Hong Kong’s Ming Shing Group To Become 16th-Largest Corporate Bitcoin Holder With $483M Purchase

Hong Kong-based construction giant Ming Shing Group is set to become the 16th-largest corporate Bitcoin holder globally after agreeing to buy 4,250 BTC worth $482.9 million.

The BTC will be acquired from British Virgin Islands–registered Winning Mission Group at an average price of $113,638 through convertible promissory notes and stock warrants instead of cash, reflecting Ming Shing’s long-term strategy to enhance shareholder value through digital assets.

If the deal closes as planned by Dec. 31, the company’s holdings would rise to 5,083 BTC, making it the 16th-largest corporate Bitcoin holder globally based on today’s rival holdings.

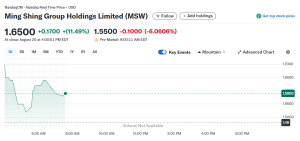

The announcement sent the company’s shares soaring more than 11% before after-hours profit-taking trimmed gains.

Ming Shing Group share price (Source: Google Finance)

Ming Shing Group To Issue Convertible Promissory Notes And Stock Warrants

Promissory notes are a type of IOU that can later be turned into company shares, while the warrants give Winning the ability to buy shares at a fixed price in the future.

The transaction will involve a third party by the name of Rich Plenty Investment Limited, which will receive half the value of the deal. As such, both this third party and Winning Mission Group will receive a convertible note worth more than $241 million and a warrant to purchase more than 200 million Ming Shing Group shares.

At any time, each of those companies is able to convert their debt into Ming Shing Group shares at $1.20 per share. However, neither of the companies can hold more than 4.99% of Ming Shing Group at any given time, according to the press release. These promissory notes will have a 10-year maturity.

The same 4.99% limit will be applied to the warrants, but they are redeemable at $1.25 per share anytime in the next 12 years.

Ming Shing Shares Jump As The Company Looks To Expand Its Bitcoin Holdings

The deal is part of the company’s mission to offer more value to its investors, which it believes Bitcoin will enable it to do.

“We believe the Bitcoin market is highly liquid and the investment can capture the potential appreciation of Bitcoin and increase the Company’s assets,” said Ming Shing Group CEO Wenjin Li. “We are devoted to creating additional value for our shareholders and actively exploring options for the Company to grow further.”

Ming Shing already holds 833 BTC, ranking it as the 45th-biggest corporate Bitcoin holder globally, data from Bitcoin Treasuries shows. With the crypto market leader trading at $113,169.63 as of 8:05 a.m. EST, the company’s current Bitcoin reserves equate to more than $94.27 million.

After receiving the 4,250 BTC, Ming Shing will rank above KindlyMD, the company led by Trump Administration crypto policy adviser, David Bailey, if it doesn’t add to its BTC holdings.

KindlyMD’s latest Bitcoin purchase was announced just yesterday, when the company bought 5,764.91 BTC for more than $670.37 million. This BTC was acquired at an average purchase price of $118,204.88 per coin.

Global BTC Treasury Race Gathers Momentum

Over the past 30 days, 14 more companies have joined the corporate Bitcoin buying spree, pushing the number of public companies that hold BTC on their balance sheets to 297, according to Bitcoin Treasuries data.

The majority of those entities are based in the US, which accounts for 103 companies. Canada has the second-most BTC treasury firms at 43 such companies.

Combined, the companies hold 3.67 million BTC. Strategy leads with its reserves of 629,376 BTC. Since starting its BTC accumulation in 2020, Strategy has achieved an unrealized profit over 54%.

You May Also Like

Cashing In On University Patents Means Giving Up On Our Innovation Future

VectorUSA Achieves Fortinet’s Engage Preferred Services Partner Designation