Bitcoin Sell-Off Risk Rises as New Whales Dominate Price Action

Bitcoin faced renewed selling pressure after briefly slipping below 90,000, as on-chain metrics highlight a shift in who controls realized value in the market. Fresh whale cohorts with younger coins now appear to hold a larger share of Bitcoin’s realized capitalization than the traditional long-term holders, while persistent large-inflow activity from big traders signals ongoing distribution near key resistance bands. The combination suggests a cautious near-term outlook for the leading cryptocurrency.

Key takeaways:

-

New BTC whales with holdings formed by UTXOs younger than 155 days now account for a larger share of realized cap than OG long-term holders.

-

Whale-dominated exchange inflows imply elevated sell-side pressure for Bitcoin as it tests the 95,000 to 90,000 area.

-

Bearish order-book data points to a potential pullback toward the 85,000 level.

-

If price fails to reclaim the 95,000–98,000 zone, distribution could extend the move toward 85,000–80,000.

New Bitcoin whales take the wheel, for now

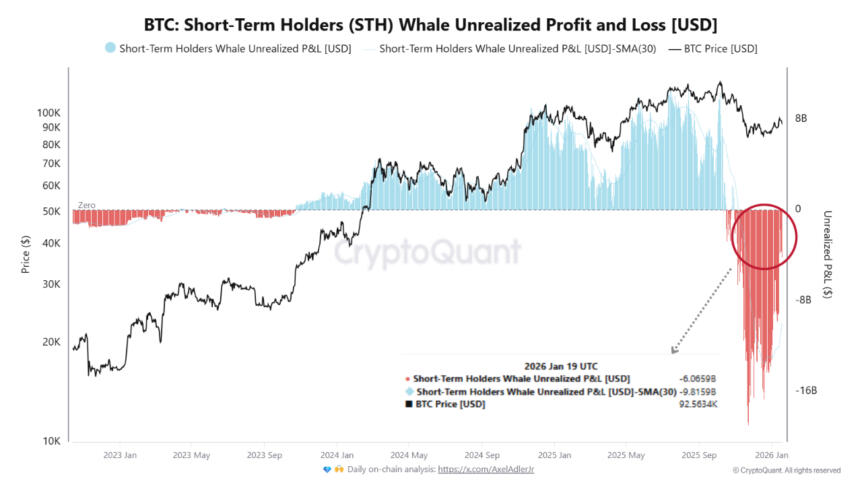

CryptoQuant analyst Moreno DV noted that new whales — defined as holders of over 1,000 BTC whose last movement involved coins aged less than 155 days — now command a larger slice of Bitcoin’s realized capitalization than the traditional long-term holders. This shift suggests that the near-term price action is increasingly driven by younger, more liquid supply rather than entrenched conviction.

Bitcoin realized cap of New and Old Whales. Source: CryptoQuantRealized cap reflects the aggregate cost basis of coins based on their last on-chain movement, indicating that a significant portion of the supply has changed hands at higher prices. The realized price for this cohort sits near 98,000, and with Bitcoin trading below that level, new whales currently carry about 6 billion in unrealized losses. Long-term holders, with a realized price near 40,000, remain largely inactive, suggesting that near-term price dynamics are being driven more by capital pressure than by conviction.

Bitcoin short-term holders (STH) unrealized PnL. Source: CryptoQuant

Bitcoin short-term holders (STH) unrealized PnL. Source: CryptoQuant

Exchange flows and market structure keep $85,000 in focus

Crypto exchange data reinforces the rising probability of a price downside. The Exchange Whale Ratio has moved into the 0.52–0.55 range, signaling that a sizable portion of BTC inflows is driven by large transactions typically associated with selling or reallocation. If this ratio stays elevated and the price cannot reclaim the 95,000 to 98,000 zone, distribution pressure could push the market toward 85,000 to 80,000.

BTC exchange whale ratio. Source: CryptoQuant

BTC exchange whale ratio. Source: CryptoQuant

Analyst XO noted that Bitcoin is trading below both the 21-period daily and the 12-period weekly exponential moving averages and has breached multiple prior higher lows. The takeaway: BTC could gravitate toward the mid-80,000s unless a sharp relief rally materializes.

On-chain research from “exitpumpBTC” shows sizable negative delta clusters below 91,000, with more than 300 million in total selling pressure realized — a signal of aggressive short positioning. While a squeeze could occur if 91,000 is reclaimed, the prevailing momentum remains downward.

Futures analyst Dom described the setup as a “failed auction.” Bitcoin briefly moved above the Value Area High, the upper bound of the recent trading range, before retreating back into the value area. Such moves elevate the likelihood of rotating toward the Value Area Low, located near 86,000.

Bitcoin analysis by Dom. Source: X

Bitcoin analysis by Dom. Source: X

This article was originally published as Bitcoin Sell-Off Risk Rises as New Whales Dominate Price Action on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

GCC and India to sign terms for start of free trade talks

PEPE Holders Looking For The Next 100x Crypto Set Their Sights On Layer Brett Presale