A look at 10 emerging launchpad platforms: from AI Agent to MEME, Solana becomes the "launch center"

Author: Nancy, PANews

With the return of funds and the recovery of sentiment, the on-chain world is quietly heating up, and many emerging token issuance platforms have also begun to launch blood-sucking attacks on the leader Pump.fun. In this article, PANews counts the 10 new Launchpad platforms that have received a lot of attention recently, involving MEME, AI Agent and SocialFi tracks, mainly concentrated in the Solana ecosystem. These platforms have their own characteristics, most of which rely on a solid ecological foundation and resource advantages, and compete for market share through innovative mechanisms and differentiated positioning such as optimizing issuance mechanisms, enriching creator incentives, enhancing token empowerment, and improving platform security.

LaunchLab

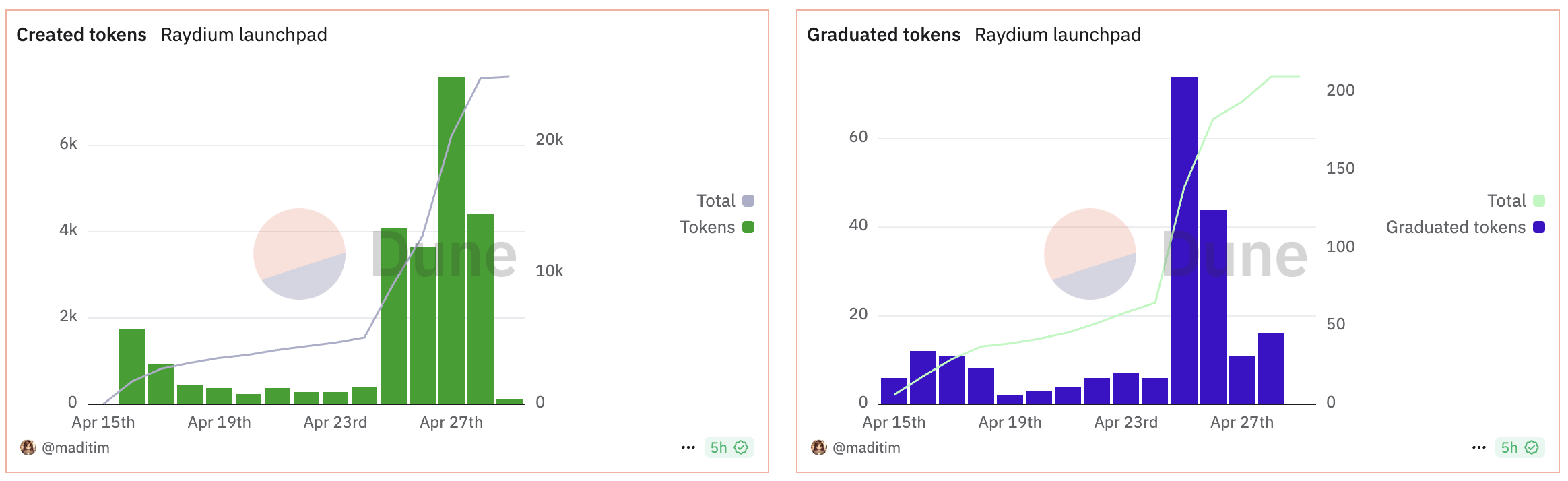

LaunchLab is a token issuance platform based on Solana, launched by Raydium in mid-April this year. Creators use the JustSendIt model to issue tokens, and once liquidity reaches 85 SOL, the tokens will be immediately migrated to Raydium's AMM. LaunchLab provides a variety of customization options, including token supply settings, distribution curves, vesting periods, etc., and can choose to receive a 10% share of transaction fees. The platform transaction fee is 1%, of which 50% goes to the community pool, 25% is used for $RAY repurchase, and 25% is used for project infrastructure and operations. On April 26, Raydium announced that it has opened a 50,000 RAY reward pool to reward users who use LaunchLab for transactions.

According to Dune data, as of April 29, LaunchLab has issued 24,916 tokens, with a graduation rate of 0.84%. In terms of the number of tokens created, since LaunchLab was launched on April 16, the issuance of tokens has been in a slump, usually in the hundreds, but since April 25, the issuance of tokens has increased significantly, with daily issuance reaching thousands. Among the 210 graduated projects, the total transaction volume is mainly concentrated in LetsBONK, TIME and Hosico tokens, with a cumulative transaction volume of nearly US$350 million, and the transaction volume of the remaining tokens is mostly concentrated in the range of tens of thousands to hundreds of thousands of dollars.

