Bitcoin Price Falls to $81K as $1.7B in Liquidations Hit Crypto

This article was first published on The Bit Journal.

Bitcoin price volatility returned with force as the market slid into one of its sharpest pullbacks in months, catching traders off guard and reshaping sentiment across digital assets. The sudden move reignited debate over risk, leverage, and the growing link between crypto and global macro forces.

According to the source, the sell-off accelerated as geopolitical tension, tariff threats, and fragile tech sentiment converged. Those pressures pushed traders to reduce exposure quickly, setting the stage for a cascading reaction that few expected.

A Nine-Month Low Shakes Confidence

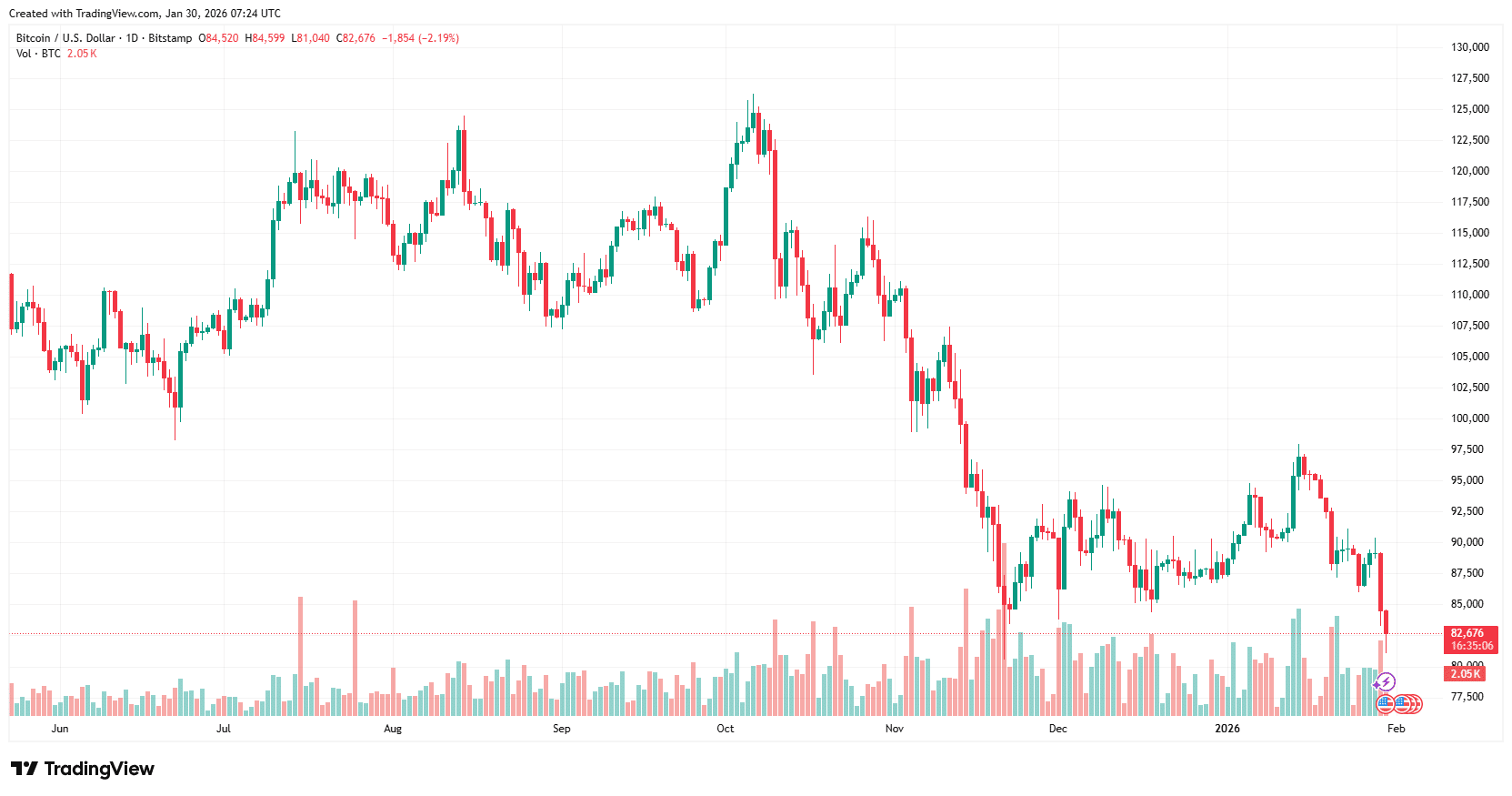

The Bitcoin crash gathered pace during early Friday trading, when the price fell to $81,058 on Coinbase, its lowest level since April, as confirmed by chart data. The asset has now dropped roughly 35% from its October all-time high near $126,000.

