Crypto Market Continues to Slump, Where Are the Marginal Buyers?

By: Primitive Ventures

Compiled by: Felix, PANews

Crypto Saturation and Structural Shift

This cycle has clearly shown that the market has reached saturation not only in terms of funds but also in terms of attention.

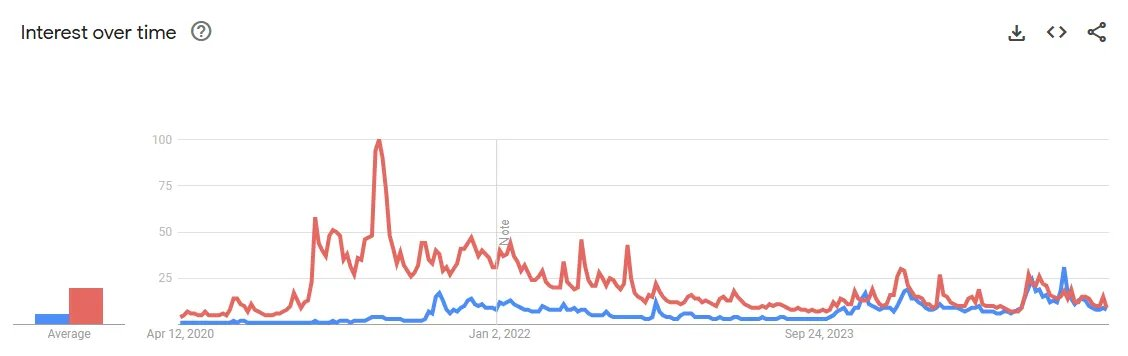

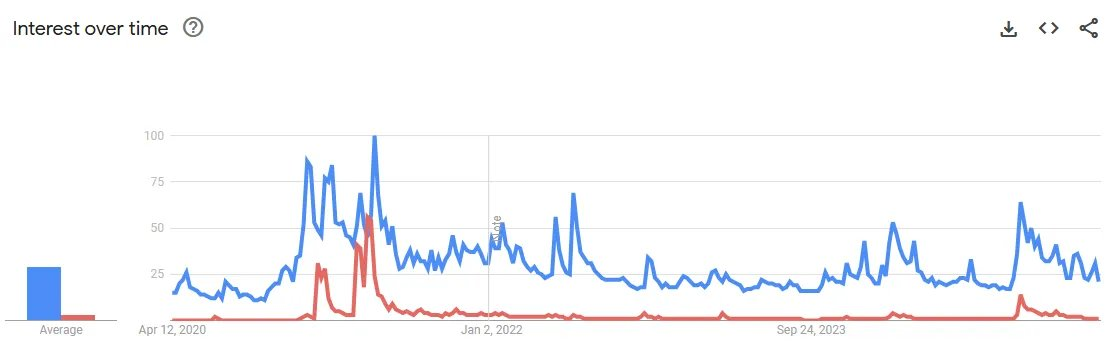

Global Google Trends data illustrates this point. Only Solana hit a new high in search interest. Despite ETF approvals, Bitcoin hitting new highs, and meme-fueled political debate, search interest for Bitcoin, Ethereum, and even Dogecoin has failed to recover to its 2021 peak levels.

Red: Ethereum Google search popularity

Blue: Solana Google search popularity

Blue: Bitcoin Google search popularity

Red: Dogecoin Google search popularity

As attention has fallen, prices have fallen as well. Most major assets are still trading below their highs from the previous cycle. This means that cryptocurrencies have reached mainstream saturation as an asset class, but are still not widely adopted as a currency.

This duality defines the current situation. Speculation is well known, but its actual use is still misunderstood. The next marginal buyer may not come for the coin, but for the infrastructure.

Player Structure: Game is Clearing

To understand why even the top-down narrative can’t sustain momentum, one needs to understand who is still participating.

Source: PV internal research

Spot traders on centralized exchanges (CEXs), once the backbone of retail power, have gradually faded. As the get-rich-quick effect of CEXs fades, the inflow of new users has stagnated. Worse, many existing users have either left or turned to riskier perpetual contract trading. At the same time, the rise of spot ETFs has quietly siphoned off another group of potential buyers. Centralized exchanges are no longer the default entry point.

Yield miners, who typically have larger capital allocations, are increasingly looking off-chain. As on-chain yield opportunities decrease and risk-adjusted returns decline, capital is turning to more stable sources of real-world income.

NFT and GameFi players, once the driving force of cultural adoption of cryptocurrencies, have been largely sidelined. Some have turned to memecoin, but that wave seems to have peaked as the Trump craze fades, leaving most participants disappointed.