Letsbonk.Fun

Letsbonk.Fun based on Solana was developed by members of the MEME coin BONK community in cooperation with Raydium. It allows users to create their own MEME coins by clicking "Create Token", filling in token details and customizing supply creation. It also provides developers with functions such as wallet tags and binding curves. After the token is launched, it can be quickly connected to DEXs such as Raydium and Jupiter. A 1% handling fee will be charged for each transaction on the platform, which will be used to develop the fund pool, BONKsol validators, and repurchase and destroy BONK. Platform users can also participate in LaunchLab's 50,000 RAY prize pool.

Arc Forge

Arc Forge is an Agent token issuance solution launched by the AI Agent project arc on Solana in mid-February this year. The platform is built on Meteora DLMM and integrated with Jupiter routing. It has major advantages such as more efficient liquidity, prevention of order grabbing robots and customized liquidity strategies. Only reviewed high-quality projects can participate.

auto.fun

auto.fun is a code-free AI agent launchpad platform based on Solana launched by Eliza Labs for issuing new tokens and autonomous agents. The native token is ai16z. The platform allows users to deploy complex artificial intelligence agents without a technical background and adopts a fairer token issuance mechanism. auto.fun adopts a dual-pool system: the SOL:AT main pool is the main liquidity pool of the platform, which pairs the newly released agent token (AT) with SOL and provides liquidity through Raydium; $ai16z:AT is the goal of the future stage, aiming to pair liquidity with AT by repurchasing $ai16z from the platform revenue. Each project released on auto.fun will receive a liquid NFT powered by Raydium, which can give project creators ownership of liquidity and achieve continuous revenue capture through NFT. In the liquidity pool of each AT token, auto.fun will charge a 10% fee, which will be used to repurchase $ai16z tokens from the market. According to the official website, as of April 27, the highest market value of tokens on auto.fun was only a few hundred thousand dollars.

