Daily Market Update: Stocks and Crypto Fall Ahead of Major Earnings Week and Jobs Report

TLDR

- Bitcoin dropped to $74,000 before recovering above $76,000 as thin liquidity amplified price swings during weekend trading

- Crypto markets saw $510 million in liquidations over 12 hours, with long positions accounting for $391.6 million in losses

- US stock futures fell sharply on Monday, with Nasdaq 100 futures down 1% and S&P 500 futures dropping 0.8%

- Gold plunged 10% and silver crashed 15% on Monday after a historic 30% single-day drop on Friday

- Over 100 S&P 500 companies including Amazon, Alphabet, and Disney are set to report earnings this week

Bitcoin fell briefly to $74,000 early Monday before bouncing back above $76,000. The rapid price swing showed how thin trading volumes can create large price movements in both directions.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

The cryptocurrency market faced heavy selling pressure over the past 12 hours. Traders saw $510 million in leveraged positions liquidated during this period.

Long positions took the biggest hit at $391.6 million in losses. Short positions accounted for $118.6 million in liquidations.

The selling wave hit other major cryptocurrencies hard. Ethereum dropped more than 8% in 24 hours.

BNB, XRP, and Solana all declined between 4% and 6%. Dogecoin and TRON also posted losses as buyers stepped back from the market.

Weekend trading made the situation worse for crypto prices. Order books became thinner with traditional markets closed and institutional traders mostly inactive.

This shallow market depth meant relatively small selling pressure could push prices through key support levels. The same thin liquidity also allowed buyers to push prices back up quickly.

Stock Markets Face Pressure from Multiple Fronts

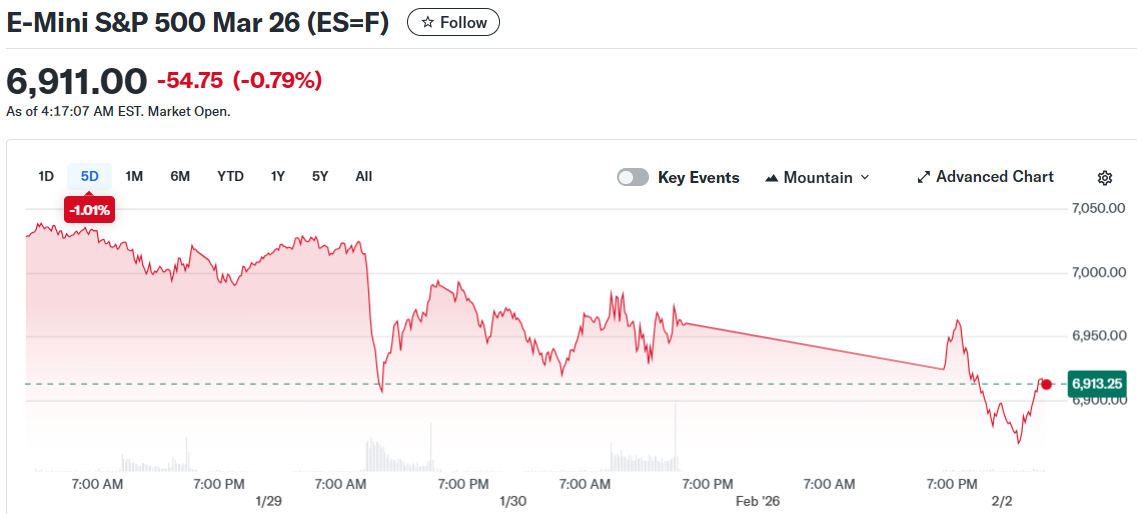

US stock futures dropped sharply in early Monday trading. Nasdaq 100 futures fell 1% while S&P 500 futures declined 0.8%.

E-Mini S&P 500 Mar 26 (ES=F)

E-Mini S&P 500 Mar 26 (ES=F)

Dow Jones futures slid 0.6% as investors reacted to losses from Friday. The declines followed a dramatic sell-off in precious metals that shocked markets.

Gold briefly dropped as much as 10% on Monday. Silver sank over 15% after crashing roughly 30% in its biggest single-day drop on record Friday.

Both metals were recovering some losses by midday. The precious metals crash has unwound much of their strong 2026 rally.

Bitcoin extended its losses over the weekend, falling below $80,000 for the first time since April. The token was trading near $77,000 on Monday morning.

Earnings and Jobs Data Ahead

President Trump’s nomination of Kevin Warsh to lead the Federal Reserve added to market uncertainty. Traders are speculating about future interest rate moves.

Most market participants still expect two rate cuts by year-end. The Fed decision comes as investors digest mixed signals about artificial intelligence investments.

Nvidia and other AI-focused companies have driven market moves throughout early 2026. Earnings results have pushed leading tech companies in opposite directions based on performance.

More than 100 S&P 500 companies will report earnings this week. Amazon, Alphabet, Disney, Palantir, and Advanced Micro Devices are among the high-profile names scheduled to announce results.

The January jobs report comes out Friday morning. Economists predict employers added 65,000 jobs last month with the unemployment rate holding steady at 4.4%.

China released manufacturing data for January that showed mixed results. A private survey indicated slight factory expansion while the official gauge showed contraction.

The data provided background context but did not directly impact crypto markets. Beijing’s tight control of the yuan limits China’s immediate influence on Bitcoin through capital flows.

The post Daily Market Update: Stocks and Crypto Fall Ahead of Major Earnings Week and Jobs Report appeared first on CoinCentral.

You May Also Like

Kaspa Price Prediction 2030: Can KAS Reach $1 or Will Traders Chase This 100x Crypto Presale Instead?

SEC greenlights new generic standards to expedite crypto ETP listings