Bitcoin Volatility Alert: Trump Expected To Tap Kevin Warsh As Fed Chair Today

US President Donald Trump is expected to unveil his pick for the next Federal Reserve chair on Friday morning, with former Fed governor Kevin Warsh emerging as the clear market favorite, an event that could jolt rate expectations and, by extension, Bitcoin and crypto volatility.

Warsh met with Trump at the White House on Thursday, according to reporting from Reuters and the Wall Street Journal’s Nick Timiraos, after Trump told reporters he planned to announce his choice Friday. Trump added a pointed tease about the mystery candidate: “A lot of people think that this is somebody that could’ve been there a few years ago,” a nod to the fact he considered Warsh for the job roughly eight years ago before selecting Jerome Powell.

What Warsh Means For Bitcoin And Crypto Markets

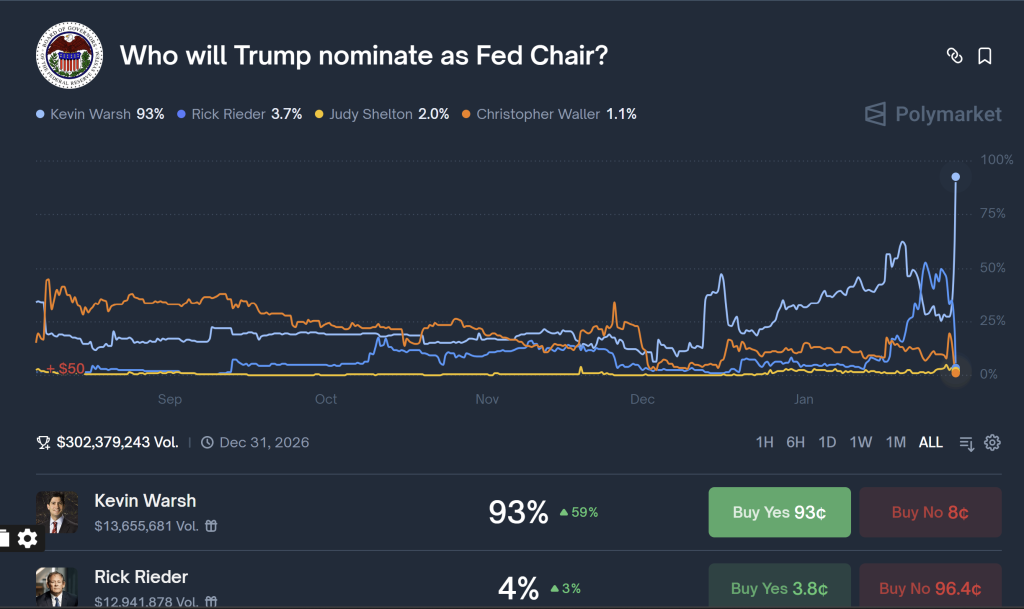

The fastest repricing has happened not in Treasuries, but in prediction markets. Polymarket’s contract on Trump’s Fed chair nominee is currently showing Warsh at 93%, with the market displaying roughly $302 million in volume, levels traders interpreted as a leak-driven stampede rather than a slow drift.

That surge dovetails with a Bloomberg report saying the Trump administration is preparing for a Warsh nomination, and with commentary from macro traders who see the process tightening into a single outcome.

Several market observers frame a potential Warsh chairmanship as dovish on the policy rate but hawkish on the Fed’s footprint. Macro trader Alex Krüger wrote via X: “Warsh has advocated for a structural overhaul of the Federal Reserve and a ‘new Treasury-Fed Accord.’ He posits that an AI-driven productivity boom is inherently disinflationary, providing the basis for aggressive rate cuts. He also contends that the Fed’s balance sheet has been used to subsidize Wall Street and should be reduced significantly, signaling a strong stance against QE.”

Former Fed trader Joseph Wang distilled the trade-off more bluntly: “A Warsh Fed looks to trade lower asset prices for a lower rate path… This is a step to reverse Bernanke’s wealth effect.” That framing matters for Bitcoin and crypto because it separates “rate cuts” from “easy financial conditions”—two concepts markets often conflate during risk-on moves. Wang added an ominous shorthand: Warsh “will get you a lot of cuts, but you might not like how we [get] there.”