Airdrop hunters, often seen as the most persistent group of on-chain participants, are now openly clashing with projects over unfulfilled promises. Many are unable to even cover costs.

Looking across each user group, the trends are clear: engagement is declining, conviction is waning, and retail investors are leaving.

Tipping point: Conversion stagnation

The problem isn’t just fatigue among the existing user base, conversions themselves are stagnant.

Top CEXs serve about 400 million users (excluding duplicate users), but only about 10% of users are converted to on-chain users (wallet users). The penetration rate has hardly changed since 2023; the industry has difficulty converting users from the custody layer.

Source: PV internal research

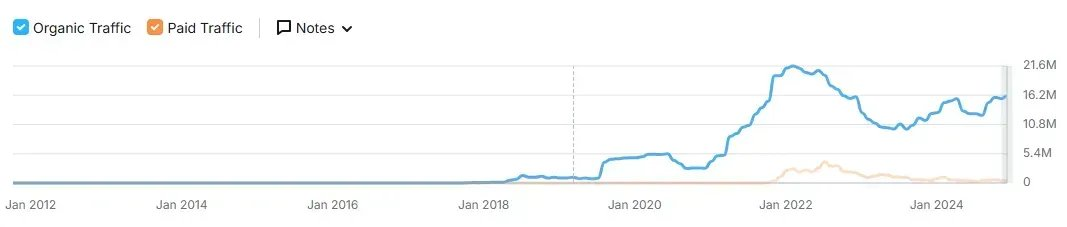

Meanwhile, traffic on major exchanges has continued to decline since the peak of the 2021 bull run, and has not recovered even as Bitcoin hits new highs. The conversion funnel has not expanded.

Binance traffic; data source: Semrush

Coinbase traffic; data source: Semrush

Worse still, the threshold of cryptocurrency awareness may have been reached. According to a Consensys survey, 92% of respondents worldwide have heard of cryptocurrency, and 50% claim to understand it. Awareness is no longer a problem, but interest is.

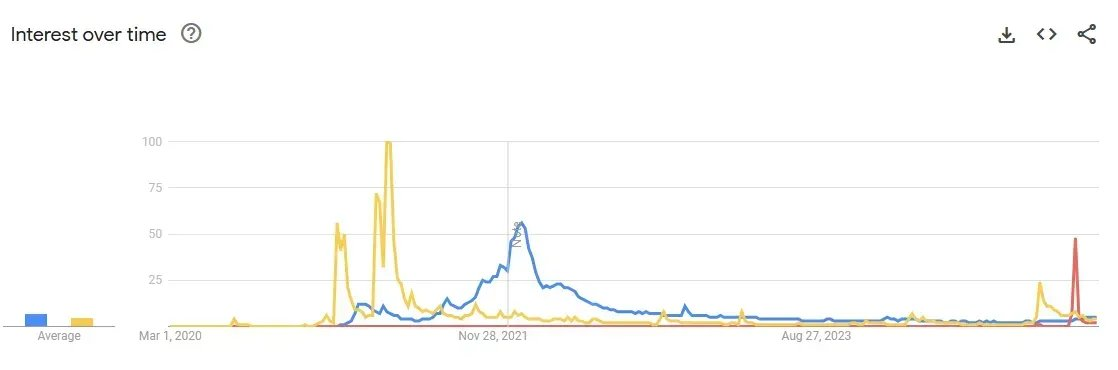

And the enthusiasm curve for retail investors is flattening. In the last cycle, NFT and Dogecoin attracted a large number of users. In this cycle, even Trump's memecoin cannot enter the mainstream. The curiosity that once drove retail inflows is fading.

Yellow: Dogecoin Google search popularity

Blue: NFT Google search popularity

Red: Trump meme Google search popularity

Slogan: The power of mirage

The OM pull-up was a carefully planned action: turning to the hottest RWA, forming an alliance with UAE capital, reaching cooperation, using KOLs for publicity, and squeezing liquidity through token economics reset.

Source: PV internal research

But despite a 100x price surge, no meaningful spot volume has occurred. OM lacks something that even the most perfect script cannot fabricate: true marginal buyers.

OM Trading Volume

When centralized exchanges adjusted perpetual contract leverage and market makers encountered internal friction, the system quickly broke down. A 95% drop ensued, not due to a minting spiral or a bug, but because there was simply no buying.

OM is not a failure of execution. It reflects a structural problem: on today’s centralized exchanges, even a 100x price surge cannot generate new demand.

