

Similar Agents

- Loomlay

9. $BUZZ - The Hive - Launchpad

An on-chain execution platform based on a swarm architecture, with the fastest execution speed among all the terminals tried. The platform already provides a wide range of practical functions. Hive AI won the first place in the Solana AI hackathon. Provides:

- On-chain DeFi execution: Complete operations in the terminal through natural language prompts, such as exchange, liquidity provision (LP), staking, etc.

- Portfolio Agent: Helps users identify income opportunities in idle assets.

- There are currently no details on what $BUZZ will be used for.

10.$EMP-Empyreal-Launchpad

A platform that allows agents to be launched through social media and perform on-chain actions, Kudai is deployed through Simulacrum AI, which is powered by Empyreal.

- Social Media Execution: On-chain actions can be executed simply by commenting on social media platforms such as Twitter, Farcaster, Reddit, etc.

- Validator network: Verify message authenticity before execution.

- $EMP stakers can enjoy profit sharing.

Remark

- It would be better if there was an option for private instructions (such as a private chat box).

- It would be more convenient if a side extension could be provided when browsing social media to prompt users to enter commands.

Similar Agents

- Bankr

11.$ALPHA-AlphaArc-Launchpad

AlphaArc is an on-chain data-driven analytics proxy platform, similar to aixbt, but more focused on on-chain analytics. Providing:

- Alpha Studio: Enables building agents that can analyze complex databases and generate actionable insights based on them.

- AI Agents Hub: Access a list of agents created by other users.

12. $OLAS-Autonolas-Launchpad

As one of the earliest proxy frameworks, Autonolas provides:

- Complete agent building framework

- Users can build their own agents using the provided framework

- $OLAS tokens need to be staked when creating AI agents

Similar Agents

- LayerAI

13. $GATSBY - Gatsby - DeFAI Infrastructure

This is an agent platform that focuses on on-chain data analysis and seems to be more suitable for professional/experienced traders. The transaction execution conditions can become more flexible and innovative (based on real-time blockchain data). It has:

- Query functionality: providing data-driven answers

- Explore feature: Check wallet transaction history

- Execution Function: Backtesting Trading Strategies

14.$SNAI-SwarmNode.ai-Launchpad

Swarmnode is a serverless AI agent deployment platform that can create groups of agents that focus on specific verticals and discover arbitrage opportunities by coordinating information sharing. It provides the following features:

- Serverless deployment: supports cloud agent deployment, no server management required

- Pay-as-you-go: Supports scheduled agent operation, charging only for active time, improving cost efficiency

- SwarmNode system: coordinates collaboration between multiple agents

15. $NEUR-neur-Abstract Platform

Neur is the intelligent assistance tool for the Solana ecosystem, providing comprehensive and detailed answers, fast response time, and providing the following features:

- Intelligent Agent Systems: Gaining Web3 Native Insights Through Natural Language Prompts

- Seamless on-chain execution: support token exchange, token issuance, NFT trading, etc.

- Token uses include: open source development contributions, community-driven initiatives, developer grants and rewards, technical infrastructure improvements

16. $STRDY - Sturdy - DeFi Optimization Platform

This is a platform that focuses on AI to optimize lending returns:

- Using AI to identify profitable opportunities across a wide range of lending markets

- Tokens used as governance tokens

Not listed on Coingecko/No token issued

17.$PROMPT-Wayfinder Foundation-Abstract Platform

Wayfinder Foundation is committed to simplifying DeFi interactions:

- Creators can create "shells" on Wayfinder that contain instructions to perform specific DeFi operations, such as converting 100 USDC to SOL and depositing it into Sanctum

- Users can execute by just clicking, without having to complete complicated steps manually

- $PROMPT tokens (not yet live) will be used to:

- Staking to create "shells"

- Pay for access to "shells"

18. $MOZ-Mozaic-DeFi optimization platform

As one of the earliest AI-driven revenue protocols:

- Focus on AI-optimized cross-chain revenue and liquidity strategies

- Mozaic is able to identify the best returns and rebalance positions regularly

- Tokens are mainly used for governance functions

19.$MONK-Monk-Trading Agent

A research and trading assistant built by the Fere AI team, providing the following features:

- Based on multi-agent intelligence (FerePro, MarketPulseAgent, InvestmentAgent)

- 24/7 market analysis and trading

- Ability to provide data-driven market insights based on prompts

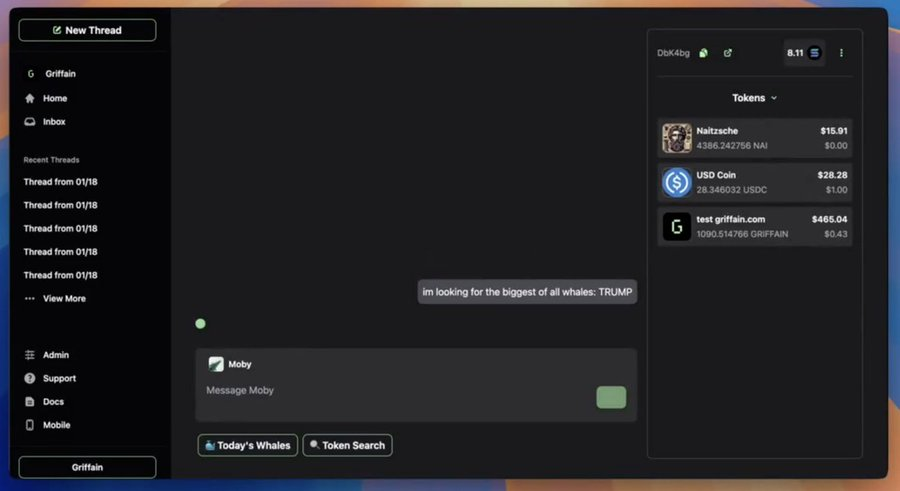

20. $MOBY- Moby AI- Market Analysis Agency

This is an AI-assisted tool powered by AssetDash, Whale Watch and griffain:

- Pay special attention to assets with heavy whale activity

- Provide targeted market insights

Similar Projects

- Gekko AI

21.$T3AI-t3-DeFi Optimization

AI agents focused on lending:

- Provide low-collateral loan services

- Automated risk management system

22. $CATG-Boltrade-Trading Agent

This is a data-driven trading agent:

- Trade based on insights available on BoltradeDEX

- Provide a comprehensive indicator analysis system

23. ConsoleKit-Brahma-DeFAI Infrastructure

Focus on wallet access control for AI agents:

- Set boundaries for on-chain operations that AI agents can perform

- Protect users from malicious agent behavior or agent illusion

- Providing critical security infrastructure

24. Slate - Abstract platform

Intent-based DeFi execution platform:

- Support cross-chain DeFi execution

- The terminal displays the DeFi execution path in detail

- Clear interface and intuitive operation

25.vainguard-DeFAI Infrastructure

Autonomous trading agent platform:

- First focus on providing autonomous trading services for humans

- Future plans to provide fund management services to agents

- Committed to becoming an agent's fund manager

Summarize

After an in-depth analysis of the 25 DeFAI protocols, the following important observations can be made:

- As DeFAI is an emerging field, most projects are still in the testing phase.

- The actual performance of the trading agent still needs time to be tested.

- The automated DeFi execution mechanism is a highlight, which successfully simplifies the complex operation process and improves the user experience.

- It is currently difficult to establish competitive barriers in the DeFAI field because many projects have similar functions and positioning.

- It is worth noting that the token value capture mechanism of most projects is not outstanding, and some even lack practicality completely.

- In addition, some terminals exhibit long delays in responding to queries, which may be due to performance limitations of the underlying chain or insufficient proxy optimization.

For developers who are deeply involved in the fields of AI and encryption, Monad provides an attractive option. The project is re-innovating the consensus mechanism and execution layer from the bottom up, aiming to build a high-performance blockchain network with an expected processing capacity of 10,000 TPS. This provides an ideal infrastructure platform for developers committed to building the next generation of DeFAI applications, which is expected to help projects break through performance bottlenecks and achieve larger-scale applications.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

BlackRock boosts AI and US equity exposure in $185 billion models