LayerZero (ZRO) Price Jumps 20% as Demand Outpaces Supply Unlocks

The post LayerZero (ZRO) Price Jumps 20% as Demand Outpaces Supply Unlocks appeared first on Coinpedia Fintech News

LayerZero’s native token (ZRO) is gaining attention as it surged 20% today, extending the rally over 42% this week. Despite ongoing token unlock concerns, buyers stepped in aggressively and lifted the ZRO price beyond the $2 hurdle. The rally appears to be fueled by a combination of whale accumulation, rising open interest, and a clean breakout.

Now, with momentum shifting back to the upside, traders are watching this move marks a short-term relief rally or the start of a broader trend reversal, with key demand and resistance levels coming into focus.

Token Unlock Pressure Fades as Whales Absorb Supply

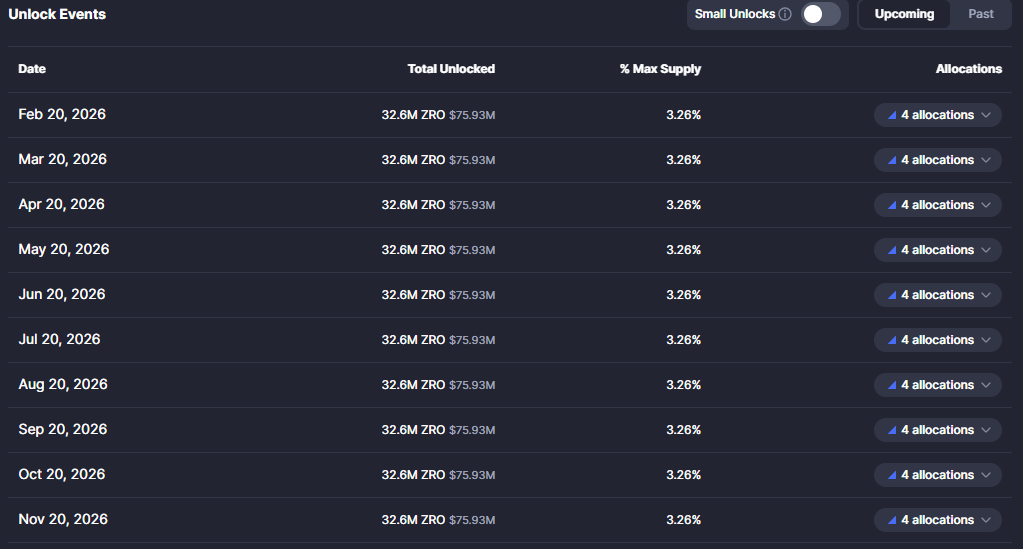

The key driver behind the ZRO price rally is the fresh demand from the market. Roughly 32.6 million ZRO, about 3.26% of maximum supply is set to unlock every month through 2026, creating a visible and recurring supply overhang.

Under normal conditions, this kind of dilution leads to persistent selling pressure as early holders take advantage of liquidity. However, in ZRO’s case, the market responded differently.

Instead of breaking down, ZRO absorbed the fresh supply and continued moving higher. Further On-chain data shows that large wallets stepped in during the unlock window, not to distribute, but to build exposure. One major whale address opened a 5x leveraged long position worth nearly $800,000, while other high-value wallets increased activity through settlement flows.

The implication is clear, the unlock event did not weaken price because smart money treated it as an accumulation opportunity, not an exit point. When an asset rallies in full awareness of ongoing dilution, it signals that demand has overtaken supply as the dominant force in price discovery.

ZRO Price Action Signals Structural Breakout

ZRO’s price action displays a clean breakout of a long-term downtrend. After weeks of compression, LayerZero token price broke out of its descending trendline and closed decisively above the $2.20 resistance zone, which has previously rejected multiple upside attempts. The breakout was accompanied by sharp volume spurt and strong follow-on buying movement, suggesting real participation rather than a thin liquidity spike.

The broader chart structure now shows a shift from lower highs into higher highs and higher lows, confirming a transition from bearish consolidation into bullish expansion. With the former resistance now acting as support, the key demand area sits around $1.90–$2.00.

As long as ZRO price holds above this region, the bullish structure remains intact. On the upside, the next major liquidity zone appears near $2.70, followed by a higher expansion region around $3.30–$3.60, which aligns with the measured move of the breakout pattern. Beyond that level, historical supply thins out, placing ZRO into a low-resistance price discovery range.

You May Also Like

Securities Fraud Investigation Into Corcept Therapeutics Incorporated (CORT) Announced – Shareholders Who Lost Money Urged To Contact Glancy Prongay Wolke & Rotter LLP, a Leading Securities Fraud Law Firm

Microsoft Corp. $MSFT blue box area offers a buying opportunity