PUMP price drops 15% as Bonk lauchpad dominates market share

Memecoin launchpad Pump.fun saw a more than 90% decline in revenue amid a collapse in its market share.

- Pump.fun revenue dropped more than 90%.

- Bonk-powered LetsBonk dominates memecoin launchpads.

Solana-based (SOL) memecoin launchpad Pump.fun (PUMP) is rapidly losing its dominant position in the memecoin launchpad space. On Friday, August 1, the price of the PUMP token dropped 15%, from $0.00309 to a daily low of $0.002495, before rebounding to $0.0028. While the drop coincides with a broader market decline, it also reflects Pump.fun’s falling revenues and shrinking market share.

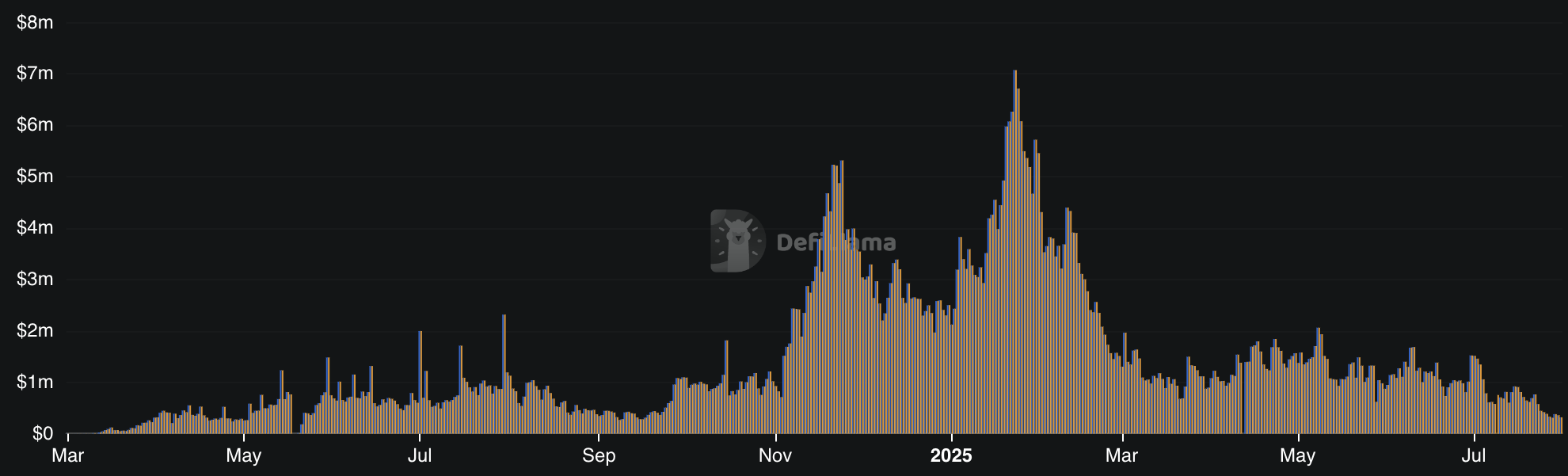

Notably, Pump.fun’s daily fees stood at $316,000 on August 1. On July 28, revenue hit a 10-month low at $307, according to DeFiLlama. This marks a 95% decline from the all-time high in daily revenue of $7 billion on January 23.

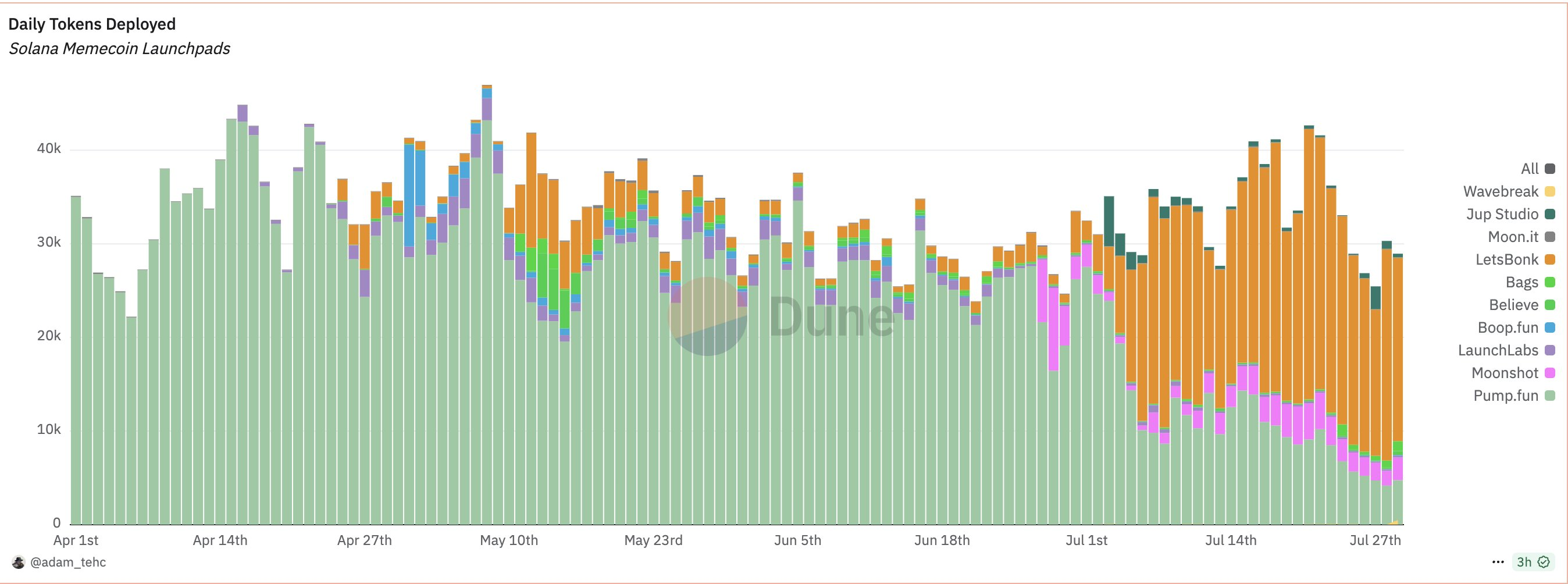

At the same time, Pump.fun experienced a significant drop in market share. In late July, its revenue share plummeted from 88% to just 19%, while LetsBonk’s dominance surged from 25% to about 78%. Pump.fun is also losing ground in the number of daily memecoin launches, with LetsBonk now leading the category.

Pump.fun is increasingly losing out to Bonk

Pump.fun’s revenue share has declined despite recent efforts to expand its ecosystem and incentivize creators. In May, Pump.fun introduced a 50% revenue share model, allowing creators to earn a portion of trading fees generated on the platform. On March 20, Pump.fun also launched its own decentralized exchange, PumpSwap, to capture additional fee revenue.

LetsBonk is a Solana-based memecoin launchpad created by the team behind the Bonk memecoin. Bonk is one of the largest memecoins on the Solana network, supported by a strong community. Since its launch in April, LetsBonk has offered a 60% revenue share and distributed fees to BONK token holders.

You May Also Like

GBP/USD rises as Fed rate cut odds boost Sterling

Crossmint Partners with MoneyGram for USDC Remittances in Colombia