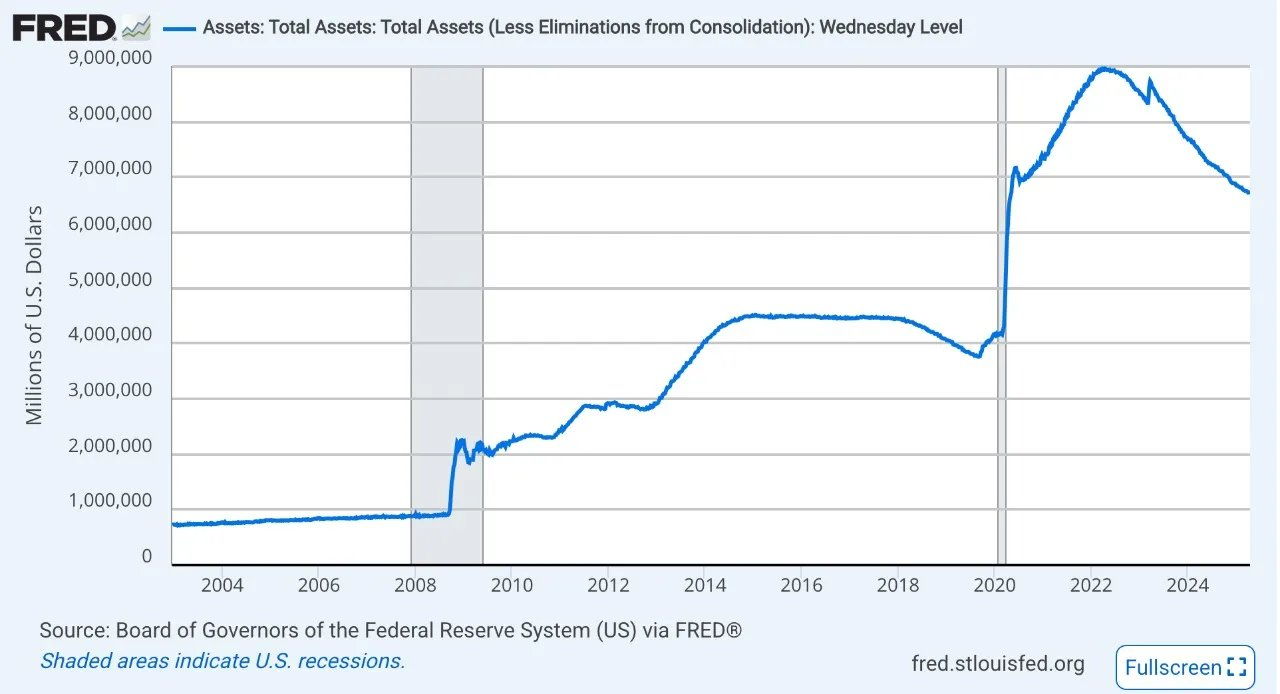

Fed Quantitative Tightening and Dollar Shortage

The structural shift in buyer behavior cannot be understood in isolation from macro liquidity. Since 2022, the Federal Reserve has begun to significantly reduce its balance sheet, launching one of the most cautious quantitative tightening cycles in recent years.

The Fed’s balance sheet peaked at nearly $9 trillion in the post-COVID-19 period, greatly stimulating global risk appetite through excess liquidity. But as inflation picked up, the Fed changed its strategy, reversing course by draining reserves, tightening financial conditions, and curbing the loose leverage that had fueled speculation in a variety of risky assets, including cryptocurrencies.

This tightening not only slows capital inflows, it also structurally limits the type of buyers that cryptocurrencies have always relied on: fast-moving, risk-taking speculators.

