Bitcoin Hyper Unveils High-Throughput Bitcoin Layer-2 as Presale See Whales Buy $150K in One Week

Bitcoin Hyper ($HYPER) took a leap forward this week with its plan to bring high-speed, low-cost transactions and smart-contract functionality to Bitcoin via a Solana Virtual Machine (SVM) rollup architecture.

The project will position the world’s largest crypto asset for everyday payments and scalable on-chain apps while preserving Bitcoin’s settlement assurances.

The $HYPER presale has cleared the $10.8M mark amid heightened market interest.

Crucially, this week saw whales swimming into the presale; over $150K was added to the total in a series of whale buys.Why Bitcoin Hyper, and what’s drawing the whales in? Time for a closer look.

Bitcoin’s Throughput and Fees Don’t Match 2025 Demand

Despite its dominance, Bitcoin’s base layer was optimized for security and decentralization. By enabling capability only for simple smart contracts, Bitcoin’s designer kept vulnerabilities low and autonomy high.

That’s not always great for high-frequency consumer transactions or complex applications.

In peak periods, Bitcoin users face unpredictable fees and slow settlement times, making point-of-sale payments, gaming, and high-volume micro-transactions impractical on Layer 1 alone.To become more than just a store of value, Bitcoin requires a solution that doesn’t spoil Bitcoin’s appeal – but can address the very real problems that face the networks.

Concrete pain points today include:

- Consumer payments: A coffee, concert ticket, or cross-border payment needs seconds-level confirmation and minimal fees. Base-layer Bitcoin can’t deliver that at scale with an average of only 7 transactions per second.

- On-chain apps: DeFi, gaming, and creator tools require complex smart contracts and high TPS, capabilities Bitcoin doesn’t natively provide.

- Merchant UX: Businesses require predictable costs and reliable finality on the level of current credit card rails to finally adopt crypto at scale.

Bitcoin set fresh all-time highs last month and remains a strong asset with deep institutional flows. But it lags behind when it comes to the everyday, low-latency utility required for speed and programmability.

Bitcoin Hyper’s SVM Rollup on Bitcoin

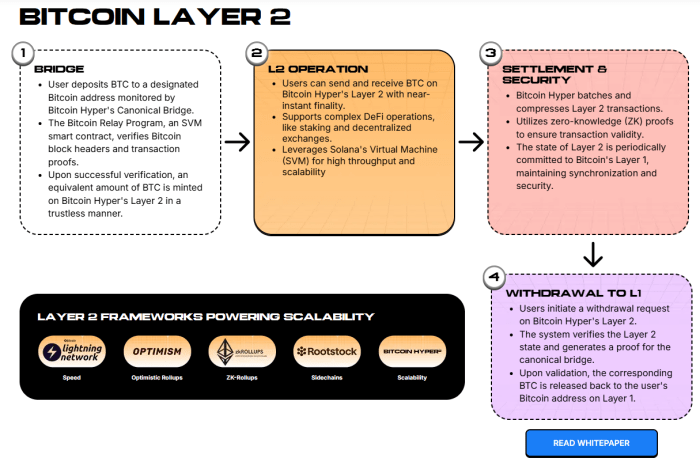

Bitcoin Hyper proposes a rollup-style Layer-2 that uses the Solana Virtual Machine (SVM) for high throughput and low latency, while anchoring security and finality to Bitcoin Layer 1.

It’s a hybrid model that seeks to combine core strengths from both blockchains:

- Canonical Bridge and Minting: Users deposit $BTC to a monitored L1 address. An SVM smart contract – Bitcoin Relay Program – verifies the Bitcoin block headers and proofs. Valid deposits are trustlessly reflected (minted) one-for-one on Bitcoin Hyper L2.

- Fast L2 Execution: Transactions and smart contracts run natively on the SVM, delivering near-instant finality and high throughput with thousands of transactions per second. Wrapped Bitcoin on Bitcoin Hyper will be suitable for dApps from payments and DEXs to gaming and social dApps.

