Portugal Orders Polymarket Shutdown, but Platform Remains Active

Portugal’s gambling regulator reportedly ordered Polymarket to shut down operations in the country, though no official enforcement document has been published and the platform remains fully accessible to Portuguese users.

Polymarket allows users to bet on real-world events using cryptocurrency.

The Serviço de Regulação e Inspeção de Jogos gave the prediction market 48 hours to cease operations on January 17, according to Portuguese broadcaster Renascença, which obtained direct statements from the regulator.

The deadline expired on January 19, but the site continues to operate without location-based blocks in Portugal.

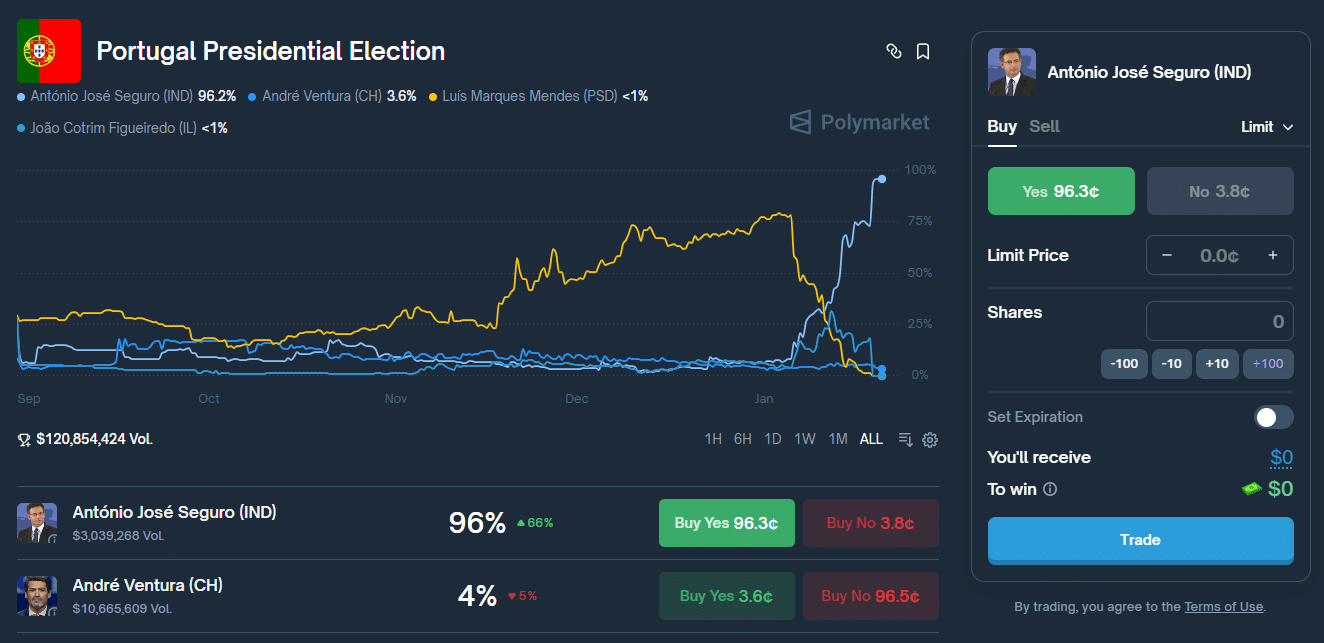

Polymarket’s Portugal Presidential Election market showed over $120 million in trading volume, with António José Seguro at 96% probability as of January 20, 2026. | Source: Polymarket

SRIJ confirmed to the Portuguese broadcaster that Polymarket has no authorization to offer betting services in the country.

The regulator stated it learned about the platform “very recently” and considers its activity illegal under national law.

SRIJ indicated it would proceed with requesting internet service provider blocks, though no such instructions have been issued as of January 20.

Legal Framework Excludes Political Betting

Portugal’s Decreto-Lei n.º 66/2015 lists only permitted gambling activities, which include sports betting and casino games.

Political prediction markets do not appear in any authorized category.

Filipe Mayer, a gambling law expert at CCA Law Firm, told Renascença that political betting falls outside what the law allows.

Portugal’s presidential election markets generated more than $120 million in trading volume on the platform.

Activity jumped sharply in the hours before official results were announced on January 18, with more than €5 million traded during a two-hour window.

Global Regulatory Pattern Continues

The Portuguese action follows similar enforcement efforts in other countries, including France, where authorities investigated a trader who wagered millions on the 2024 US presidential election.

Polymarket now faces restrictions in over 30 countries, including Singapore, Belgium, and Ukraine.

Some jurisdictions have blocked the platform entirely, while others allow users to view markets without placing bets.

The enforcement gap contrasts with Polymarket’s recent US expansion. The platform received CFTC approval from the Commodity Futures Trading Commission in November 2025 to operate as a regulated exchange under federal supervision.

The $9 billion platform also struck a deal with Dow Jones to distribute prediction data to outlets including The Wall Street Journal.

Polymarket has not issued any public statement regarding the Portuguese action.

nextThe post Portugal Orders Polymarket Shutdown, but Platform Remains Active appeared first on Coinspeaker.

You May Also Like

Tropical Storm Basyang expected to drench Caraga, Northern Mindanao

Hoskinson to Attend Senate Roundtable on Crypto Regulation