SuperRare NFT platform loses $730K in RARE token exploit

A critical bug in the SuperRare staking contract allowed an attacker to drain $730,000 in RARE tokens.

- SuperRare lost $730,000 to a hack.

- Attackers targeted its staking contract.

- Critical bug enabled anyone to take ownership.

Crypto hacks continue to plague crypto protocols. On Monday, July 28, a critical vulnerability on the NFT platform SuperRare (RARE) enabled attackers to steal an estimated $730,000 in RARE tokens. According to several crypto security platforms, including Blockaid, the attackers targeted one of SuperRare’s staking contracts.

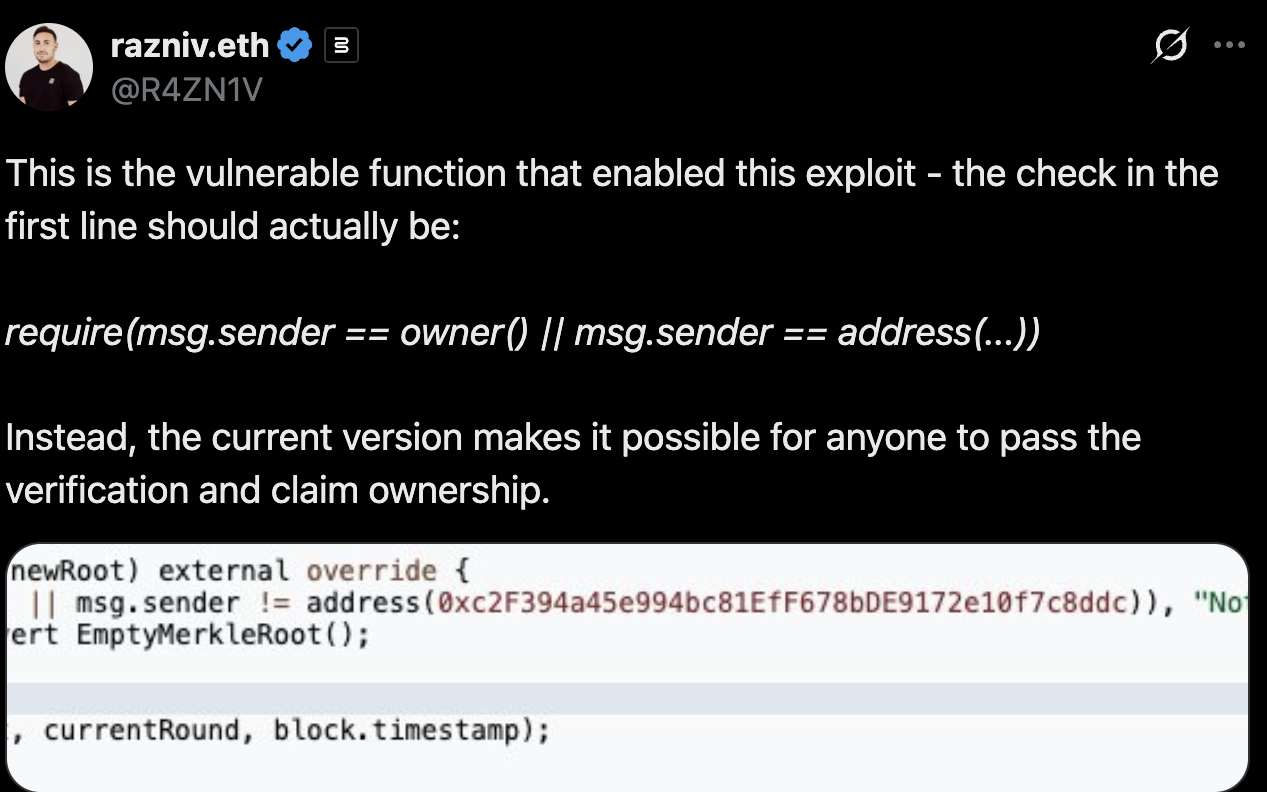

In particular, attackers targeted the RareStakingV1 staking contract, which suffered from a critical vulnerability in its code. Subsequent analysts showed that the RareStakingV1 contract had a bug that enabled anyone to pass the verification and take over the contract.

After the attackers managed to take control of the smart contract, they transferred the assets to their wallets. Still, blockchain security experts stressed that the attack only the staking contract, with the NFT marketplace and the RARE token remaining unaffected.

SuperRare token dips 6% after the hack

Following the hack, the SuperRare token dipped 6%, from its daily high of $0.0617 to $0.05815. Still, the token remains above its weekly lows and is still up 13% from the month prior. This is likely due to the fact that the vulnerability affected only a small fraction of the assets on the marketplace.

Currently, RARE has a market cap of $48.01 million. According to DappRadar, the SuperRare marketplace has a lifetime volume of $249.71 million, with 6,120 individual traders. Still, volumes in the NFT marketplace took a significant dip in recent years. Over the past 30 days, the platform registered just $2,120 in sales, with the average sale falling under $450.

You May Also Like

Top Altcoins To Hold Before 2026 For Maximum ROI – One Is Under $1!

UBS CEO Targets Direct Crypto Access With “Fast Follower” Tokenization Strategy