Time.fun

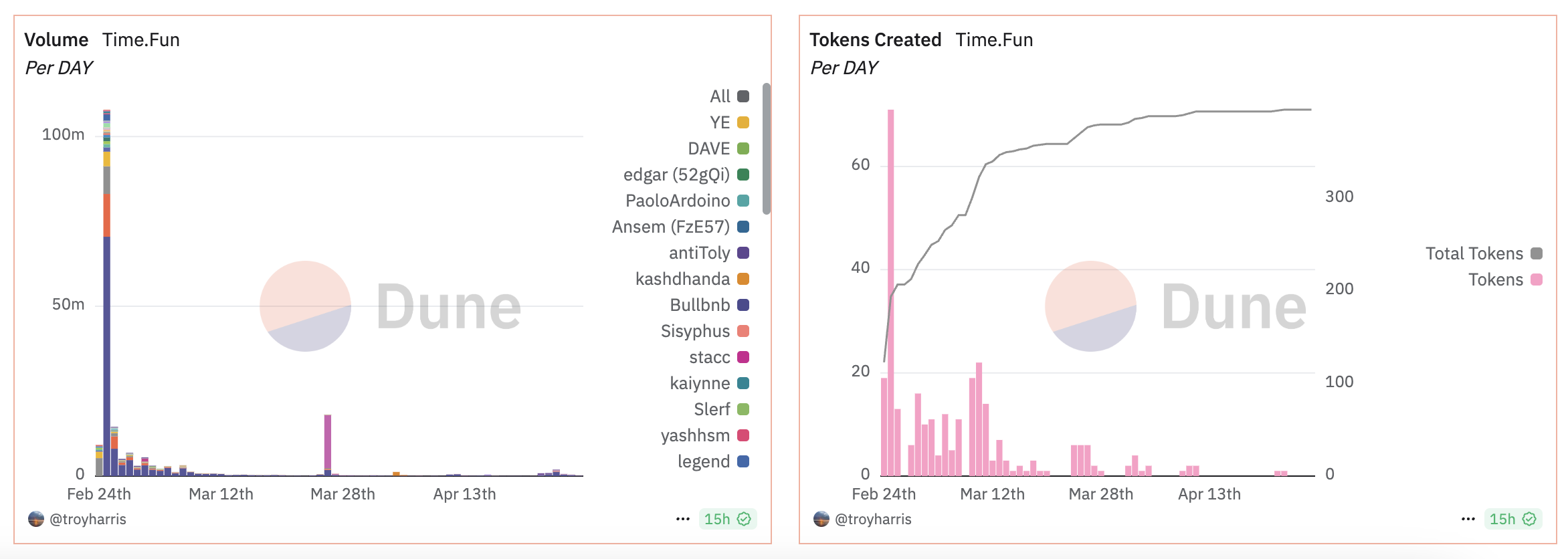

Time.fun is a time tokenization platform that migrated from Base to the Solana ecosystem. Creators need to register through the platform interface. They can customize the token name, symbol, and initial supply, and set the pricing of time services (in USDC), but identity verification is required.

Time.fun has been frequently recommended by Solana co-founder Toly in the past two months. He recently launched an auction on the platform, attracting a total bid of more than US$1.2 million. Three entrepreneurs won the opportunity to present their projects to Toly himself and the Solana ecological community. They will introduce their entrepreneurial projects in the live broadcast on May 6 and receive on-site comments from Toly.

According to Dune data, as of April 28, the Time.fun platform had issued only 396 tokens, but the daily issuance has continued to decline since the peak on the first day of launch, and the issuance has even dropped to single digits or even zero for many days. At the same time, the platform's total transaction volume has exceeded US$200 million, of which Solana contributed more than US$100 million on the first day of launch, and then the transaction volume gradually fell back, currently maintaining in the range of tens of thousands to hundreds of thousands of dollars. The transaction volume is mainly driven by the token $toly, which has long accounted for more than half.

Genesis Launches

Genesis Launches is a launch platform recently launched by Virtuals Protocol based on Base and Solana. Its core goal is to allow community users to fairly participate in the incubation of new AI Agent projects at an early stage, prevent robots and snipers from grabbing shares at low prices, and protect the safety of participants' funds. Each new project starts with a fixed diluted market value of 112,000 $VIRTUAL (about 120,000 US dollars). Users participate by staking Virgin Points. There is a 24-hour auction period in each round. The more points you have, the higher the distribution. Currently, users have three main ways to earn points: earn Trenchor points by investing in Sentient and Prototype Agent tokens, earn by holding $VIRTUAL tokens, and earn by staking $VADER tokens. Unused points will expire after 30 days.

Shell Launchpad

Shell Launchpad is launched by MyShel, the AI Agent platform on BNB Chain, to help users easily launch and tokenize their AI Agents. The platform has multiple creation modes, including classic mode, professional configuration mode and ShellAgent mode, which are designed to meet the needs of novice users, developers with a certain technical background and professional developers. Shell Launchpad provides 300+ modular AI widgets, and users can quickly combine and build complex AI Agents, and set the basic information of their AI Agents such as name, description, token, category, etc. according to their needs, and configure the token economic model, including total supply, fundraising amount, etc. Once the AI Agent's financing reaches the target, the platform will automatically go online on DEX.