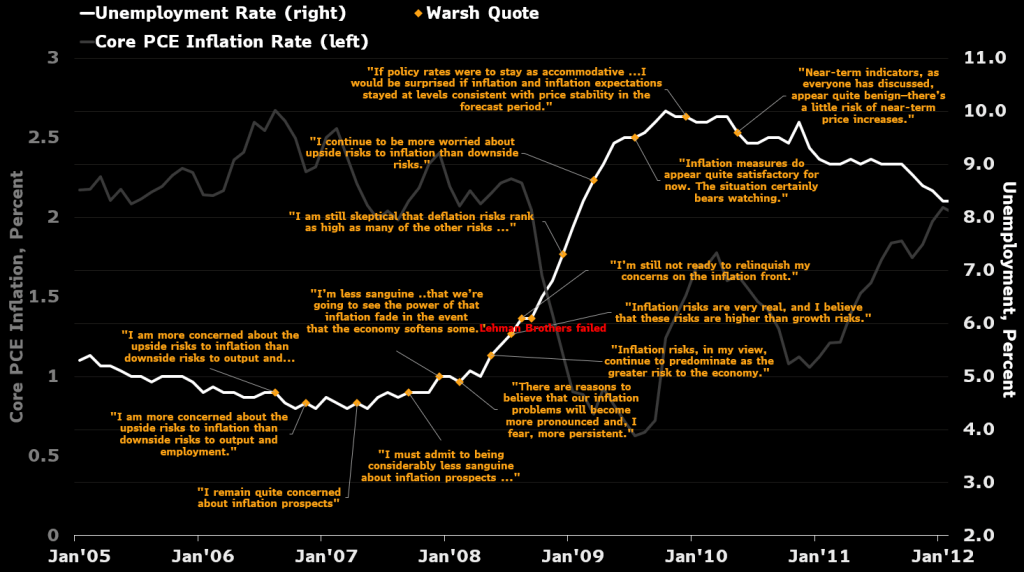

Warsh’s reputation as an inflation hawk also complicates any clean “dovish” label. Bloomberg’s Chief US Economist Anna Wong shared the below analysis and resurfaced a 2009 inflation comment attributed to Warsh, made months after Lehman and with core PCE still low, arguing that if Trump “wants someone easy on inflation, he got the wrong guy.

Chief Market Strategist at Wellington-Altus James E. Thorne added via X: “Kevin Warsh remains the strongest choice for Fed chair because he uniquely combines market credibility with a clear willingness to reset policy in a more disciplined, rules‑based direction. He is structurally hawkish on inflation and the balance sheet, but tactically flexible enough to support meaningful rate cuts when conditions warrant, which aligns with the Trump–Bessent objective of moving the funds rate lower without sacrificing institutional legitimacy.”

Krüger conceded Warsh’s track record “is not the best,” while still arguing there is “unique credibility in a former inflation hawk advocating for aggressive cuts.”

Warsh, Bitcoin, And ‘Market Discipline’

For Bitcoin and crypto, one underappreciated angle is that Warsh has publicly described Bitcoin in surprisingly non-hostile terms. In a Hoover Institution interview published July 8, 2025, Warsh rejected the idea that Bitcoin threatens the dollar, while still treating it as a policy signal. “Bitcoin does not make me nervous,” he said. “I think of it as an important asset that can help inform policymakers when they’re doing things right and wrong. It is not a substitute for the dollar.”

Warsh also cast Bitcoin’s role as a kind of feedback mechanism for central bankers: “I think it can often be a very good policeman for policy,” he said, before widening the lens to distinguish “real innovators” from “imitators” and “incompetents” in the broader proliferation of crypto tokens.

At press time, Bitcoin traded at $82,695.

You May Also Like

In ‘Running With Scissors,’ Cavetown learns to accept that risk is in everything