Market Meltdown: Gold, Silver, Stocks & Crypto Crash Altogether—What’s Next for Bitcoin Price?

The post Market Meltdown: Gold, Silver, Stocks & Crypto Crash Altogether—What’s Next for Bitcoin Price? appeared first on Coinpedia Fintech News

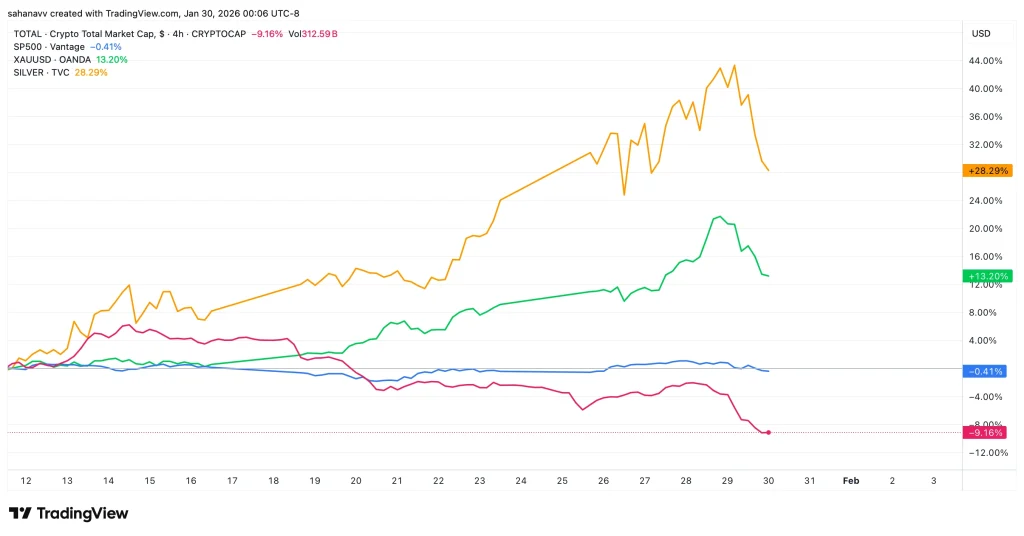

Gold and silver prices retreated after scaling record highs as traders moved to lock in profits following an extended rally. The weakness spilled into equities, with the S&P 500, Nasdaq, and technology stocks sliding sharply. Market sentiment turned cautious after earnings from Microsoft raised concerns around slowing AI-related spending.

Crypto markets mirrored the broader risk-off move. Bitcoin price slipped close to the $81,000 level, while major altcoins extended losses. Forced selling and liquidations in leveraged positions accelerated the decline, amplifying downside pressure across digital assets.

Stronger Dollar Emerges as a Key Factor

The simultaneous drop across precious metals, stocks, and crypto raised a key question: was this driven by a single negative headline or a combination of profit-taking, stretched valuations, and tightening financial conditions?

Unlike typical market cycles, where gold rises as stocks and crypto fall, this move reflected a broader liquidity-driven reset rather than asset-specific weakness. After weeks of strong gains, multiple markets appeared overbought, leaving prices vulnerable once risk appetite faded.

One of the main macro drivers behind the sell-off has been renewed strength in the US dollar. The DXY Index, which tracks the dollar against a basket of major currencies, reversed its recent downtrend after falling more than 3% since mid-January. The rebound signals renewed demand for the greenback as investors rotate toward safety and liquidity.

The momentum gained further support after the latest FOMC decision kept interest rates unchanged. Adding to the shift in sentiment, reports around a potential new Federal Reserve Chair also influenced expectations, strengthening the dollar and pressuring risk assets priced in USD.

What Next for Bitcoin (BTC) Price—Will it Hold the $80,000 Support?

Bitcoin’s price action suggests the market is entering a decisive phase after breaking below the ascending channel that previously guided its recovery. This breakdown indicates fading bullish momentum and increases the probability of further downside in the near term. If BTC fails to reclaim the $88,000–$90,000 resistance zone, sellers may continue to dominate, dragging the price toward the $80,600 support level.

A deeper pullback into the $77,000–$74,000 demand zone cannot be ruled out if selling pressure intensifies. However, this region remains crucial for the broader structure, as a strong reaction here could signal stabilization and renewed accumulation. Overall, Bitcoin is likely to remain volatile, with price direction hinging on how it reacts to these key support levels.

You May Also Like

Taiko and Chainlink to Unleash Reliable Onchain Data for DeFi Ecosystem

Why The Green Bay Packers Must Take The Cleveland Browns Seriously — As Hard As That Might Be