Wintermute suspected as a market maker for Pump.fun’s PUMP token

Wintermute may be one of the market makers behind Pump.fun’s PUMP token, with on-chain data showing test transfers ahead of its expected launch on open markets.

Wintermute, one of the most active market makers in the crypto space, appears to be involved in supporting the expected open-makret launch of PUMP token by the Solana (SOL) memecoin launchpad Pump.fun.

According to on-chain investigator @ai_9684tpa, a test transaction of 10 PUMP tokens was sent to a wallet linked to Wintermute, suggesting the firm may be providing liquidity or preparing for larger market-making operations. More token transfers tied to market makers are expected in the coming days.

According to ai_9684tpa’s analysis, the 48-hour period following the public sale will begin at 10 p.m. tonight, marking the likely timeframe for the project’s TGE, which is expected to occur sometime between 10 p.m. tonight and 10 p.m. tomorrow.

PUMP token launch has already drawn widespread attention after its public sale raised $500 million in just 12 minutes on July 12. The sale, hosted on major exchanges, offered 125 billion tokens at a fixed price of $0.004 each. This priced the token at an FDV of $4 billion.

All purchased tokens remain frozen and are expected to be distributed and unlocked between July 14 and 15, marking the 48- to 72-hour post-sale window.

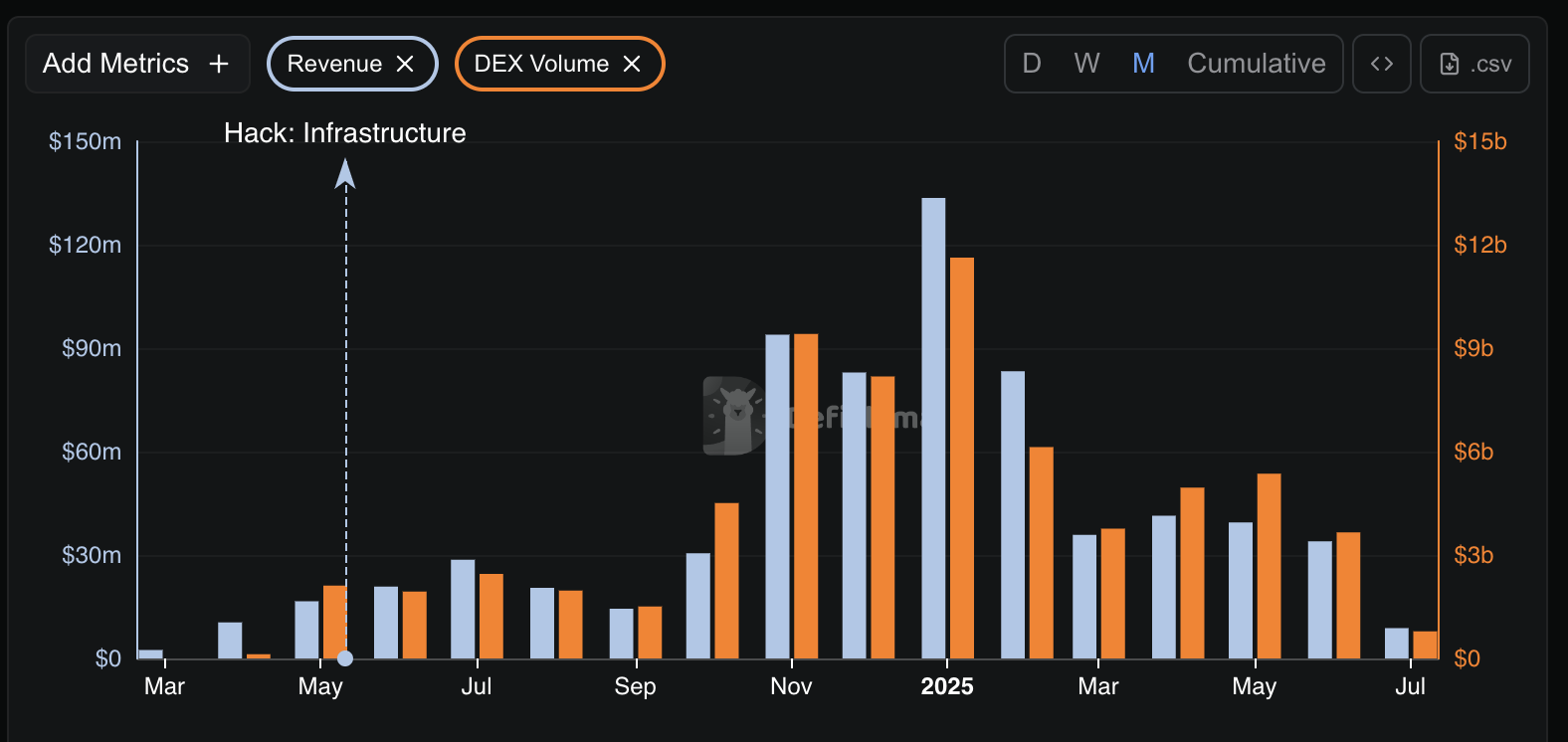

Despite the record-setting raise, the token launch comes amid waning activity on Pump.fun’s original launchpad. According to DeFiLlama, the platform’s monthly volume has fallen sharply from a high of $11.6 billion in January to just $3.66 billion in June. Launchpad-generated revenue followed a similar trajectory, dropping from $133 million to $34 million over the same period.

While some in the crypto space have hailed PUMP as a major comeback for ICOs and memecoins, others have drawn comparisons to earlier boom-and-bust cycles, pointing to the delayed token unlock and sudden sellout as signs of manufactured scarcity.

Critics argue that the 48–72 hour freeze on token transfers, combined with limited public access and heavy insider allocations, creates an uneven playing field that favors automated trading firms and early backers. In that light, the launch feels less like grassroots token distribution and more like a tightly controlled liquidity event dressed in memecoin branding.

You May Also Like

Bitcoin ETFs Outpace Ethereum With $2.9B Weekly Surge

CME Group to launch options on XRP and SOL futures