Bitcoin Price Faces Structural Pressure as Losses Spread Across On-Chain Holders

The post Bitcoin Price Faces Structural Pressure as Losses Spread Across On-Chain Holders appeared first on Coinpedia Fintech News

Bitcoin price slipped below a critical volatility band near $83,000 in late January 2026, triggering renewed downside concern. At the same time, on-chain data shows losses spreading rapidly across holders, placing Bitcoin price behavior in a zone historically associated with heightened stress and late-stage corrections.

Bitcoin Price Breaks Below a Key Volatility Structure

From a technical perspective, Bitcoin price recently closed below the lower boundary of the Gaussian Channel on the weekly chart. This volatility-based indicator, built using statistical medians and standard deviations, has historically helped define trend strength during bull cycles.

When BTC price USD has slipped beneath this band in prior market expansions, it has often coincided with corrective phases rather than full trend reversals. That said, the current breakdown near the $83,000 region suggests weakening momentum rather than immediate capitulation.

Meanwhile, broader market conditions remain fragile. January’s volatility failed to reclaim key resistance levels, reinforcing the perception that Bitcoin price is consolidating under pressure rather than resetting for an immediate upside continuation.

Sentiment Deteriorates as Losses Dominate On-Chain

At the same time, sentiment indicators across social platforms have turned increasingly defensive. Community responses following the recent breakdown show growing expectations of deeper retracements, with downside levels being openly discussed rather than dismissed.

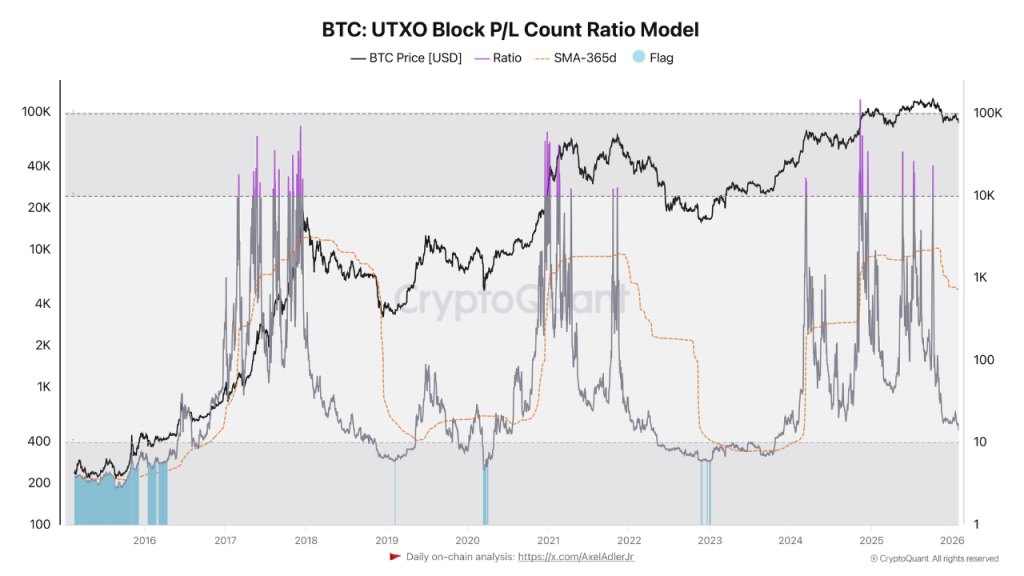

That said, sentiment alone rarely defines market bottoms. Instead, on-chain data provides a clearer picture of structural stress. One notable metric is the ratio comparing UTXOs in loss versus those in profit. This ratio has now fallen to levels typically associated with late correction phases or bear market environments.

When profits dominate, elevated ratios often precede sell-offs as holders realize gains. Conversely, when losses become widespread, selling pressure tends to diminish not because confidence returns, but because fewer participants remain in profit.

UTXO Loss Ratios Signal Peak Stress Conditions

Still, the current environment reflects broad investor strain. Data shows a growing share of UTXOs slipping into unrealized loss, creating a negative feedback loop where fear replaces momentum. Historically, when this ratio approaches extreme lows, it has aligned with periods where downside risk begins to compress.

From an analytical standpoint, this does not imply immediate recovery. Rather, it highlights that Bitcoin price is entering a zone where forced selling often slows, even if volatility remains elevated. Short-term conditions remain bearish, but structurally, the market is approaching a region where pressure becomes asymmetrical.

The BTC price USD is therefore less driven by optimism and more by exhaustion dynamics, where sellers gradually lose dominance as losses spread.

Bitcoin Price Navigates a Compression Phase

In the current setup, Bitcoin price analysis reflects a convergence of technical weakness and on-chain stress rather than a single catalyst-driven move. The breakdown below volatility bands aligns with an environment where most participants are underwater, amplifying fear while simultaneously reducing incentive to sell aggressively.

From this angle, Bitcoin price behavior is increasingly shaped by compression rather than expansion. Whether this phase resolves through further downside or stabilization will depend on how quickly loss dominance peaks and volatility contracts.

You May Also Like

Securities Fraud Investigation Into Corcept Therapeutics Incorporated (CORT) Announced – Shareholders Who Lost Money Urged To Contact Glancy Prongay Wolke & Rotter LLP, a Leading Securities Fraud Law Firm

Microsoft Corp. $MSFT blue box area offers a buying opportunity