Structural shifts: Where the next demand may emerge

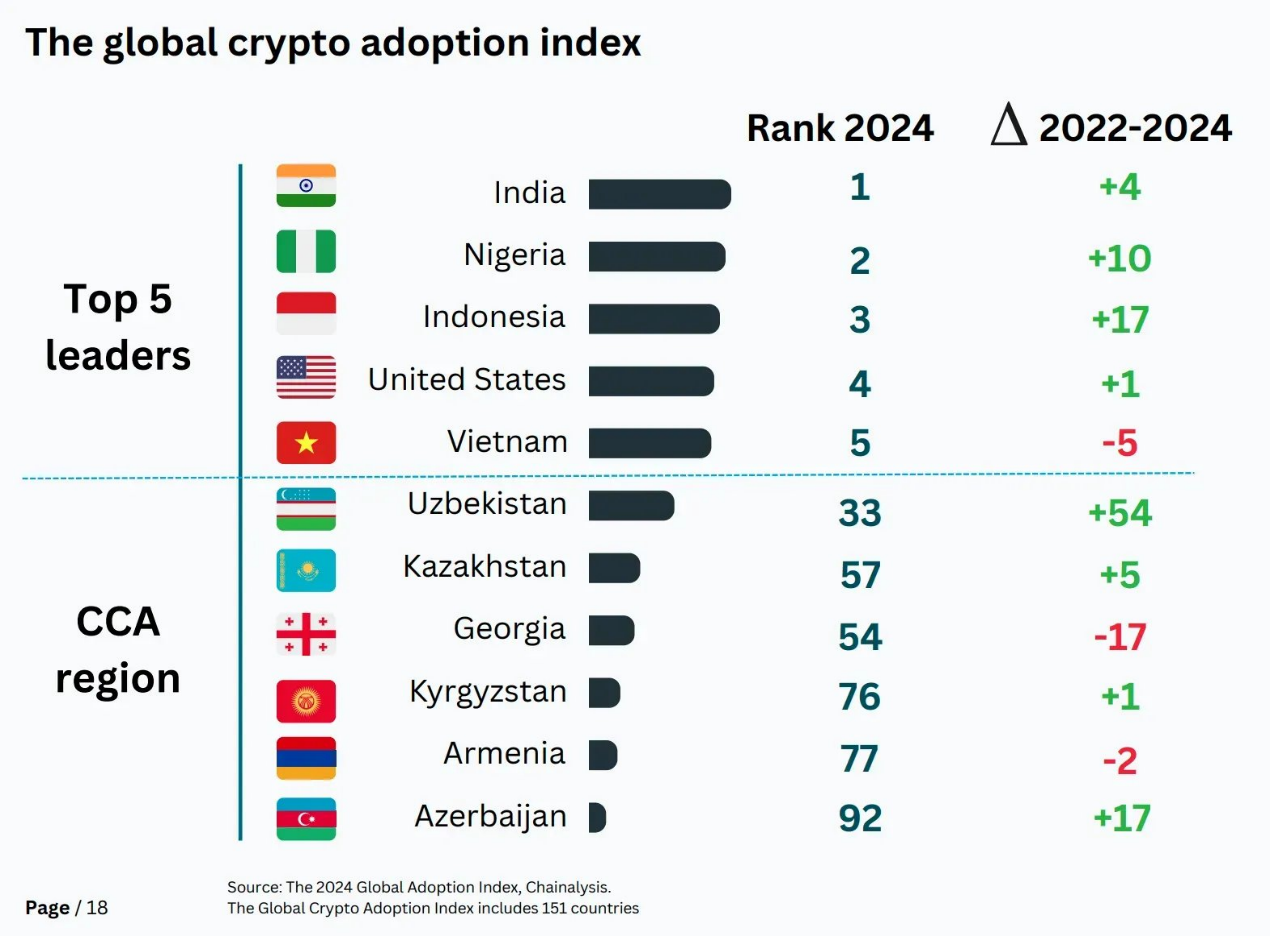

If the next marginal buyers don’t come from crypto-native speculators, they may emerge from structural shifts driven by policy, necessity, and real-world demand.

The normalization of stablecoin regulation could usher in a new phase of digital dollar dominance. In an era of rising tariffs, capital controls, and geopolitical fragmentation, cross-border capital requires faster and more covert channels. Stablecoins, especially those aligned with U.S. interests, are expected to become a practical tool for economic influence.

And adoption is quietly taking off in regions long ignored by the industry. In parts of Africa, Latin America, and Southeast Asia, where national currencies are unstable and large populations are unbanked, stablecoins have real uses in remittances, savings, and cross-border trade. These users are the new frontier of global dollarization.

As the scale of RWA expands, more users will participate in it for the purpose of obtaining real assets on the chain rather than speculation.

The Barbell Era: This is not a collapse, but a rebalancing

The dearth of marginal buyers is not simply a cyclical low, but a structural result, the downstream effect of two forces:

Cryptocurrency as an asset has captured much of the world’s attention. The dream of getting rich overnight has lost its luster.

The dollar shortage is real. The Fed's quantitative tightening and macro tightening have structurally reduced the buyer base.

After all the cycles, narratives, and reinventions, crypto is splitting into two distinct paths, and the divergence is only growing.

On one side is a speculative system once driven by memes, leverage, and narrative reflexivity, now moribund by the withdrawal of liquidity. These markets depend on continued marginal inflows, without which even the most carefully designed strategies cannot sustain buying.

On the other hand, policy-led, utility-driven adoption is slowly but undeniably emerging. Stablecoins, compliant channels, tokenized assets are all growing. Not driven by hype, but out of necessity. Not a bubble, but enduring.

What we are witnessing now is not a market crash but a structural rebalancing.

Related reading: From 100,000 to 75,000: The cyclical truth behind the deep correction and the signal of the bull market restart

You May Also Like

SBI VC Trade Adds Litecoin to Japanese Lending Program

Work Dogs TGE Is Running — Is WD About to Drop in Q2 After March 30?