The Bitcoin price breaking below recent ranges triggered defensive behavior across derivatives markets, where leverage had quietly built up.

Source: Tradingview

Source: Tradingview

Liquidations Reveal Crowded Bets.

The scale of forced selling stood out. Data available through this derivatives dashboard shows that around 270,000 traders were liquidated in just 24 hours, with total losses reaching about $1.68 billion.

Roughly 93% of those liquidations came from leveraged long positions, mainly tied to Bitcoin and Ether, which traded near $2,713 at the time. This wave of liquidations amplified the Bitcoin crash, turning a sharp decline into a broader rout.

Support Levels Under the Microscope

From a technical perspective, the Bitcoin price is now near a key monthly support zone closely watched by analysts. A failure to hold this area could invite further selling.

At the same time, the broader crypto market lost nearly $200 billion in total value in a single day, according to live market pricing. That synchronized move showed the Bitcoin crash was not isolated but part of a broader risk-off shift.

Geopolitics and Tariffs Unsettle Markets.

Macro headlines played a decisive role. The United States sent another warship to the Middle East as tensions with Iran intensified. Speaking to reporters, Donald Trump said,

Trump also declared a national emergency and signed an order threatening tariffs on goods from countries supplying oil to Cuba. These developments weighed heavily on risk assets, further pressuring the Bitcoin price.

Metals Slide Alongside Crypto.

Traditional safe havens failed to offer relief. Gold fell about 9% from its record high near $5,600 per ounce, while silver corrected roughly 11.5%.

Analysts noted the contrast with recent sessions when gold nearly added Bitcoin’s entire market value in a single day. This time, both metals and crypto moved lower together, underscoring how the Bitcoin crash fit into a broader market reset.

Bitcoin Price Slides To $81K As Bitcoin Crash Triggers $1.7B Wipeout

Bitcoin Price Slides To $81K As Bitcoin Crash Triggers $1.7B Wipeout

Tech Earnings Add Fuel

Weakness in technology stocks added another layer. After disappointing earnings marked by heavy spending and slower cloud growth, Microsoft shares dropped 10%, their steepest fall since March 2020.

Jeff Mei, an exchange executive, said the dip had a “clear correlation” with that earnings shock, explaining that investors feared a broader pullback in AI-related stocks. His comments, shared here, suggested the Bitcoin price reaction may have been exaggerated, given months of prior decline.

Conclusion

The Bitcoin price now faces a defining test as markets weigh fear against fundamentals. This episode highlights how leverage and global news can magnify moves in either direction. For students, developers, and analysts, the lesson is clear. Understanding context matters as much as reading charts when volatility returns.

Glossary of Key Terms

Liquidation: It refers to the forced closure of a position when losses exceed the margin.

Leverage: It means using borrowed funds to increase trade size.

Support level: It describes a price area where buying often appears.

Risk-off signals: A shift toward safer assets during uncertainty.

FAQs About Bitcoin Price

What triggered the sudden fall?

Rising geopolitical tension, tariff threats, and weak tech earnings combined.

Why were liquidations so large?

Heavy leverage caused forced selling as prices dropped quickly.

Is this a long-term trend?

Many analysts view it as a cyclical correction rather than a structural break.

What should readers watch next?

Macro headlines, derivatives data, and reactions near support.

Sources / References

Tradingview

Bitbo

Nasdaq

Read More: Bitcoin Price Falls to $81K as $1.7B in Liquidations Hit Crypto">Bitcoin Price Falls to $81K as $1.7B in Liquidations Hit Crypto

You May Also Like

Taiko and Chainlink to Unleash Reliable Onchain Data for DeFi Ecosystem

Why The Green Bay Packers Must Take The Cleveland Browns Seriously — As Hard As That Might Be