From a candy vendor to a crypto tycoon, Coinbase founder's entrepreneurial secrets and industry predictions

Author: TRACER

Compiled by: Tim, PANews

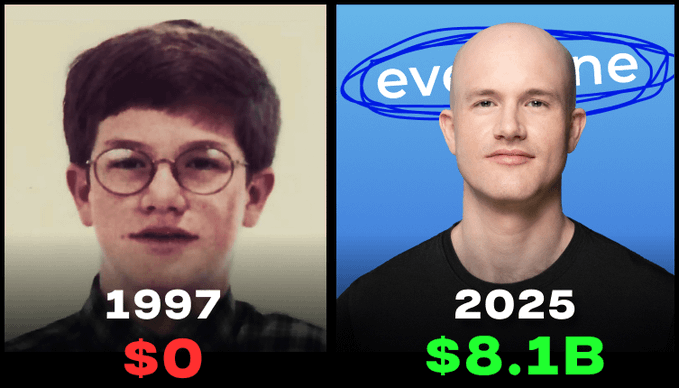

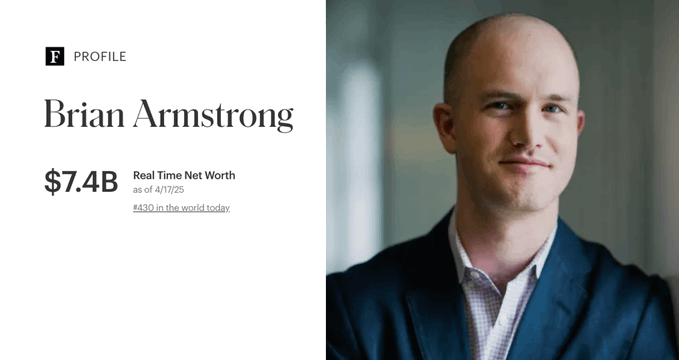

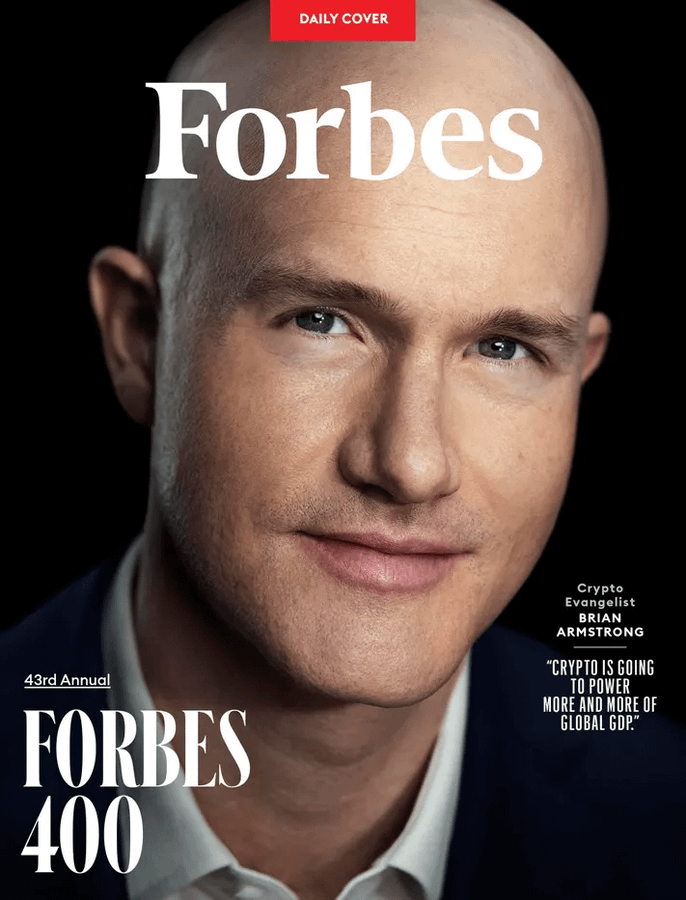

Brian Armstrong is one of the richest figures in the cryptocurrency space, having founded the Coinbase exchange, making $8 billion in just five years, and Forbes ranking him as one of the top investors in the world.

Here are his Memecoin tips, strategies, and top five predictions.

The cryptocurrency industry has a lot to thank for its huge growth, and Brian Armstrong

This is one of them.

