Arizona Moves to Exempt Crypto From Property Taxes – Will Voters Approve This Tax-Break?

Lawmakers in Arizona are working on a bill to exempt digital assets from property tax in the event the voters pass a constitutional change in the latter part of this year.

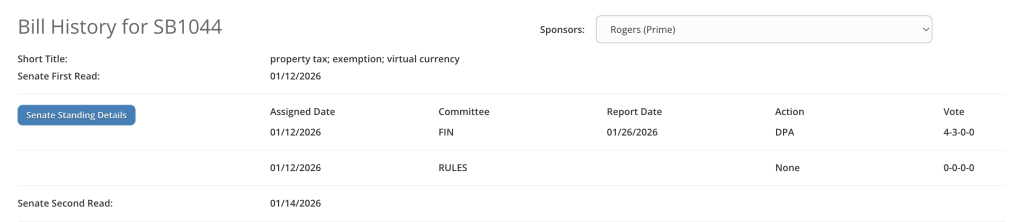

The Arizona Senate Finance Committee passed Senate Bill 1044 by a vote of 4 to 3, which would have allowed a bill to be passed to exempt the virtual currency from property taxation by the state government.

Source: azleg.gov

Source: azleg.gov

Meanwhile, the committee passed Senate Concurrent Resolution 1003, designed to make a constitutional change to the Arizona Constitution by formally excluding digital currency as part of the definition of taxable property.

Crypto Tax Question Heads Toward Arizona’s 2026 Ballot

These two measures were sponsored by Senator Wendy Rogers and now await the Senate Rules Committee to look into their constitutionality before any further action can be taken.

The Arizona law requires that alterations that affect the state constitution are subject to the approval of the voters.

Should SCR 1003 become a law, the proposed amendment would be included in the November 2026 general election ballot.

This will allow the residents to have the last word on whether the property-based, or more precisely, ad valorem, taxation of virtual currency should be exempted.

SB 1044 is meant to match state laws with that constitutional amendment; however, it would become effective only in the case of an amendment voted on by citizens.

Arizona already levies a flat 2.5% personal income tax, transaction privilege taxes, and property taxes, but the property tax rates are relatively low in comparison with other states.

Arizona Moves to Block Local Taxes on Blockchain Nodes

The push is an expansion of a wider set of crypto-related actions Rogers proposed in December.

She also introduced Senate Bill 1045 side by side with SB 1044 and SCR 1003, and this would stop counties, cities, and towns from imposing taxes or fees on individuals or businesses that use blockchain nodes.

The node-related bill would not have to be approved by the voters, since it can be enacted into law via legislative means only.

Arizona has already taken several steps to tailor its tax rules around digital assets.

In 2022, the state exempted crypto airdrops from state income tax by treating them as gifts at the time they are received.

Arizona also allows gas fees to be deducted when calculating gains or losses and permits certain state agencies to accept cryptocurrency payments through approved service providers.

Crypto Push Meets Resistance in Arizona Governor’s Office

At the same time, the state’s crypto agenda has faced consistent resistance from the governor’s office.

Governor Katie Hobbs vetoed four Bitcoin- and crypto-related bills during the 2025 legislative session.

The bill includes proposals to establish a state-managed Bitcoin reserve and allow agencies to accept crypto for taxes and fines.

Hobbs cited concerns about market volatility, fiscal risk, and operational uncertainty.

She has approved just two crypto-related bills, one allowing the state to hold abandoned digital assets in their original form under updated unclaimed property rules and another tightening compliance requirements for crypto ATM operators.

The tax exemption proposal also arrives amid a national debate over how digital assets should be taxed.

Several states, including Florida, Texas, Wyoming, and Nevada, do not levy personal income taxes, effectively eliminating state-level taxes on most crypto gains.

Other states have pursued narrower reforms, such as Missouri’s move to eliminate state income tax on capital gains and Ohio’s stalled effort to exempt small crypto transactions.

At the federal level, lawmakers are preparing to revisit crypto tax policy after years of relying on guidance issued by the Internal Revenue Service in 2014.

You May Also Like

Shibarium May No Longer Turbocharge Shiba Inu Price Rally, Here’s Reason

👨🏿🚀TechCabal Daily – When banks go cashless