Multi-dimensional analysis of the seven key tracks of stablecoins: Who is the real winner?

Original article by Rob Hadick , General Partner at Dragonfly

Compiled by: Yuliya, PANews

As the stablecoin ecosystem continues to develop, the market is paying more and more attention to its future development direction and value distribution. This article will deeply analyze the various tracks of the stablecoin market and their value potential from multiple dimensions.

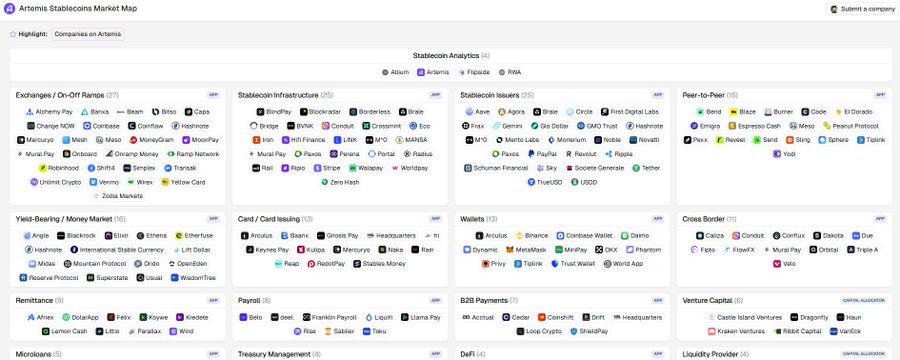

Compared with the traditional framework, this analysis adopts a more detailed classification method, which is due to the complexity and nuances of the payment field itself. For investors, it is particularly important to accurately grasp the role positioning and ownership structure of each participant. The main classifications include:

-

Settlement Rails

-

Stablecoin issuer

-

Liquidity Providers

-

Value transfer/currency services

-

Aggregate API/Messaging Platform

-

Merchant Gateway

-

Stablecoin-driven applications

One might ask: Why are there so many categories, especially when core infrastructure like wallets or third-party compliance are not covered? This is because each area has its own unique defensive "moat" and different ways of capturing value. While there is overlap between vendors, it is critical to understand what is unique about each layer. Here is an analysis of the value distribution of each area:

1. Settlement track

This is a typical field dominated by network effects, and its core competitiveness is reflected in:

-

Deep Liquidity

-

Low fee structure

-

Fast settlement

-

Stable system availability

-

Native compliance and privacy protection

This is likely to be a winner-takes-all market. General-purpose blockchains are unlikely to meet the scalability requirements of mainstream payment networks, and Layer 2 or dedicated solutions may have more development potential. The winners in this space will be extremely valuable and will likely focus on the stablecoin/payment space.

2. Stablecoin issuer

Currently, issuers such as Circle and Tether have achieved remarkable success with strong network effects and a high interest rate environment. But future development requires:

-

Build an efficient and reliable infrastructure

-

Improving compliance standards

-

Optimize the minting/redemption process

-

Strengthen integration with central banks and core banking systems

-

Improve overall liquidity (such as Agora)

Although SaaS (stablecoin as a service) models like Paxos may spawn more competitors, stablecoins issued by neutral non-bank institutions and fintechs may have more advantages because transactions between closed systems require a trusted neutral third party. Issuers already have a lot of value, and some issuers will continue to win big, but they need to develop a more comprehensive business than just issuing.

3. Liquidity Providers (LPs)

Currently, it is mainly dominated by OTC and exchanges, showing a highly commercialized feature. Competitive advantages mainly rely on:

-

Low-cost funding

-

System stability

-

Deep liquidity and trading pair support

In the long run, large institutions will dominate the market, and LPs focusing on stablecoins will find it difficult to establish lasting advantages.

4. Value Transfer/Money Services (“PSPs” for Stablecoins)

The moats of these "stablecoin orchestration" platforms (such as Bridge and Conduit) come from:

-

Proprietary payment rails

-

Direct Bank Partnership

-

Global coverage

-

Adequate liquidity

-

High level of compliance capabilities

There are relatively few platforms that truly own proprietary infrastructure, but the successful ones are expected to form an oligopoly in the regional market and complement traditional PSPs (payment service providers) to become very large enterprises.

5. Aggregate API/Messaging Platform

Such market participants often claim that they provide the same services as payment service providers (PSPs), but in essence they are just encapsulating and aggregating APIs. These platforms bear neither compliance nor operational risks, and more accurately, they should be regarded as market platforms for PSPs and liquidity providers (LPs).

While these platforms are currently able to charge higher service fees, they will eventually face the risk of having their profits squeezed or even being eliminated entirely because they do not actually handle the core pain points in the payment process or participate in infrastructure construction. These platforms often label themselves as "Plaid in the stablecoin field", but ignore a key fact: blockchain technology itself has already solved most of the pain points that Plaid solves in the traditional banking and payment fields. Unless they can expand in the direction of end users and take more responsibility in the technology stack, it will be difficult to maintain their profit margins and the sustainability of their business.

6. Merchant Gateway/Entrance

Such platforms help merchants and businesses accept stablecoin or cryptocurrency payments. Although there is sometimes overlap with PSPs, they mainly focus on providing convenient developer tools, integrating third-party compliance and payment infrastructure, and packaging them into a user-friendly interface. They hope to emulate Stripe's development path - acquiring the market through simple access and then expanding their business horizontally.

However, unlike Stripe's early market environment, developer-friendly payment solutions are now ubiquitous, and channel distribution capabilities are the key to success. Existing payment giants can easily work with payment orchestration companies to add stablecoin payment options, making it difficult for pure cryptocurrency gateways to find their own market position. Although companies like Moonpay or Transak have enjoyed strong pricing power in the past, this advantage is not expected to last.

There are still opportunities in the B2B field, especially in large-scale fund management and large-scale stablecoin applications, but the B2C field is highly competitive and faces severe challenges.

7. Stablecoin-driven financial technology and applications

It is now easier than ever to create a "digital bank" or "fintech" product based on stablecoins, making the field extremely competitive. Success will depend on distribution capabilities, go-to-market strategies, and differentiated product insights - not unlike traditional fintech.

In developed markets, traditional fintech giants such as Nubank, Robinhood, and Revolut can easily integrate stablecoin functionality, while startups need to find unique value propositions.

There may still be some opportunities for unique products in emerging markets (such as Zarpay), but it will be difficult to succeed in developed markets if you rely solely on stablecoin-backed financial services as a differentiator.

Overall, pure-play consumer cryptocurrency/stablecoin startups in this category are likely to face extremely high failure rates and will continue to face challenges, but enterprise-facing businesses may still have an opportunity to find their niche.

Conclusion

Although this framework does not cover all edge cases and overlapping areas, it provides a useful thinking framework for investors who are deeply involved in this field. As the market continues to evolve, new opportunities and challenges will continue to emerge, and understanding these market dynamics is critical for industry participants.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

BlackRock boosts AI and US equity exposure in $185 billion models