- Proofs and Settlement: Batched L2 state updates are compressed and posted back to Bitcoin, with ZK proofs ensuring validity. Users can always withdraw wrapped $BTC back to L1, preserving Bitcoin’s assurances.

- Why SVM (not EVM): SVM’s parallel execution and performance characteristics make it a better fit for payments-first use cases and low-latency apps.

Using $HYPER, you can unlock everyday $BTC payments, with seconds-level processing and low-fee checkouts – and L1 settlement behind the scenes.

You can also power Bitcoin-based DeFi. Swaps, lending markets, and yield strategies, executed at Layer 2 speed. If you’re more into memes than ETFs, you can launch and trade red-hot meme assets without congesting the L1.

Why $HYPER Matters for Bitcoin’s Standing

Bitcoin leads by market cap and brand. Extending speed and programmability on top of Bitcoin’s settlement credibility could expand its addressable market from ‘store-of-value and ETFs’ to ‘daily money and apps.’

The smart money is already catching on. In the past week, a series of hefty transactions in the Bitcoin Hyper presale reveal that whale investors spent $150K amassing $HYPER tokens:

- $19K on Aug. 14

- $26K on Aug. 14

- $17.7K on Aug. 15

- $15.2K on Aug. 18

- $16.3K on Aug. 19

So far, the Bitcoin Hyper presale has raised over $10.8M, demonstrating investor interest in the project’s ambitions for a lightning-fast Bitcoin Layer 2.

$HYPER Token: Utility and Economics for Layer 2

$HYPER is the native token for transaction fees, staking, and governance on the Bitcoin Hyper network. Tokens are allocated across development, listings, marketing, rewards, and treasury.

Investors in the ongoing presale can stake $HYPER tokens for dynamic 102% returns. Learn how to buy $HYPER in our guide and stake your tokens right away for max gains; rewards will be disbursed over two years.

Our price prediction shows real potential for $HYPER: from its current price of $0.012765, we think the project could reach $0.32 by the end of 2025, representing a 2,683% increase from its final presale price.What is Bitcoin Hyper? It’s the first Bitcoin Layer 2 to take a truly unique approach to resolving Bitcoin’s scalability issues – with the potential to materially benefit not just the Hyper Layer 2, but the original Bitcoin, too.

Bitcoin Continues Growth, Sets Stage for $HYPER’s Launch

Bitcoin printed a new record around $124.5K on Aug. 14, before consolidating in the $113-118K range. U.S. spot Bitcoin ETFs continue to channel institutional demand.

$HYPER’s launch at a time of continued growth for Bitcoin, could set the stage for monster gains for both protocols. If Bitcoin becomes both the base collateral of crypto and a high-throughput transactional network via an L2, its dominance could become even more entrenched.

Corporate treasuries remain a significant structural underpinning for Bitcoin. (Micro)Strategy reports holdings exceeding 629K $BTC as of Aug. 18, exerting steady, long-duration capital pressure that can amplify the impact of new demand entering.

![]()

In other words, if the Bitcoin Hyper layer creates buying pressure for $BTC – for new, L2-powered use cases, perhaps – then $BTC’s price could spike even further.

Bitcoin Hyper: Launching the Future of Bitcoin

With its Bitcoin Layer-2 that combines an SVM execution layer with rollup-style settlement on Bitcoin, Bitcoin Hyper could change the game.

The goal is to provide Bitcoin-grade security with near-instant, low-fee transactions, enabling payments, DeFi, and high-throughput apps to run at scale, but remain settled on Bitcoin.Visit the Bitcoin Hyper presale page to get a glimpse of Bitcoin’s future.

And always do your own research – this isn’t financial advice.

You May Also Like

Water150 Unveils Historical Satra Brunn Well: The Original Source of 150 Years of Premium Quality Spring Water Hydration

Amazon signs AI and cloud partnership to accelerate growth