Crypto ETFs Snap Winning Streak With $319 Million in Outflows

Bitcoin ETFs lost $122 million and ether ETFs lost $197 million on Monday, ending their inflow streaks. Heavy redemptions in Blackrock’s funds and Ark 21Shares drove the pullback, with no ETH ETFs recording inflows.

Market Pause: Crypto ETFs See Heavy Outflows After Record-Breaking Run

The exchange-traded fund (ETF) rally that had defined crypto markets over the past two weeks finally hit pause on Monday. Both bitcoin and ether ETFs turned red, with investors pulling out more than $300 million combined. After consecutive days of record inflows, the sharp reversal suggests a cooling period, though trading volumes remained strong.

Bitcoin ETFs registered $121.81 million in net outflows, largely defined by two heavy exits. Blackrock’s IBIT shed $68.72 million, while Ark 21Shares’ ARKB lost $65.75 million. A modest $12.66 million inflow into Bitwise’s BITB helped cushion the blow but wasn’t enough to flip the tide. Total value traded was still robust at $2.77 billion, though net assets slipped to $150.89 billion.

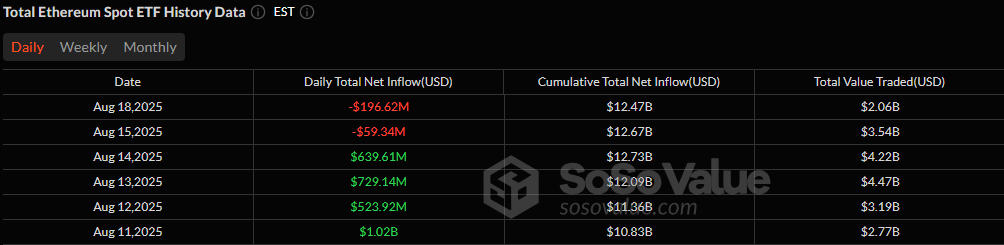

Ether ETFs had an even tougher day, logging $196.62 million in outflows. Blackrock’s ETHA led the retreat with $87.16 million in redemptions, followed closely by Fidelity’s FETH at $78.40 million.

Source: Sosovalue

Source: Sosovalue

Grayscale’s ETHE saw $18.70 million exit, while Franklin’s EZET and Vaneck’s ETHV dropped $6.63 million and $4.79 million, respectively. Bitwise’s ETHW rounded out the losses with nearly $1 million in exits. No ether fund posted gains. Total value traded was a steady $2.06 billion, with net assets sliding to $27.74 billion.

An analysis of crypto ETFs by Dragonfly analyst, hildobby, shows that BTC ETFs currently hold 6.38% of the total BTC supply, while ETH ETFs hold 5.08% of the total ETH supply. At the current pace, ETH ETF holdings are expected to surpass BTC ETF holdings as a share of total supply by September.

After a week of record-breaking inflows, Monday’s red day doesn’t yet confirm a reversal, but it highlights investor sensitivity at these levels. Whether this marks a brief cooldown or the start of a broader shift remains the question heading into the rest of the week.

You May Also Like

How to earn from cloud mining: IeByte’s upgraded auto-cloud mining platform unlocks genuine passive earnings

Vitalik Buterin Reveals Ethereum’s Long-Term Focus on Quantum Resistance