He entered this field because of his belief in technology, and completely changed the trajectory of his life with his belief in Bitcoin.

Brian Armstrong's growth experience and industry insights are worth reading again and again, and we can draw inspiration from them:

Born in San Jose, California, Brian had entrepreneurial potential at an early age.

He once admitted in an interview that he was called into the principal's office for selling candy on the school playground.

In high school, he developed a passion for Internet technology and began to learn programming.

After that, he entered Rice University for further studies and obtained a master's degree.

After graduation, he chose to live in Buenos Aires, Argentina for a year, during which he experienced hyperinflation.

The method to combat this economic turmoil: cryptocurrency, became the direction of his future research.

After graduating from university and working in a series of jobs, he and his friends co-founded an intermediary service platform for finding private tutors.

The platform allows teachers to post their personal information and offer their teaching services to potential student clients.

Brian Armstrong served as CEO of the project for eight years and eventually sold it for 21 times his annual income.

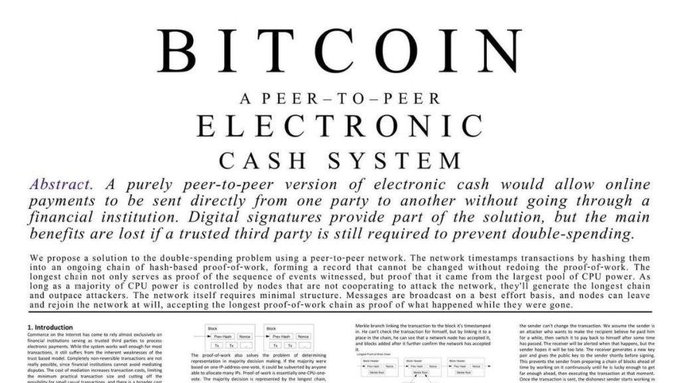

Brian Armstrong first learned about Bitcoin during Christmas 2010 while staying at his parents’ house in San Jose and stumbled upon Satoshi Nakamoto’s seminal document, “Bitcoin: A Peer-to-Peer Electronic Cash System.”

From that moment on, he began to think about starting a big business.

He used a sentence as his entrepreneurial principle: "It is not the gold diggers who get rich, but the shovel sellers."

At that time, there was a direct competitor in the industry, the famous Mt. Gox, but the platform had serious transaction delay problems.

In 2021, Brian Armstrong and Fred Ehrsam officially registered Coinbase.

Coinbase began to receive a large amount of investment, with a valuation more than 8 times Brian’s original goal. He had just set out to create a company with a valuation of $1 billion.

Today Brian Armstrong is living his ideal life and has billions of dollars in wealth.

He also actively shares his own opinions and suggestions, which you should definitely refer to:

Currently, Brian Armstrong firmly believes that there is a need to reform cryptocurrency regulatory policies.

The previous government severely hampered the growth of the industry and now is the perfect time to correct that.

There are discussions about appointing a pro-cryptocurrency SEC chairman and establishing a clear and stable legal framework, which would be a significant boon to the cryptocurrency market.

Brian Armstrong holds a fairly positive view on Memecoin and believes that they have certain development prospects.

In his view, just as GIFs and online memes have become part of the Internet economy, Memecoin may also become an important cultural and even economic phenomenon.

This is a weighty point, and one that deserves careful consideration.

Brian also shared a piece of media-viewing advice: Don’t listen to the promoters on YouTube.

There are three core elements to focus on when analyzing a project:

- Number of GitHub code contributions

- How active the team is on Twitter and Discord

- If a project remains silent in response to criticism, this is a red flag.

The current policies of the new Trump administration may significantly increase the inflow of institutional liquidity into the market. All this stems from the fact that government actions will effectively enhance the confidence of financial institutions. The core driving force is that the government is advancing relevant legislation on stablecoins and digital dollars.

Brian Armstrong believes that cryptocurrency will never replace the traditional financial system, but will be a powerful supplement to it.

Exchange-traded funds (ETFs), asset custody services, and products that are deeply integrated with banks and financial technology platforms will become development trends.

This is essentially a practical advice: be sure to develop products that can interface with traditional financial architectures.

You May Also Like

SBI VC Trade Adds Litecoin to Japanese Lending Program

Work Dogs TGE Is Running — Is WD About to Drop in Q2 After March 30?