Swarms LaunchPad

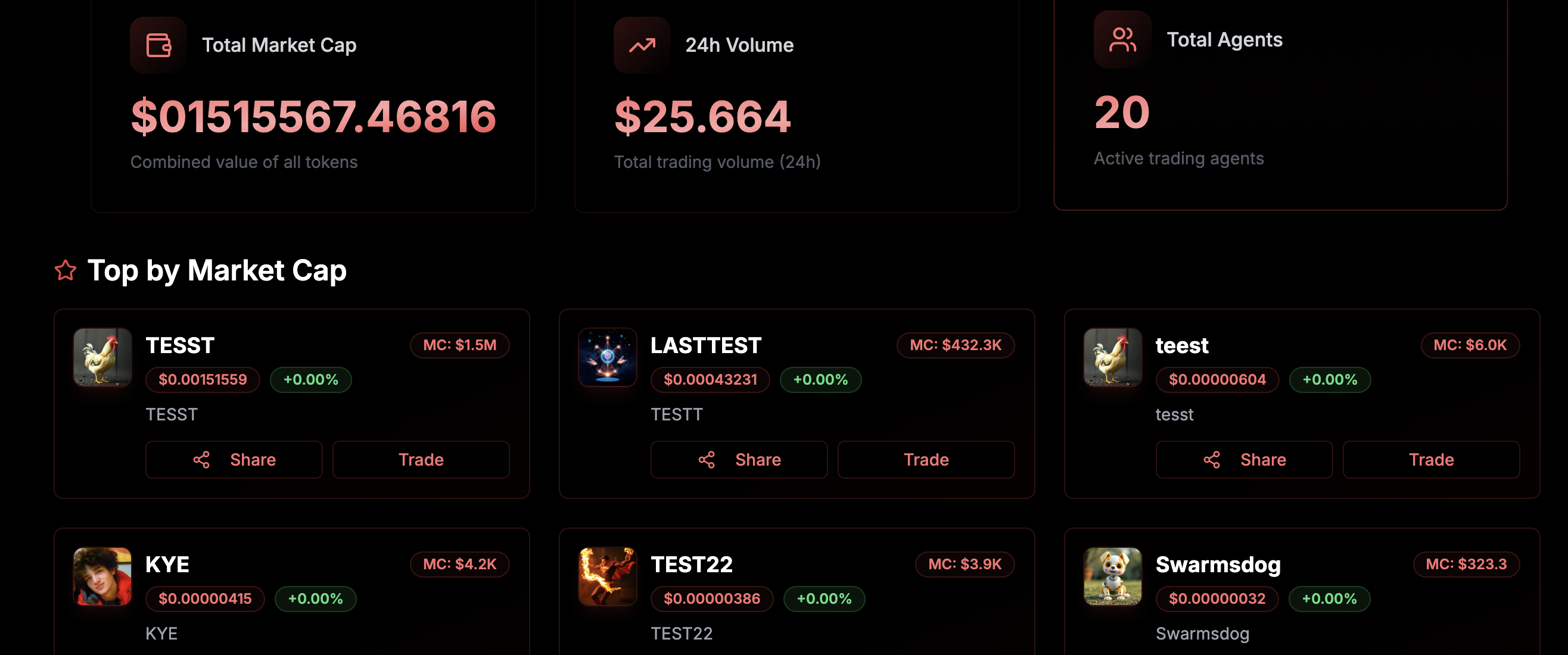

Swarms LaunchPad is an AI agent token issuance platform developed by the AI Agent project Swarms on Solana, which is used to create, deploy, tokenize and monetize intelligent agents. Users can build customized AI agents through Swarms SDK (supports Python/Rust SDK), upload their own AI agents for tokenization, and trade them through Swarms Dex. These tokenized AI agents can be sold or rented on the Swarms market, and developers can make profits through purchase fees, rental shares or trading income. Developers of high-quality agents can receive additional SWARMS token rewards.

Recently, Swarms LaunchPad has undergone a major upgrade, including performance optimization, integration of Gecko Terminal, new comment functions and holdings page, and the source code has been fully open sourced to GitHub.

The official website of Swarms LaunchPad shows that as of April 29, the total number of Agents on the platform is 20, with a total market value of approximately US$1.5 million.

someting

At present, Someting has not been officially launched and is still in the whitelist stage. According to known information, Someting has cooperated with Meteora, including unilateral liquidity, dynamic pools and vaults, and has a unique Bonding Curve mechanism with lower fees and faster binding time. On the Someting platform, token liquidity requires 42 SOLs to graduate, the transaction fee is 0.69%, supports custom bond curves, has anti-sniping functions and integrates market makers to automatically provide liquidity. At the same time, in order to enhance the credibility of the project, Someting also has a verification badge of the X platform.

Launch Coin on Believe

Launch Coin on Believe allows users to create and issue new tokens through simple social interactions. The core mechanism is to trigger the generation of a new token by replying to a tweet with @launchacoin + token name.

It should be noted that the predecessor of Launch Coin on Believe is PASTERNAK, a celebrity coin created by Ben Pasternak, the founder of Clout. Pasternak is also one of the founders of Monkey (one of the largest social applications in Web2). Clout is a SocialFi platform that combines the characteristics of platforms such as Friend.Tech, Pump.fun and Moonshot, allowing celebrities and creators to issue tokens named after themselves, and has received support from Alliance DAO and others.

You May Also Like

Victra Named 2025 Recipient of Verizon’s Best Build Compliance Award

Stablecoins could face yield compression after Fed’s rate cut